Software Bear Market: 2 Stocks With Massive Upside, According to Wall Street

Key Points

Fears of AI disruption have sent Wix and Adobe shares down even as their businesses are doing just fine.

Wix's website development platform keeps growing, and the stock is trading at a low price.

Adobe has been at risk of AI disruption, but it isn't showing up in today's numbers.

- 10 stocks we like better than Wix.com ›

The latest narrative in the financial world is the risk that artificial intelligence (AI) will disrupt existing software businesses. With new tools emerging from heavily funded AI labs that allow developers to quickly "code" new projects with only natural-language prompts, shareholders have become concerned that competition will pop up everywhere and erode existing profits for software providers.

I believe this threat is overrated, presenting investors with a nice opportunity to buy high-quality software businesses at a reasonable price. Here are two software stocks with massive upside coming out of this software bear market, according to Wall Street.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Wix's accelerating growth

Wix.com (NASDAQ: WIX) is a website development platform that lets individuals or teams easily build websites without code. It has been thrown out with the software bathwater, down to close to 70% in the last year. It makes little sense to sell Wix over low-code software development, as the company has been enabling individuals to do just that for building websites for a decade.

Wall Street currently has an average price target of $151 for the stock, compared to its current trading price of $72.

In fact, new AI tools that Wix is developing to help further improve its website development platform should increase its addressable market. We are already seeing this in the numbers. Revenue growth accelerated to 14% last quarter, up from 13% in the same quarter a year ago. It is not a huge acceleration, but it clearly shows that AI tools are not killing Wix's website development growth engine.

The company has also acquired start-up Base44, which helps users build mobile apps without coding. This fits perfectly alongside Wix's low-code website-building platform. Base44 had virtually zero revenue when it was acquired last fall, but was already on pace to hit $50 million in annual recurring revenue (ARR) by the end of 2025. That is some phenomenal growth that should carry forward into 2026.

Wix's free cash flow was $570 million over the last 12 months. The market cap is currently under $4 billion. This is a fantastic opportunity for investors to buy a durable growth stock at a dirt cheap price.

Image source: Getty Images.

Adobe's cheap stock price

Adobe (NASDAQ: ADBE) is down nearly 45% over the last 12 months. The software conglomerate that supports video/photo editing, app development workflows, PDFs, and many other programs for the creative industry has faced growing concerns about AI disruption. The stock's average price target is $429, compared with its current price of $258.

The idea is that marketing agencies or small developer teams can copy Adobe's product suite, platform integrations, and decades of software development by simply asking an AI bot to replicate it. While investors should not underestimate the growing capabilities of chatbots like Claude, this feels unlikely. A group of marketers does not want to spend time building video editing software, so they pay Adobe a small subscription fee each year.

Other start-ups, such as Figma or Canva, are the real competitive threats to Adobe. Both have grown in recent years and encroached on Adobe's product turf. However, so far, it looks like Adobe can still grow through this increased competitive pressure. Last quarter, the business posted record revenue of $6.2 billion, a large backlog, and began buying back shares at a discount.

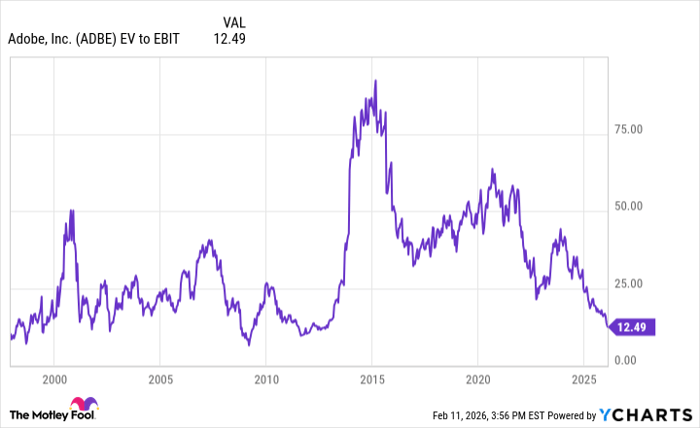

Adobe's revenue has consistently grown for the last 10 years and should keep growing as the company raises prices on its software subscriptions while adding new customers. The stock trades at just 12.5x trailing operating earnings, which is one of its lowest levels ever, making it an ideal time to scoop up some shares.

ADBE EV to EBIT data by YCharts

Is AI disruption real?

It may be easier for a group of software developers to build competing products to Wix or Adobe than it was a few years ago. But this does not mean customers will automatically switch to new programs over systems they have trusted to run their businesses for decades. You are taking a major risk by porting over your entire operating system to a software program built by AI when existing solutions from Wix, Adobe, or any other trusted software already work for you.

The idea that small business owners paying for a Wix website or teams of marketers using Adobe will somehow vibe code replacement platforms and churn off of these software programs is laughable. AI disruption is a real risk to the entire business world, but it doesn't mean existing software programs will die tomorrow, or that everyone will spend their days using AI chatbots to code software replacements.

Don't let the headlines and falling share prices scare you. Now is a great time to buy the dip on Adobe and Wix.com stock.

Should you buy stock in Wix.com right now?

Before you buy stock in Wix.com, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Wix.com wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 15, 2026.

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe and Wix.com. The Motley Fool recommends the following options: long January 2028 $330 calls on Adobe and short January 2028 $340 calls on Adobe. The Motley Fool has a disclosure policy.