Prediction: This Will Be SoundHound AI's Stock Price by 2030

Key Points

SoundHound AI is looking to expand the industries it's involved with.

Management sees 50% growth for the foreseeable future.

- 10 stocks we like better than SoundHound AI ›

SoundHound AI (NASDAQ: SOUN) is a popular AI stock due to its growth rate and size. It's a relatively small company at a $5 billion market cap, but its revenue is rising at over 50% year over year. Despite this, its stock has sold off heavily over the past few weeks and has fallen nearly 40% from its all-time high. That's a deep sell-off, and it may have many investors wondering if now is the time to buy the stock.

What matters for a company's stock price is the future, and SoundHound AI's looks bright. I think its stock price could be much higher by 2030, and if it goes right for SoundHound AI, it's a must-buy at these levels.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

SoundHound AI must appeal to the consumer

SoundHound AI integrates audio recognition technology with generative AI. This isn't a new technology, as digital assistants like Siri and Alexa have utilized artificial intelligence for some time to perform tasks similar to those of SoundHound AI's product. The difference is that SoundHound AI's platform is more accurate in certain tasks, such as drive-thru ordering at a fast food restaurant.

That's just one application for SoundHound AI's software, and it's a fairly limited one. However, if its technology is deployed across every drive-thru at every fast-food restaurant in the U.S., that's a sizable market opportunity. Other areas SoundHound AI is attempting to break into are financial services, healthcare, and insurance. These industries have sizable customer service teams to handle issues and claims. If generative AI-powered agents from SoundHound AI can replace the humans who normally staff these roles, SoundHound AI could capture a massive market opportunity.

There's just one problem: SoundHound AI isn't human. If consumers overwhelmingly reject AI replacing humans in some of these daily interactions, then SoundHound AI's software has a relatively limited application. The key is for consumers to accept AI integration, which may not occur for a few years. Technology is often rejected when it first rolls out. Many consumers initially hesitated to use credit cards online due to concerns about their information being stolen, but now, most don't think twice about making online purchases. I could see voice AI integration going the same way, as it may seem odd at first, but eventually it becomes normal and a part of daily life.

That's the bull case for SoundHound AI integration, as the bear case could be outright rejection, and its business fails for factors outside of its control. However, if you examine SoundHound AI's growth rates, it's clear that the company is performing well.

SoundHound AI's stock price could soar over the next few years

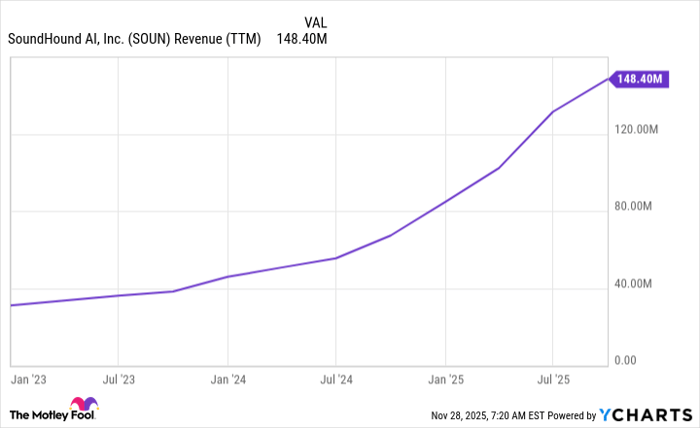

In Q3, SoundHound AI's revenue rose 68% year over year to $42 million. In Q2, management stated that it has visibility to 50% organic growth rates for the "foreseeable future." Q3 results backed that statement up, but what will SoundHound AI's stock price look like by 2030 if it can sustain that growth through 2030?

Over the past 12 months, SoundHound AI's revenue totaled $148 million. Should SoundHound AI sustain that growth rate through the end of 2030, its revenue would total $1.24 billion. SoundHound AI's stock would deserve a premium valuation for a software stock if it can deliver that level of growth for five years, so I'll price the stock at 20 times sales. That would give SoundHound AI a market cap of nearly $25 billion -- about a 400% rise.

SOUN Revenue (TTM) data by YCharts

At nearly $12 per share now, that would price the stock at about $60 per share. That's a huge rise and would make it a must-buy stock. But remember, its success is tied to consumer adoption. If the consumer accepts AI integration, then I could see this stock price coming to fruition. If they reject it, don't be surprised if SoundHound AI's stock is a market loser.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $540,587!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,118,210!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 195% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of December 1, 2025

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool recommends SoundHound AI. The Motley Fool has a disclosure policy.