El Salvador’s Nayib Bukele Marks Bitcoin Day With a Bold Bet Ahead of September 8 Woes

El Salvador’s president, Nayib Bukele, marked Bitcoin Day with a symbolic gesture, igniting speculation about the pioneer crypto’s trajectory.

His remark comes at a time when historical patterns suggest turbulence may be ahead.

Bukele’s Bitcoin Day Gesture Meets Market Seasonality Warnings

On September 7, Bukele indicated on X (Twitter) that he was buying 21 BTC for Bitcoin Day. At present rates, with BTC trading for $111,175 as of this writing, this meant a purchase worth $2.334 million.

In hindsight, El Salvador adopted Bitcoin as legal tender on September 7, 2021. The move cemented the small Central American nation’s reputation as a global crypto pioneer.

“El Salvador Celebrates Bitcoin Day! The Bitcoin Office is proud to have been building Bitcoin country for three of the four years since El Salvador made Bitcoin legal tender,” the Bitcoin Office shared.

Therefore, the timing is deliberate, and comes at a time when the gold versus Bitcoin conversation is boiling over.

Beyond players such as Tether, El Salvador also made headlines in the same narrative only recently, with gold rising in the Central American country as the Bitcoin strategy progressively faces a global test.

However, this year’s commemoration comes amid growing scrutiny of Bitcoin in El Salvador, with the IMF questioning the authenticity of the nation’s claims. Against this backdrop, users remain skeptical about Bukele’s claims.

Strategy’s Michael Saylor Hints at More Bitcoin Purchases

Beyond President Bukele, MicroStrategy co-founder and executive chairman Michael Saylor, the world’s most visible corporate Bitcoin bull, hinted at plans to buy more BTC.

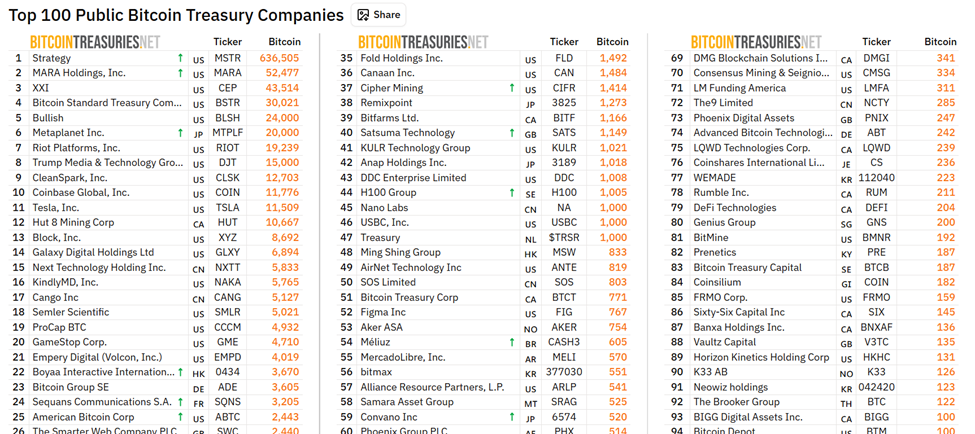

The comment was widely interpreted as a hint at the business intelligence company’s further accumulation of Bitcoin. Data on Bitcoin Treasuries shows Strategy (formerly MicroStrategy) already holds more than 636,000 BTC.

Corporate BTC Holders. Source: Bitcoin Treasuries

Corporate BTC Holders. Source: Bitcoin Treasuries

Investors closely track Saylor’s moves because MicroStrategy has become a proxy for Bitcoin exposure on Wall Street.

However, they also attract criticism. Hedge fund veteran Fred Krueger pushed back against claims that MicroStrategy’s debt-fueled strategy resembles a Ponzi scheme.

Is September 8 A Bearish Calendar Marker?

While Bukele and Saylor project confidence, some analysts warn that the calendar itself could be a headwind.

Timothy Peterson, author of Metcalfe’s Law as a Model for Bitcoin’s Value, pointed out that September 8 is historically one of the weakest trading days for Bitcoin.

“On any given day, Bitcoin is up 53% of the time for a typical gain of +0.10%. September 8 is down 72% of the time for a typical loss of -1.30%. This makes it the 7th worst day of the year,” Peterson explained.

More importantly, he added, the day often predicts the entire month: when September 8 closes negative, Bitcoin posts a monthly loss 90% of the time.

Such data highlights the tension between Bitcoin’s symbolic milestones and its often-brutal market realities. Whale Insider highlighted an equally brutal reality, that $10 billion BTC shorts could be wiped out if Bitcoin prices reach $117,000.

Despite short-term risks, long-term believers remain undeterred. Billy Boone reminded followers that Bitcoin’s market is dominated by just two million coins in active circulation.

“When those dry up, it’s not gradual,” he wrote.

The user argues that adoption fears are misplaced and supply constraints could accelerate price discovery.

This perspective resonates with El Salvador’s strategy. Bukele’s government has positioned Bitcoin as a foundation of national reserves alongside gold. They wager that scarcity and digital adoption will shield the country from fiat instability.

The anniversary of Bitcoin’s legal tender experiment coincides with one of its historically weakest trading days, and the contrast is stark.

Bukele’s 21 BTC gesture and Saylor’s “More Orange” hint suggest unwavering conviction, but market data points to caution.