Where Will Palantir Stock Be in 5 Years?

Key Points

Palantir's platform is growing at warp speed.

The company has clients in the government and commercial sectors.

The stock carries a premium price tag.

- 10 stocks we like better than Palantir Technologies ›

Palantir Technologies (NASDAQ: PLTR) has been one of the most successful stock picks in 2025. Its stock has risen over 130% so far, although it was up nearly 175% at its peak.

This gain follows other impressive returns in 2023 and 2024, but investors can't travel back in time and capture those returns. Instead, they need to shift their focus from what happened in the past to what will occur over the next five years.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

With a long-term mindset, investors can make the decision if this sell-off is a great buy-in opportunity, or if this is a healthy correction for a stock that has delivered jaw-dropping returns over the past few years.

Image source: Getty Images.

Palantir's product is becoming a staple in the AI realm

Palantir got its start by offering artificial intelligence-(AI) powered data analytics solutions to the government. Eventually, it expanded into commercial real estate and continues to enjoy the strength of having two massive customer bases.

Palantir's platform takes several inputs and allows those with decision-making capabilities to make the best-informed decisions at all times. Furthermore, it offers generative AI agents that can take care of some repetitive tasks or automate the decision-making process in other areas. This platform has seen explosive growth and is taking the AI world by storm.

In Q3, revenue surged by 63% year over year, exceeding expectations. Additionally, Palantir generated a massive amount of profits, with its profit margin rising to an incredible 40%. Digging in a bit deeper, commercial revenue rose 73% year over year to $548 million, powered by U.S. commercial growth of 121%. Government revenue growth was also quite strong, rising 55% to $633 million.

There's really no sign of weakness in Palantir's business; it's an absolute juggernaut. What's even more impressive is how much room it has to run. Palantir has 530 total clients in the U.S., which indicates it could substantially expand its reach.

However, its quarter-over-quarter customer growth count slowed to 9% year over year, down from 12% and 13% in the two prior quarters. This is a trend investors should keep an eye on, as U.S. client growth will be a huge driver for future success.

Still, Palantir looks like an absolutely incredible business with a huge runway, but will that translate into stock success?

Palantir's stock looks extremely overvalued

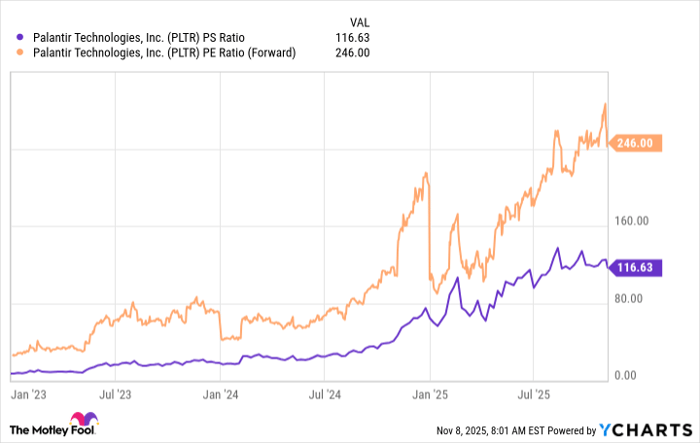

You'd be hard-pressed to find an investor who isn't impressed with Palantir's business or quarterly results. The problem is Palantir's stock valuation. Palantir is one of, if not the most expensive, stocks on the market. It trades for 117 times sales and 246 times forward earnings.

PLTR PS Ratio data by YCharts

Those are extreme valuations that convey a ton of growth already baked into the stock price. In fact, it could hamper future growth.

To set a baseline of where Palantir should be valued, I think it's smart to look at other AI players, like Nvidia (NASDAQ: NVDA). Nvidia makes graphics processing units (GPUs) that are the backbone of all the AI technology we know today. During its run (which included multiple quarters of 200% or greater growth), it never traded for more than 46 times earnings or 50 times forward earnings

If we set a 50 times earnings multiple at a reasonable level, assume Palantir can grow at a 50% compounded annual growth rate (CAGR), and achieve 40% profit margins, that would indicate it would have revenue of $29.6 billion and profits of $11.8 billion. That's a massive increase from today's levels, but with Palantir's current market cap of $424 billion, that would price Palantir at 36 times 2030's earnings. For reference, Nvidia trades at 28 times next year's earnings right now.

So, where will Palantir be five years from now? I'd expect it to be in the same place. There is about four to five years' worth of incredible growth already priced into Palantir's stock, and this will prevent the stock from having more success even as the business is thriving. As a result, I think investors should look to some different AI stocks besides Palantir.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $599,784!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,716!*

Now, it’s worth noting Stock Advisor’s total average return is 1,035% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 10, 2025

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia and Palantir Technologies. The Motley Fool has a disclosure policy.