Alphabet Just Gave Nvidia and Broadcom Investors 185 Billion Reasons to Cheer

Key Points

Alphabet and Broadcom designed a custom AI chip.

Nvidia's units are attractive in a cloud computing environment.

- 10 stocks we like better than Alphabet ›

Listening to other companies' earnings reports outside of the ones you invest in is an important task for investors. You can pick up lots of useful information, especially from the customers of companies that you're invested in.

One of the companies to report earnings recently dropped a bombshell that should make Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO) investors jump for joy. Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) told investors that they should expect capital expenditures between $175 billion and $185 billion for 2026.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

This confirmed that we're entering into another year of huge AI spending, which should benefit stocks like Nvidia and Broadcom. This announcement makes me even more bullish on these two stocks, as it shows we're still in the early innings of AI spending.

Image source: Getty Images.

Alphabet is fulfilling internal and external computing capabilities

Alphabet is in a fairly unique position among the AI hyperscalers in that it is using its computing resources for both internal and external computing needs.

On the internal side, it's powering its in-house generative AI model, Gemini. It's also using these resources in Google DeepMind, another AI research wing of Alphabet. Alphabet has been known to use its Tensor Processing Units (TPUs) in many internal applications, as they can be more cost-effective than GPUs in many situations. Alphabet designed these TPUs in tandem with Broadcom, so increased spending on internal AI computing capabilities boosts Broadcom's growth outlook.

Another way Alphabet utilizes TPUs is through Google Cloud, its cloud computing platform. Because Google Cloud is catering to external clients, some users may not want to devote themselves to utilizing Google's internal hardware, as that locks them into the Google ecosystem. If they develop workloads meant to be run on Nvidia GPUs, then these workloads can be transferred to other cloud computing providers without much issue. So, Nvidia's hardware will also be a large part of the $175 billion to $185 billion projection.

It's impossible to know which company will benefit more from Alphabet's massive AI spending spree, but both are certainly primed to capitalize on Alphabet's plans.

Despite this announcement, each of these stocks still trades for a reasonable price tag.

Broadcom and Nvidia stocks trade for nearly the same price tag as Alphabet

Alphabet's fourth quarter was great, with revenue rising 18% year over year. For Q1, Wall Street analysts project 18% growth, according to Yahoo! Finance. While that's a great performance considering Alphabet's size, it's nothing like what Broadcom or Nvidia are expected to put up.

Broadcom and Nvidia are expected to deliver 28% and 61%, respectively, for their first quarters. You'd expect their stocks to trade at a premium to Alphabet's due to their faster growth rate, but that's not really the case.

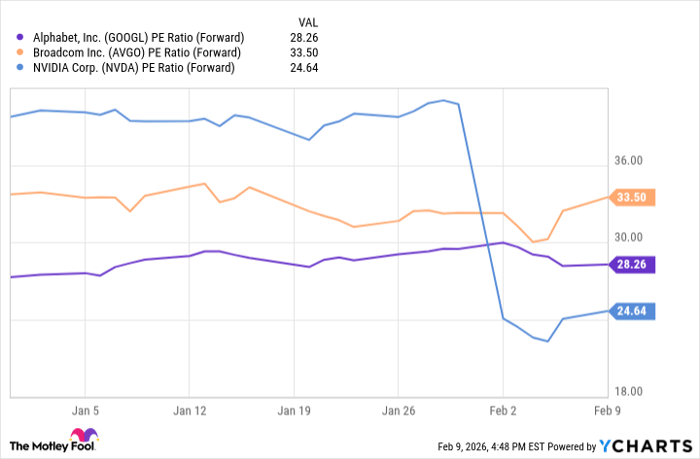

GOOGL PE Ratio (Forward) data by YCharts

Broadcom trades for the highest price tag at 34 times forward earnings, while Alphabet is in the middle at 28 times forward earnings. Nvidia is by far the cheapest at 25 times forward earnings, yet it's expected to grow the fastest.

I think this makes Nvidia a clear no-brainer buy, as investors are trying to look elsewhere for the next big AI stock, when it's right under their noses.

I think Broadcom deserves its premium over Alphabet, as several custom AI chips will enter production later this year that are similar to TPUs, but will go to different clients. This will lead to huge growth, as Wall Street analysts project 52% and 38% revenue growth for fiscal years 2026 and 2027, respectively. Broadcom will have to prove that it's worth the premium, but I think investors are safe to buy here.

Alphabet is still an intriguing investment option in its own right, but it just doesn't have the growth figures to stack up against Nvidia and Broadcom. I like Nvidia and Broadcom more, but Alphabet is still a great cornerstone investment for a portfolio.

Should you buy stock in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 16, 2026.

Keithen Drury has positions in Alphabet, Broadcom, and Nvidia. The Motley Fool has positions in and recommends Alphabet and Nvidia. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.