The 2026 COLA Is Set -- Here's the Good and Bad News for Social Security Recipients

Key Points

Social Security benefits will rise 2.8% next year.

Annual COLAs are meant to help offset the impacts of inflation for retirees.

The purchasing power of benefits has eroded significantly in recent years.

- The $23,760 Social Security bonus most retirees completely overlook ›

The rules that dictate federal programs are rarely set in stone. Rather, the regulations governing these programs are, more often than not, quite fluid -- constantly adapting to changes in the broader economy.

One program that millions of Americans monitor closely is Social Security. Perhaps the biggest reason is that each year, beneficiaries receive a cost-of-living adjustment (COLA).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

While the recent government shutdown delayed the official COLA announcement, Social Security recipients now know they will be receiving a 2.8% increase to their benefit checks.

Let's break down how this figure is calculated and examine what it reveals about the current economic picture.

Image source: Getty Images.

How are annual COLA figures calculated?

The Social Security Administration (SSA) uses data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to determine what the annual COLA will be.

Specifically, the SSA accounts for the average CPI-W for the third quarter of the year and then compares this to the average CPI-W during the same quarter a year ago. If the percentage change between these figures is positive, that number becomes the COLA for the following year.

According to SSA's data archives, the average CPI-W during the third quarter of 2024 was 308.73 compared to 317.27 for this year. The difference between these averages is about 2.8%. This marks a small increase from 2025's 2.5% COLA.

Image source: Getty Images.

Should Social Security recipients be happy with the 2026 COLA?

On the surface, a rising COLA might sound like positive news, but the reality is not so simple.

An increase to your monthly benefits signals that prices are rising -- the COLA is intended to safeguard your purchasing power, after all. Moreover, it's important for beneficiaries to keep in mind that COLAs are meant to keep up with inflation, not outrun it.

Meanwhile, the COLA formula itself is arguably flawed. Since the SSA relies on the CPI-W, which tracks price changes experienced by working-age households, this price data may not be optimal for retirees.

Broadly speaking, retirees tend to spend more on services, including healthcare, insurance, and housing, compared to active workers. In addition, these industries generally experience higher price increases relative to broader inflation growth across the entire economy.

In my eyes, the 2026 COLA might prove useful in offsetting price increases for household items like groceries or utility bills. But in reality, a 2.8% increase is highly unlikely to rejuvenate the purchasing power that's been eroded among retirees in recent years due to historically elevated inflation levels.

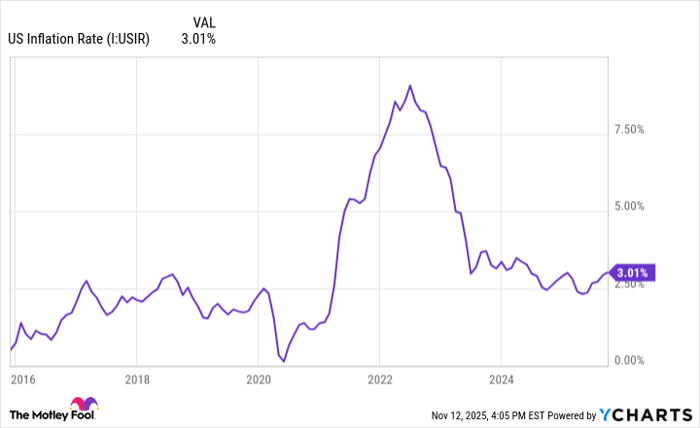

Data by YCharts.

At the end of the day, next year's increase sits squarely among historical COLA rates. Back in 2023, Social Security recipients received an 8.7% COLA, marking its highest adjustment since the 1980s. The last two years, however, featured more moderate increases of 3.2% in 2024 and 2.5% last year.

Given these dynamics, I see the 2026 COLA as a reflection of moderating inflation as opposed to a significant boost to the financial peace of mind for retirees. While these trends could suggest that inflation rates are moving toward prolonged stabilization, I do not necessarily see an increase of 2.8% as a cause for celebration among Social Security recipients.

For seniors who must live on a fixed income and a prudent budget, next year's COLA is an important reminder that Social Security benefits strive to maintain purchasing power as opposed to serving as a gateway to durable financial improvement.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

View the "Social Security secrets" »

The Motley Fool has a disclosure policy.