Ethereum’s Profit-Taking Pressure Dips — So Why Does Price Still Look Weak?

Ethereum price is down 18.5% in the past 30 days and about 5.2% this week. It is holding up slightly better than Bitcoin on the weekly chart, but it is nowhere close to recovery. One key on-chain signal shows that most traders have almost no reason left to book profits.

Under normal conditions, that would help form a bottom. However, if profit-taking pressure has already dissipated, the obvious question is why the Ethereum price still refuses to bounce.

Profit-Booking Incentive Drops, But Not Enough To Confirm A Bottom

Net Unrealized Profit and Loss (NUPL) has dropped to 0.23, the lowest reading since July 1. NUPL tracks investor psychology by measuring the amount of unrealized profit or loss in the market.

It shifts between phases such as capitulation, where most wallets hold losses, and belief or denial, where confidence grows.

ETH Profit-Booking Reasons Are Fewer Now: Glassnode

ETH Profit-Booking Reasons Are Fewer Now: Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

The last time NUPL dropped even lower was June 22, when it hit 0.17. That move came right before Ethereum rallied 106.3%, which helped NUPL rise from capitulation into belief and denial.

Today’s reading sits above that level, which means ETH has room to fall further if the market weakens.

A lower NUPL print would match the conditions that existed before the previous major reversal. Although profit-taking incentives are now minimal, the bottom signal is not yet fully aligned.

Liquidation Pressure Explains Why Price Isn’t Responding To NUPL

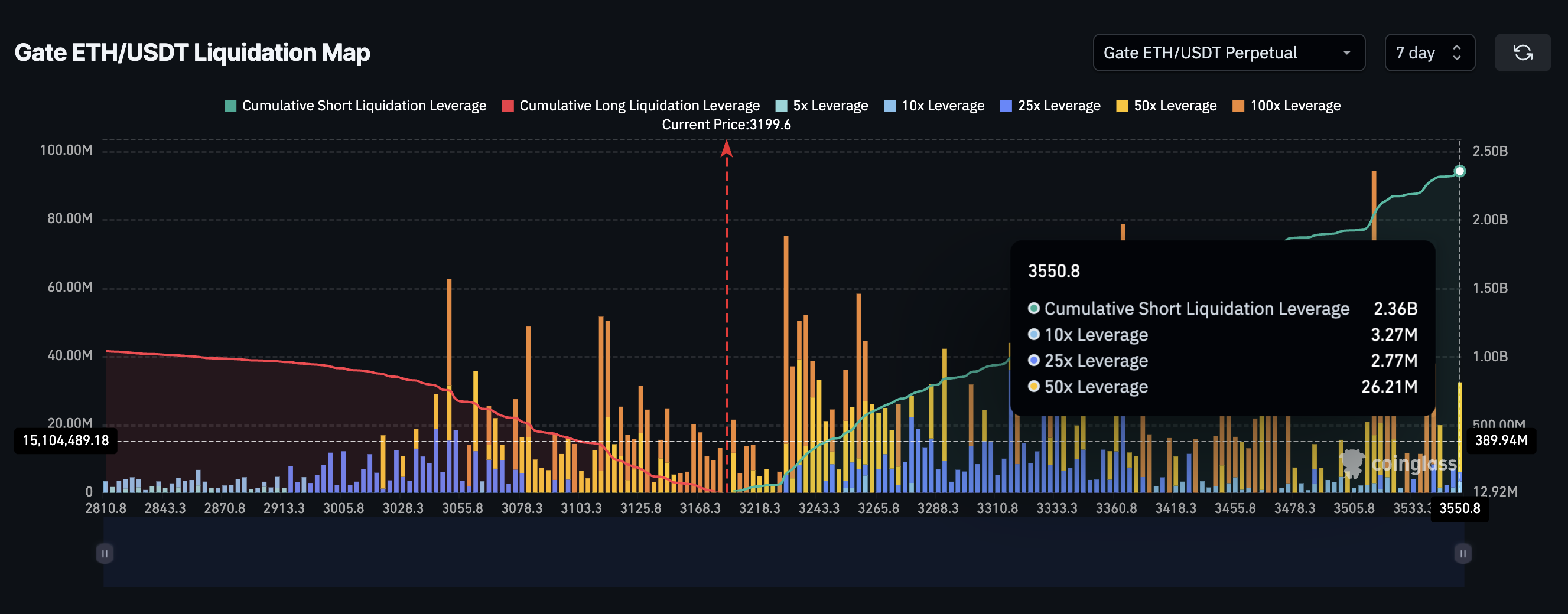

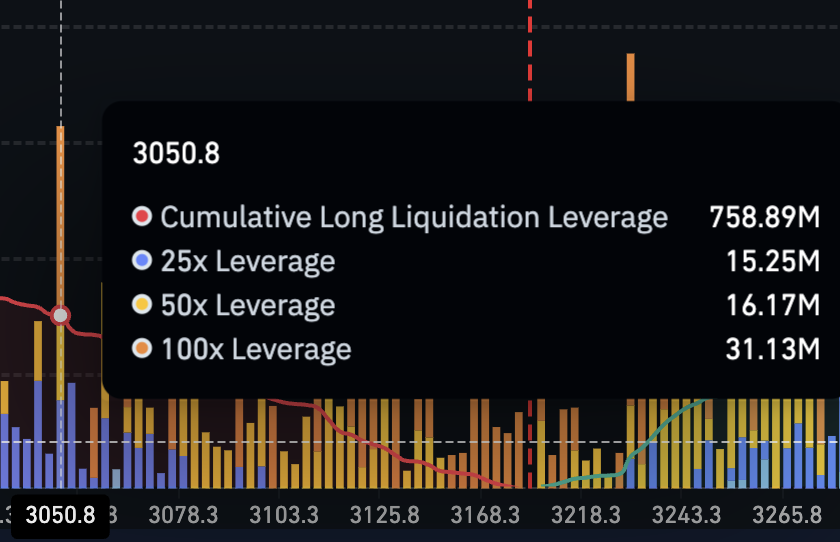

The derivatives market gives the clearest reason for Ethereum’s hesitation. On Gate’s ETH-USDT liquidation map, short exposure is heavy at $2.36 billion, but long exposure is still sizeable at $1.05 billion.

Ethereum Liquidation Map: Coinglass

Ethereum Liquidation Map: Coinglass

This imbalance keeps pressure on both sides. The thickest long-liquidation cluster stretches roughly to $3,050. ETH is trading near this level, which means even a mild drop can trigger forced selling from long traders.

Long Liquidation Leverage Could Limit Upside: Coinglass

Long Liquidation Leverage Could Limit Upside: Coinglass

Long liquidations can easily overpower the positive effect of low NUPL. Even if shorts are over-exposed, the remaining long leverage is large enough to keep the market unstable.

This is the link between the two metrics: Ethereum cannot use a profit-bottom setup as long as this long-liquidation wall remains intact.

Ethereum Price Chart Lines Up With The Same Risk Zone

The Ethereum price chart reinforces the same story. ETH is still trading inside a falling channel, and the $3,053 region remains the most important support. This is the exact zone where the strongest long-liquidation cluster sits. If the price loses $3,053, the odds of a deeper drop rise sharply.

That kind of drop aligns with the path where NUPL could slide toward its June low of 0.17, matching the setup that preceded the last major leg higher.

Ethereum Price Analysis: TradingView

Ethereum Price Analysis: TradingView

There is a bullish path, but it needs far bigger confirmation. ETH must reclaim $3,653 to show real strength, which is still more than 14% above current levels. From there, clearing $3,795 would flip the structure from bearish to neutral.

This move also tests the upper boundary of the falling channel, which has only two clean touches and is not a strong resistance. If NUPL stabilizes, shorts begin to unwind, and Ethereum price clears these levels, a sharp rebound becomes possible. Until those conditions merge, ETH stays trapped between a fading profit motive and a stubborn liquidation overhang.