Dow Jones Industrial Average gets knocked lower as investors chew on Greenland threats

- US stocks slid as Trump tariff threats tied to Greenland fueled risk-off trading, higher yields, and a weaker dollar.

- Major indices fell into the red for the year, led by tech losses as policy risk exposed stretched valuations.

- Small caps outperformed on Fed rate cut hopes and domestic exposure, while defensive stocks held up better.

US equities sold off sharply on Tuesday as geopolitical risk surged after President Donald Trump escalated rhetoric around acquiring Greenland, including new tariff threats against close US allies. Markets reacted swiftly to the prospect of a renewed trade conflict, with investors reducing exposure to US assets amid concerns that tariffs are being used as a political tool rather than a purely economic one. Treasury yields jumped, the US Dollar (USD) weakened around 1%, and volatility spiked as risk sentiment deteriorated.

Frontline indexes decline, market withers on Greenland turmoil

The Dow Jones Industrial Average (DJIA) fell 1.4%, while the S&P 500 and Nasdaq Composite declined 1.6% and 1.8%, respectively, pushing both indices into negative territory for the year. The VIX climbed above 20 for the first time since late November, reflecting rising uncertainty. Trump outlined plans to impose tariffs starting at 10% on imports from eight NATO countries on February 1, rising to 25% by June, and separately threatened 200% tariffs on French wine and champagne. European leaders have signaled strong opposition and are reportedly considering retaliatory measures, raising the risk of a broader escalation.

Market participants warned that equities were already priced for optimistic outcomes, leaving them vulnerable to policy shocks. Investors also grew uneasy about longer-term implications for capital flows, with concerns that persistent trade conflict could reduce foreign appetite for US assets and debt. The backdrop reinforced a global risk-off move, with the Euro strengthening against the Dollar and bonds selling off sharply. Trump is expected to address the issue with European leaders during meetings in Davos, where the topic has already drawn significant attention.

Key value segments draw fresh investing crowds

Technology stocks remained under pressure, leaving the Nasdaq trading lower on the year as several large-cap leaders continued to slide. Apple (AAPL) and Meta (META) are down roughly 8% year to date, while Microsoft (MSFT) has fallen about 6%, highlighting ongoing weakness in high valuation growth names amid rising geopolitical and policy uncertainty. Amid the broader selloff, defensive and value-oriented stocks offered pockets of stability, with Walmart (WMT) and Procter & Gamble (PG) reaching new highs, and insurance names such as Allstate (ALL) posting gains, as investors sought relative safety.

In contrast, small caps again showed relative resilience. The Russell 2000 outperformed the S&P 500 for the twelfth consecutive session, its longest such streak since 2008, and remains up more than 7% in 2026. Expectations for Federal Reserve (Fed) rate cuts, solid domestic growth data, and the index’s heavier exposure to US-focused businesses have helped insulate small caps from trade-related risks.

New Trump pick for Fed Chair expected

On the policy front, Treasury Secretary Scott Bessent said President Trump is close to nominating the next Federal Reserve chair, with a decision potentially coming as soon as next week. The process has narrowed to four candidates, adding another important macro catalyst for markets to monitor.

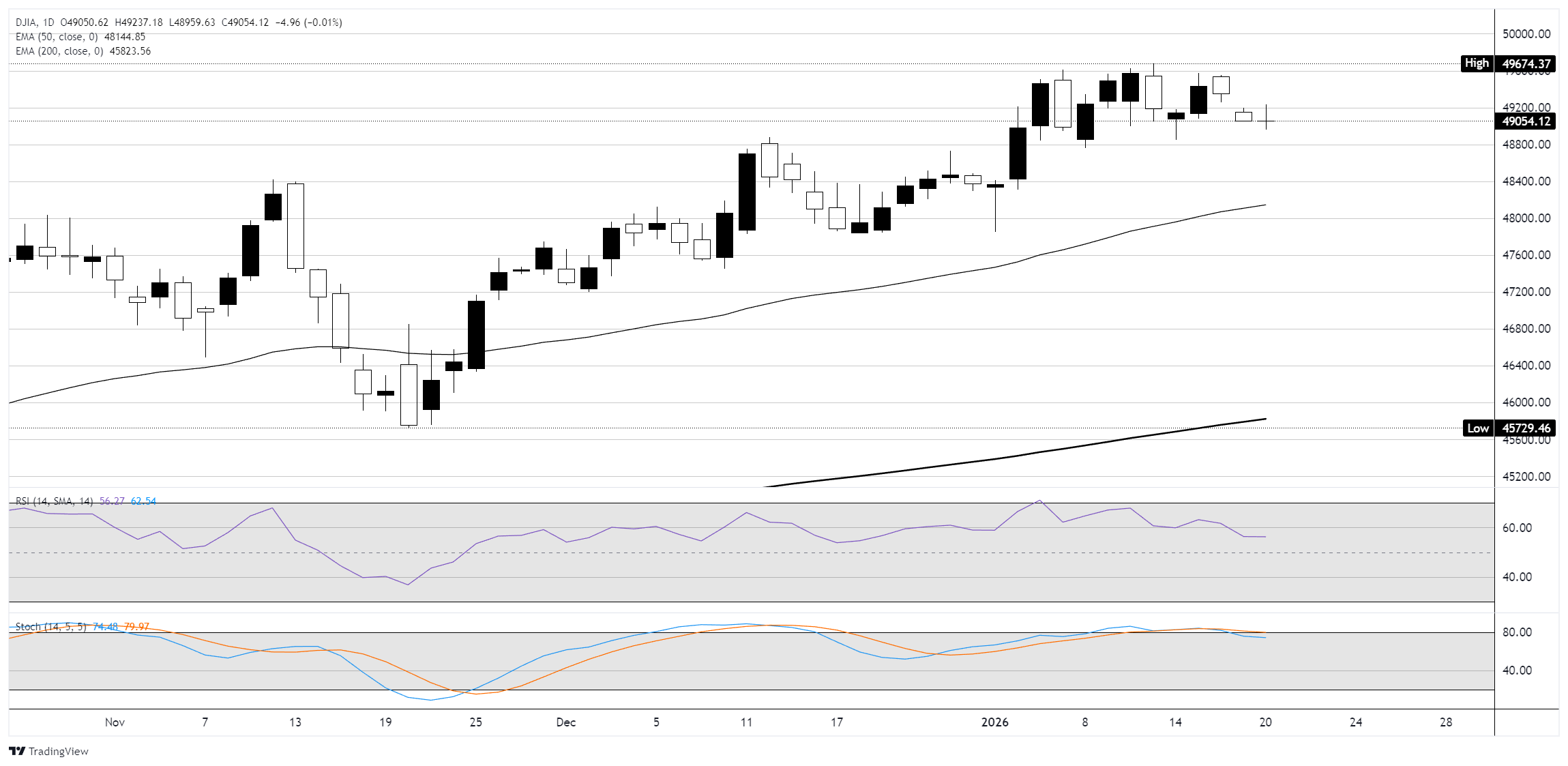

Dow Jones daily chart

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.