Ghost holding in BlackRock’s IBIT sparks Chinese Bitcoin investment whispers

- BlackRock’s quarterly report of institutional investment managers reveals a $436 million ghost holding.

- Laurore Ltd, a Hong Kong-based entity registered by Zhang Hui, has fueled rumors of Chinese investment amid the countrywide ban on BTC.

- The recent pullback in Bitcoin draws attention from large wallet investors and volume away from altcoins.

A new entity identified in BlackRock's quarterly filing for its Bitcoin (BTC) Exchange-Traded Fund (ETF) IBIT has sparked rumors of Chinese investment under the name of Zhang Hui, despite the nationwide ban on the Crypto King. The broader market demand for Bitcoin is reemerging among large wallet investors, commonly called whales, and is attracting volume away from altcoins.

Shell holding in BlackRock’s IBIT cautions a Chinese link

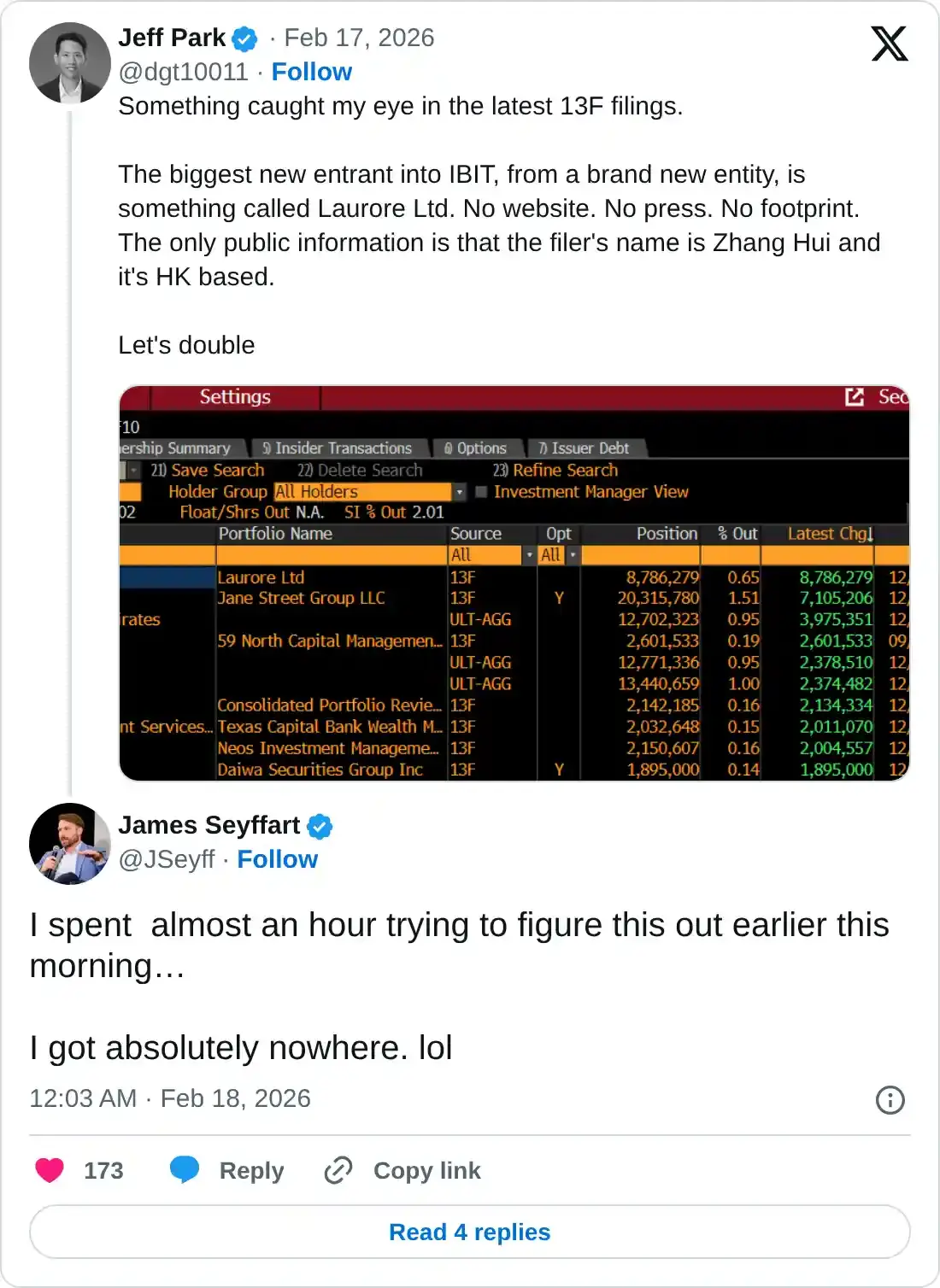

Jeff Park, an advisor to Bitwise Investment, identified an entity named Laurore Ltd in BlackRock IBIT’s 13F filing, a quarterly report filed with the US Securities and Exchange Commission (SEC) by institutional investment managers with over $100 million in assets under management. According to Park, the company is Hong Kong-based, and the ETF holding was filed by Zhang Hui, a fairly common name in China, fueling speculation about potential anonymity.

Additionally, Park noted that the “Limited” or “Ltd” suffix may indicate a connection to a Cayman Islands or other shell entity, a well-known route for anonymous access to the US markets.

FXStreet has been unable to verify the Chinese connection or provide additional information about the company or Zhang Hui, just as Bloomberg Analyst James Seyffart also noted in the post thread

However, if the investment is linked to a Chinese investor, this would indicate emerging demand in the country despite the ongoing ban on cryptocurrencies. If so, upcoming 13F filings from BlackRock’s IBIT could show more such entities or increased holdings by Laurore Ltd., which could highlight capital flight risk from China due to strict crypto restrictions.

Earlier this month, Chinese financial regulators doubled down on the crypto ban, extending it to tokenization of Real-World Assets (RWAs) and stablecoins, which are generally pegged to fiat currencies at a 1:1 ratio. This reflects a stark contrast to the push for RWAs, stablecoins, and other crypto projects in the US.

Institutions and large players remain confident in Bitcoin

The rumoured Chinese demand aligns with the consistent confidence in Michael Saylor’s Strategy (MSTR), which bought 2,486 BTC on Tuesday, bringing the total to 717,131 BTC.

Additionally, CryptoQuant data shows an increase in whale holdings despite heightened selling pressure in the market. The total balance held by whales has increased to 3.1099 million BTC on Tuesday, from 2.8874 million BTC on December 11.

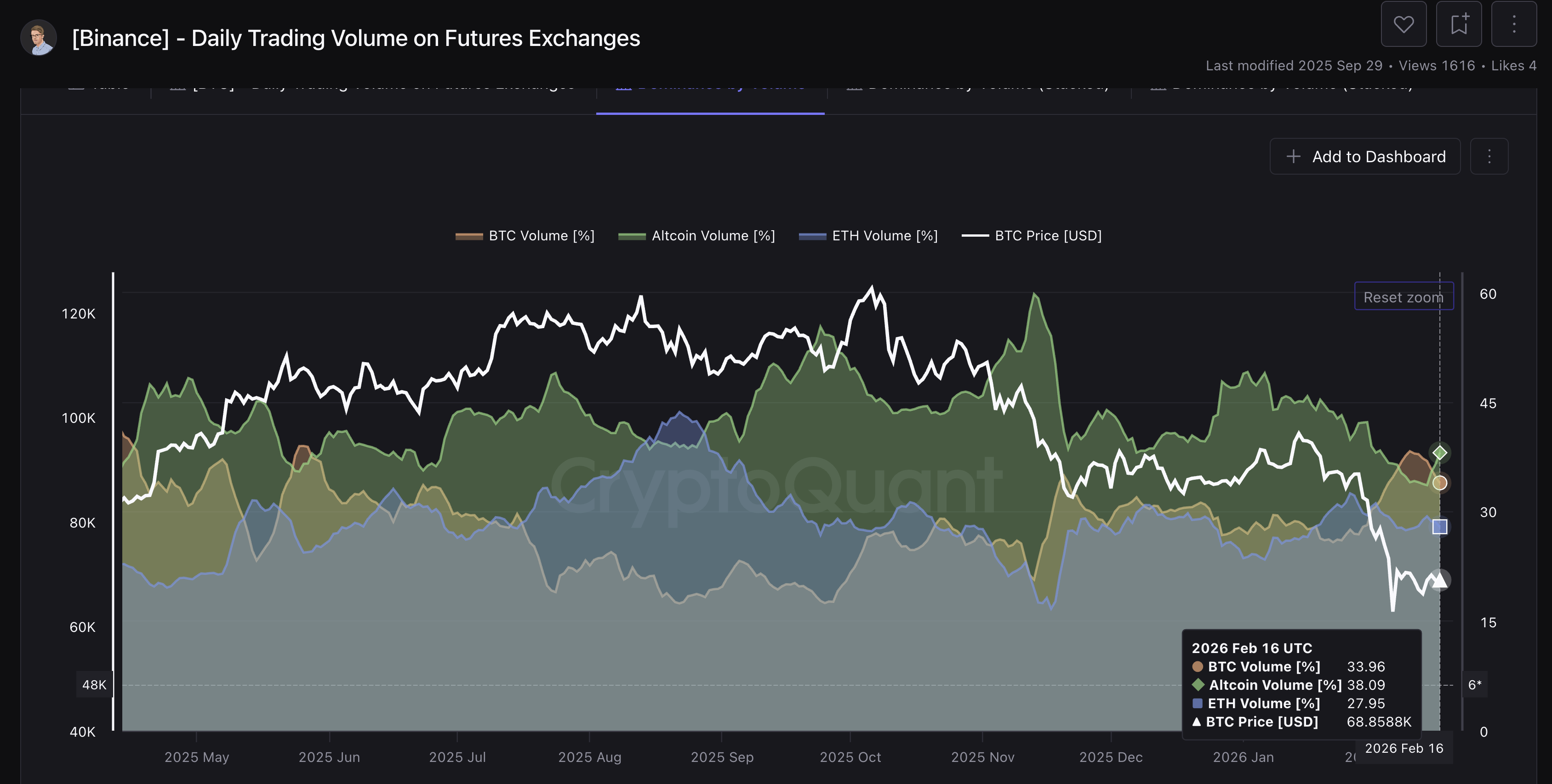

Meanwhile, on-chain data show a significant shift in volume from the altcoin market toward Bitcoin. According to CryptoQuant, altcoin volume was 38.09% on Monday, down from roughly 59.83% on November 13. Bitcoin volume has increased to 33.96% from 20.71% in the same time period, indicating that investors are shifting to Bitcoin as a relatively safe haven for capital preservation amid a bear market.

Despite on-chain signals of renewed confidence among large wallet holders, Bitcoin remains on the defensive due to ETF outflows and low derivatives sentiment.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.