Arbitrum Price Prediction: 10% losses likely for holders ahead of $107 million worth of cliff token unlocks

- Arbitrum network will unleash 92.65 million tokens to the market on Tuesday, worth nearly $107 million.

- ARB could dip 10% to $1.00 as investors, among other token recipients, are likely to cash in for quick gains.

- A flip of $1.73 roadblock into support would invalidate the bearish thesis.

Token unlocks are considered bearish catalysts, particularly when recipients are likely to cash in for a quick profit. The event, which adds tokens to the project’s circulating supply without increasing demand, leaves an effective imbalance in favor of supply. The Arbitrum network is among the projects lined up for cliff token unlocks this week, meaning traders must brace for volatility.

Also Read: ARB, STRK, AXS: Three token unlocks worth over $350 million to watch out for ahead of Bitcoin halving week

Arbitrum cliff token unlocks

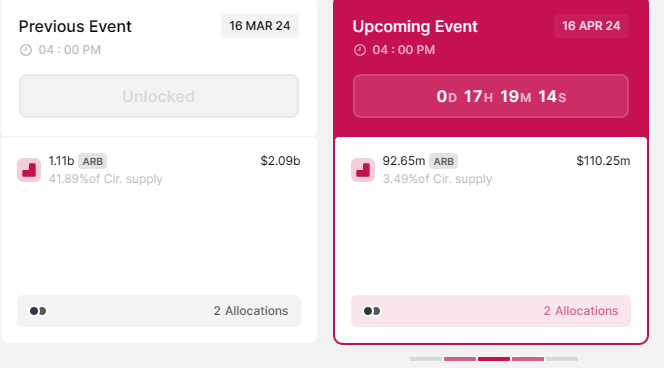

The Arbitrum network will unlock 92.65 million ARB tokens worth approximately $107 million and composing 3.49% of the network’s circulating supply. The event, slated for April 16, will see the tokens allocated to the Arbitrum team, the future team, and future advisors and investors.

ARB token unlocks schedule

The last unlocks happened on March 16, where 1.11 billion ARB tokens comprising 41.89% of the circulating supply were allocated to the team, future team and advisors, and investors. The unlock saw Arbitrum price drop by over 10%. If history repeats, the Ethereum Layer 2 (L2) token could register similar losses.

Arbitrum price outlook ahead of ARB unlocks event

Arbitrum price attempted a recovery on Sunday after bottoming out around $0.85 on Saturday. However, the recovery proved premature as the L2 token now suffers robust resistance from the north. As traders flee the market to escape being caught in exit liquidity, Arbitrum price risks further downside.

The likely play is a retest of the $1.00 psychological level, which would mark a 10% downswing. In a dire case, however, the WIF price could descend to the Saturday bottom at $0.8556. This would constitute a 25% fall below current levels.

ARB/USDT 1-day chart

On the other hand, increased buying pressure could facilitate a strong move north, sending the ARB price above the 200-day SMA at $1.45. However, for the bearish thesis to be invalidated, the price must break and close above $1.73.

A breach of the aforementioned level, which coincides with the 50-day SMA at $1.71, would encourage more buyers, sending ARB price above the forecasted target.