US Bitcoin ETFs Post $1.1B Outflows As BTC Price Struggles Below $100K

Over the last two years, the performance of the US-based Bitcoin ETFs (exchange-traded funds) has been a fair reflection of the current market sentiment. With consecutive weeks of capital outflows, there is no doubt about the predominantly bearish climate of the market.

This worsening sentiment can be seen in BTC’s dip below the psychological $100,000 price level. While selling pressure from various investor classes has been identified as one of the major factors behind BTC’s price decline, it is difficult to overlook the concurrent woeful performance of the Bitcoin ETFs.

Bitcoin ETFs Record $492 Million Outflow To Close Week

According to the latest market data, the US Bitcoin ETF market registered a daily total net outflow of over $492.1 million on Friday, November 14. This latest round of withdrawals marked the third-straight day of negative outflows for crypto-linked investment products.

Leading this massive capital outflow is the largest BTC exchange-traded fund by net assets, BlackRock’s iShares Bitcoin Trust (with the ticker IBIT). Data from SoSoValue shows that over $463.1 million was withdrawn from the spot BTC ETF on Friday.

Grayscale Bitcoin Trust (GBTC) recorded the second-highest net outflow of $25.09 million on the day. Fidelity Wise Origin Bitcoin Fund (FBTC) and WisdomTree Bitcoin Trust (BTCW) were the only other Bitcoin ETFs that recorded negative outflows to close the week, with $2.06 million and $6.03 million, respectively.

Grayscale’s Bitcoin Mini Trust (BTC) was the only spot Bitcoin exchange-traded fund that posted a capital influx on Friday, adding $4.17 million to its assets.

On Thursday, September 13, the Bitcoin exchange-traded products registered their second-worst daily performance, with a total net withdrawal of $869.86 million. Meanwhile, Friday’s $492 million outflow worsened the US-based Bitcoin ETFs’ weekly record, bringing it to a total net outflow of over $1.11 billion.

Bitcoin Lags Under $100,000: Price Overview

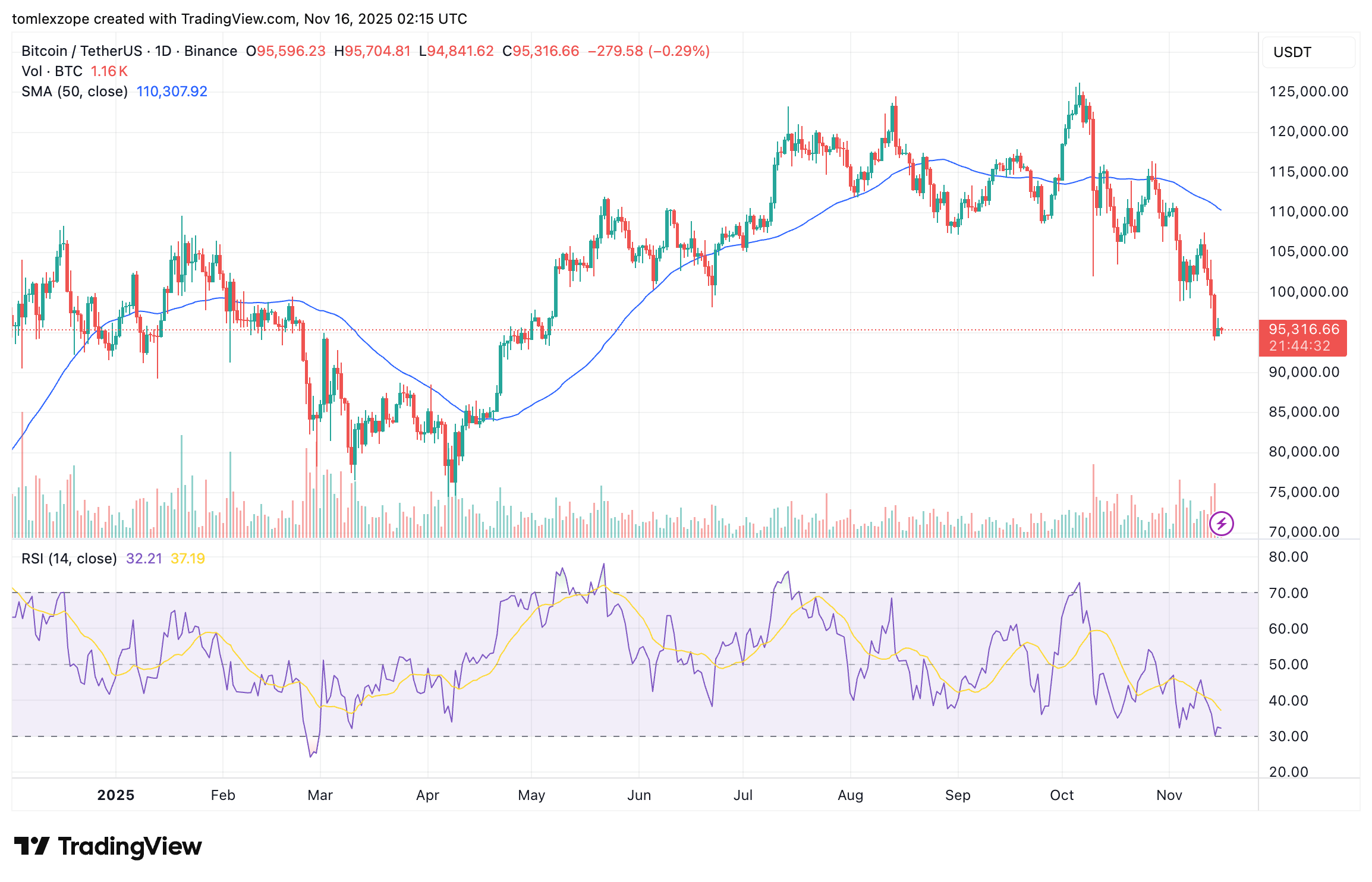

Unsurprisingly, these Bitcoin ETFs’ woeful performances have coincided with the recent price decline below the crucial $100,000 level. As seen since launch in 2024, the price of BTC tends to move in tandem with the Bitcoin exchange-traded funds.

As of this writing, the premier cryptocurrency is hovering around the $95,500 mark, showing some tame bullish action in the past 24 hours. According to data from CoinGecko, the price of BTC is down by nearly 7% in the past seven days.

While selling pressure from spot investors continues to affect the market leader, an uptick in Bitcoin ETF demand could help kickstart a turnaround for the cryptocurrency.