3 Stocks That Turned $1,000 Into $1 Million (or More)

Key Points

Nvidia, Amazon, and Microsoft started with one product and expanded from there.

It took decades to achieve impressive 1,000x returns.

- 10 stocks we like better than Nvidia ›

Finding stocks that can deliver 10x returns in a reasonable time frame is a goal for many investors. However, finding stocks capable of generating 100x or even 1,000x returns is even better.

By studying some of the greatest investments of all time, investors can pinpoint what makes for a potentially successful long-term investment story. While there's no guarantee that any stock can repeat these feats, identifying companies that display these traits is a smart idea.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Below, I'll take a look at some companies that turned a mere $1,000 into $1 million over the long haul and see what investors can learn from those companies to drive their future investment decisions.

Image source: Getty Images.

All of these stocks started with a specific product or service and gradually expanded

The three stocks I want to focus on are Nvidia (NASDAQ: NVDA), Amazon (NASDAQ: AMZN), and Microsoft (NASDAQ: MSFT). All three of these companies started off doing a specific task then dramatically grew their businesses to include other areas.

Nvidia, the leader in graphics processing units (GPUs), which are in heavy demand during the artificial intelligence (AI) revolution, didn't start off thinking that its processing units would be used in massive data centers for training AI. Instead, they were initially launched for the purpose of processing gaming graphics. Nvidia's products dominated this niche, although they slowly expanded into other use cases like engineering simulations, drug discovery, and cryptocurrency mining before ultimately seeing their biggest use case ever in AI.

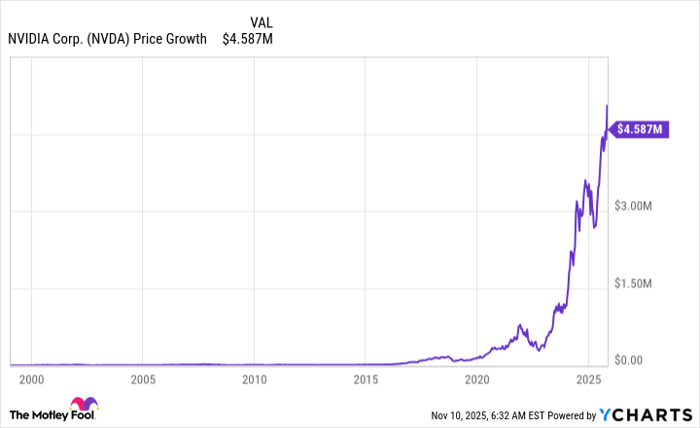

If you had invested $1,000 into Nvidia at its initial public offering (IPO), that investment would now be worth $4.6 million.

NVDA data by YCharts.

Amazon has a similar story. Its e-commerce platform started as a website that only sold books. Eventually, Amazon added more products before eventually reaching the point where you can buy nearly everything under the sun. It also launched ancillary businesses to support its e-commerce aspirations, like delivery, advertising, and third-party seller services.

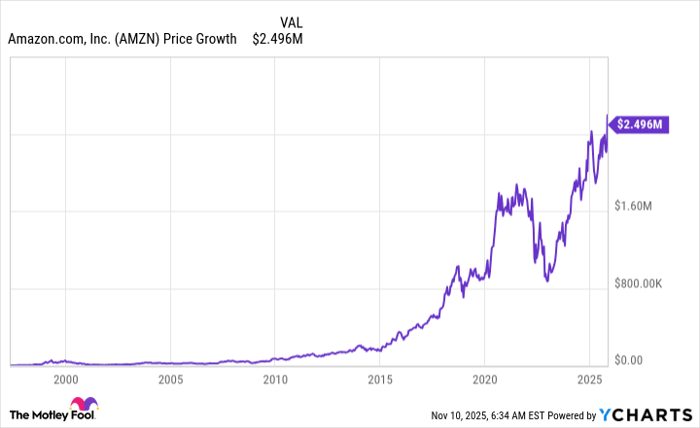

These expansions allowed Amazon to thrive and continue growing, even when nearly every person in the U.S. was already a customer. A $1,000 investment at the company's IPO would now be worth about $2.5 million -- an incredible return.

AMZN data by YCharts.

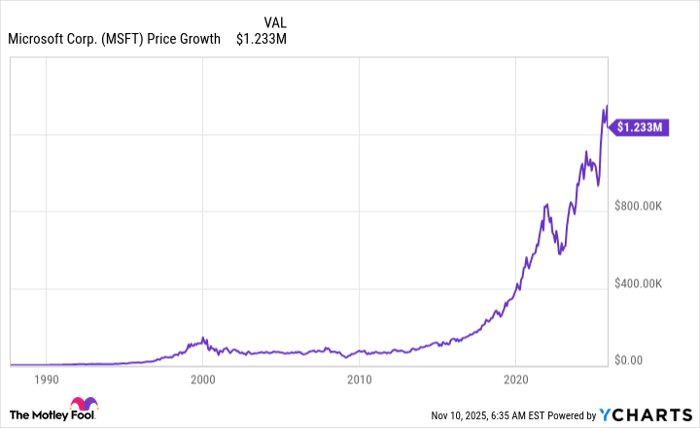

Microsoft's run took a lot longer than Amazon's or Nvidia's, but it got there eventually.

MSFT data by YCharts.

Everyone knows the story of Microsoft launching software for PCs. The company's offerings eventually expanded to include operating systems, Office products, and other programs that helped it grow into the behemoth it is today. Microsoft's products have changed the world, and its willingness to pivot into different areas, including the most recent computing trend, cloud computing, is a testament to why it was successful.

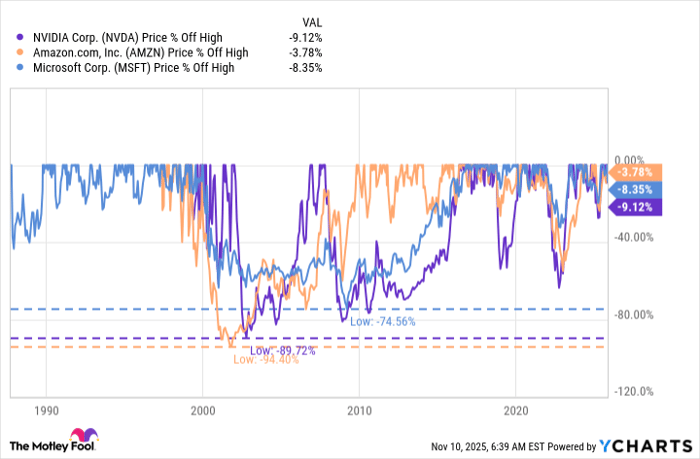

While all three of these companies turned $1,000 into at least $1 million, it wasn't always a straight line upward.

All of these companies have dealt with massive drawdowns

It hasn't been a smooth ride up for any of these companies. During their massive rises, all three have dealt with times when their stock prices were down 75% or more from their all-time highs.

NVDA data by YCharts.

Amazon lost almost 95% of its value during the dot-com crash. It took a lot of courage for some hardy investors to hold on through those tough times, but anyone who did was greatly rewarded.

It's not easy to achieve these incredible returns, but if you're looking for stocks that can, try looking for companies that have a product that's excelling in one niche but has the potential to capture a massive global market. Once you've found a company that meets that requirement, you must hold onto it for the long term and let the business do the talking. Market sentiment can drive stocks up and down and can cause stocks to disconnect from business metrics. As long as the company is continuously growing, that's all that matters.

These companies are rare, so don't be disappointed if you miss this generation's 1,000 bagger, but several stocks available for purchase in the market can provide impressive returns. The key is to find them and hold on for a long time.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $622,466!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,145,426!*

Now, it’s worth noting Stock Advisor’s total average return is 1,046% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Keithen Drury has positions in Amazon and Nvidia. The Motley Fool has positions in and recommends Amazon, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.