Cardano Price Forecast: ADA consolidates near $0.40 as bullish on-chain signals build

- Cardano price steadies around $0.40 on Monday after being rejected from the upper trendline the previous week.

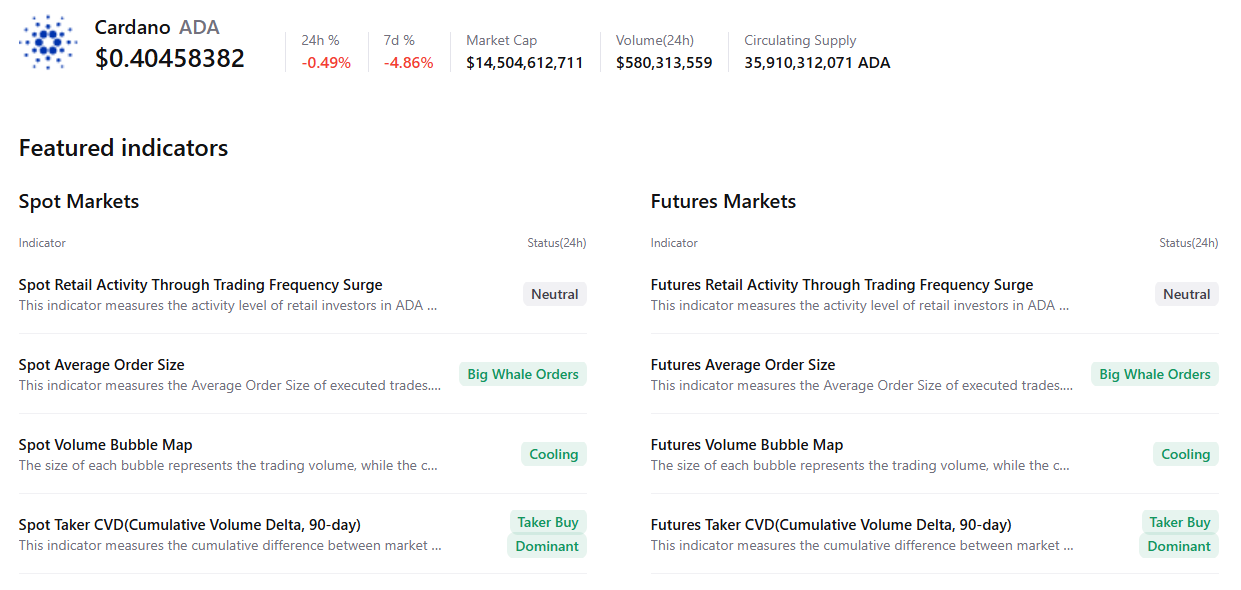

- On-chain and derivatives data indicate improving sentiment, with large whale orders, rising bullish bets among traders, and buy-side dominance.

- The technical outlook suggests ADA is attempting to break out of a falling wedge, with immediate resistance at $0.51.

Cardano (ADA) price steadies above $0.40 at the time of writing on Monday after failing to sustain a move above the upper boundary of the wedge pattern in the previous week. Meanwhile, short-term price action remains subdued, and improving on-chain and derivatives data suggest growing bullish interest, keeping the prospect of an upside breakout in focus.

Cardano’s on-chain and derivatives data suggest improving sentiment

CryptoQuant’s summary data point to a bullish outlook, as Cardano’s spot and futures markets show large whale orders, cooling conditions, and buy dominance. All these factors signal an improving sentiment among traders, hinting at a potential rally in the upcoming days.

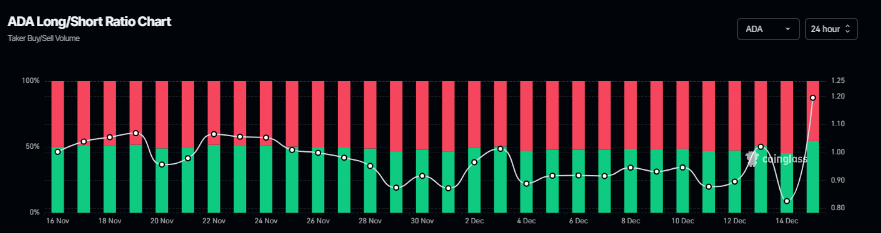

On the derivatives side, CoinGlass’s long-to-short ratio for ADA reads 1.19, the highest level in over a month. The ratio above one suggests bullish sentiment in the market, as traders are betting on the asset price to rally.

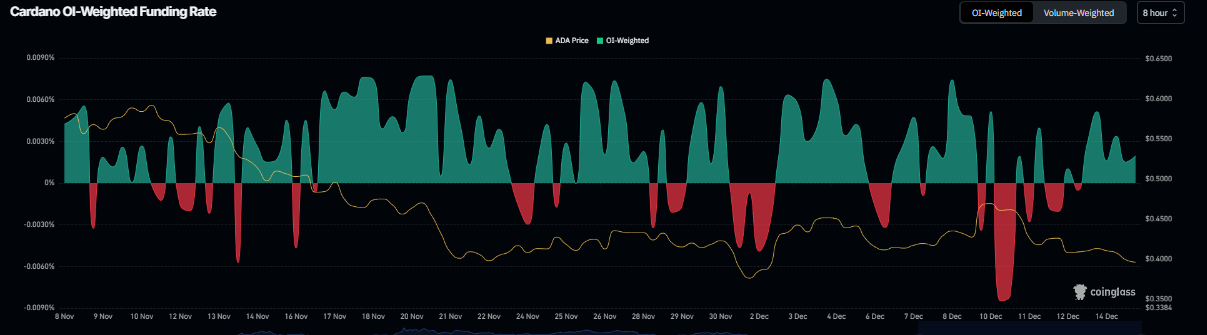

Additionally, Cardano’s funding rate data indicate a potential rally. According to Coinglass’s OI-Weighted Funding Rate data, the number of traders betting that the price of Cardano will slide further is lower than those anticipating a price increase.

The metric has flipped to a positive rate on Saturday and stands at 0.0020 on Monday, indicating that longs are paying shorts. Historically, as shown in the chart below, when the funding rates have flipped from negative to positive, Cardano’s price has rallied sharply.

Cardano Price Forecast: Is ADA preparing for a falling wedge breakout?

Cardano's price was rejected from the upper trendline of the falling wedge pattern (formed by connecting multiple highs and lows with two trendlines since mid-October) on Wednesday and declined 16% through Sunday. As of Monday, ADA hovers around $0.40.

If ADA recovers and breaks above the falling wedge pattern, it could extend the rally toward the next immediate resistance at $0.51, its 38.2% Fibonacci retracement level.

The Relative Strength Index (RSI) on the daily chart reads 40, pointing upward toward the neutral level of 50, indicating fading bearish momentum. For the bullish momentum to be sustained, the RSI must move above the neutral level.

However, if ADA corrects, it could extend the decline toward the December 1 low of $0.37.