Polymarket Odds of Clarity Act Passing Surge to 82% Amid White House Push

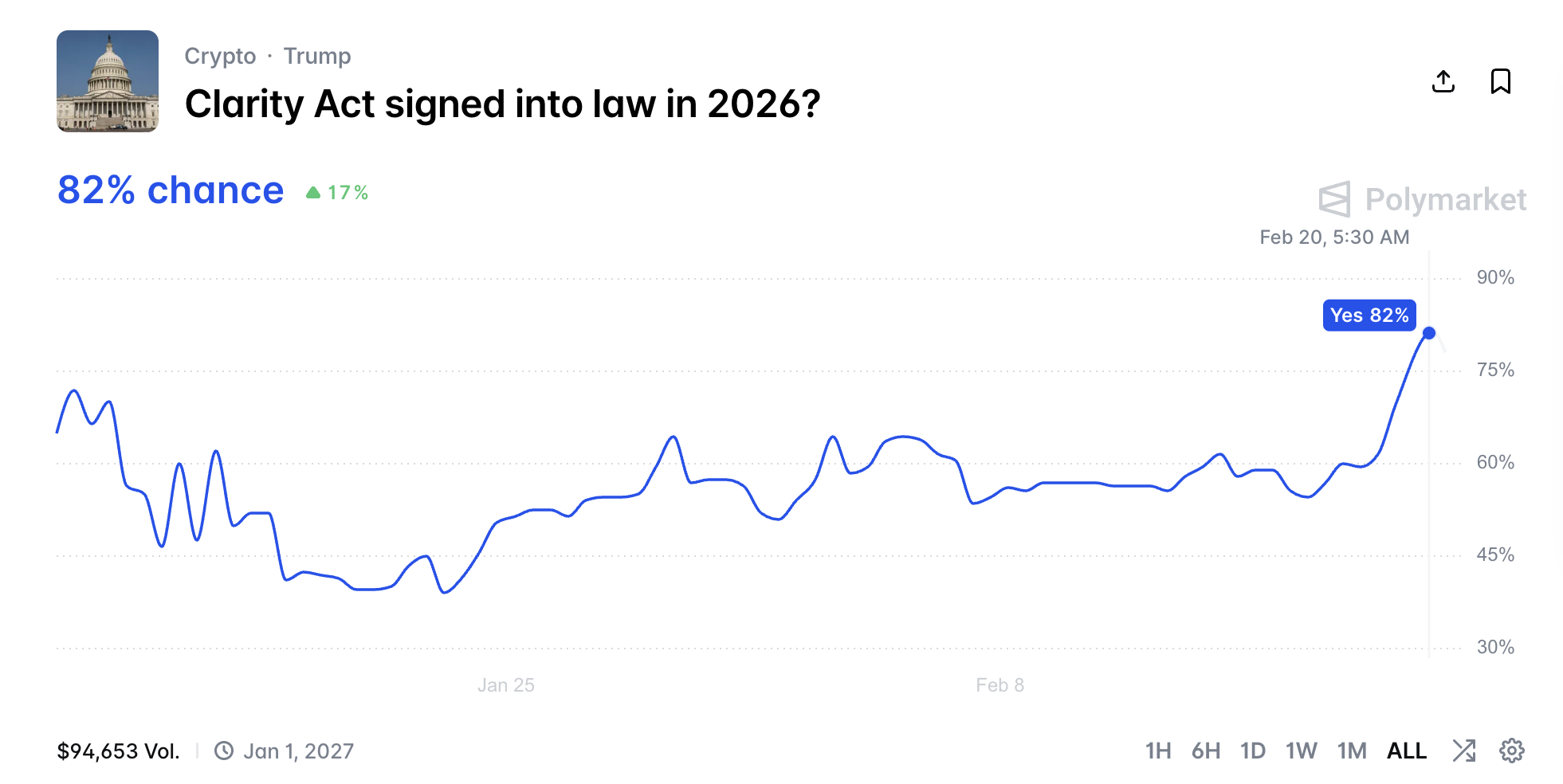

The probability of the Clarity Act being signed into law in 2026 surged to a record 82% on Polymarket earlier today.

The increase in odds comes ahead of a looming deadline to move the key crypto legislation forward.

Polymarket Signals Growing Confidence in Clarity Act as Negotiations Accelerate

Data from Polymarket shows that the probability of the Clarity Act becoming law rose sharply over the past 48 hours. Odds climbed from around 60% on February 18 to a peak of 82% earlier today.

At press time, the figure had eased to 78%, still reflecting a significant jump and signaling growing market confidence in the bill’s prospects.

Odds of Clarity Act Passing in 2026. Source: Polymarket

Odds of Clarity Act Passing in 2026. Source: Polymarket

The optimism is not limited to prediction market traders. Industry executives are also projecting strong momentum.

In an interview with Fox Business, Ripple CEO Brad Garlinghouse said there’s a 90% chance that the long-debated Clarity Act will pass by the end of April.

“The White House is pushing hard on this, and that is a big reason why it will get done. It needs to get done for US leadership,” he said.

The rise in retail optimism comes as the White House moves to push negotiations forward. According to Fox Business, a March 1 deadline has been set to advance the legislation ahead of the midterms.

White House Hosts Third Meeting as Clarity Act Deadline Nears

The Clarity Act is focused on establishing a regulatory framework for digital assets. At its core, the bill aims to clearly define regulatory oversight between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

The legislation passed the House last July. However, the Senate’s version remains stalled. The primary point of contention between banks and crypto firms centers on stablecoin yields. Last month, Coinbase withdrew its support for the bill after the Senate’s changes.

The administration has convened several discussions involving crypto firms and banking representatives, with a third meeting held on Thursday.

According to journalist Eleanor Terrett, a representative from the crypto industry argued that banks’ concerns may be rooted more in competitive dynamics than in measurable concerns over deposit flight.

A source representing banks told Terret that, for their part, they are pushing further analysis of how stablecoins could affect traditional deposit bases.

“Bank trade groups will brief their members on today’s discussions and gauge whether there’s room to compromise on allowing crypto firms to offer stablecoin rewards. One source said an end-of-month deadline doesn’t seem unrealistic, with talks set to continue in the coming days,” Terrett said.

As discussions move forward, March 1 stands out as a critical date in the legislative timeline. Despite ongoing disagreements, market analysts still view the bill as broadly positive for the industry.

If passed, it would mark a significant step toward reducing regulatory uncertainty and establishing clearer rules for the crypto sector overall.