OpenAI warns tokenized stocks on Robinhood are not equity

- OpenAI clarifies that the tokenized equity available on Robinhood has no official approval.

- Robinhood announces the launch of tokenized US stocks for its EU users.

- Elon Musk writes on his social media platform, “Your 'equity' is fake,” in response to the official OpenAI tweet.

Robinhood announced on Monday the tokenized equity launch of OpenAI and SpaceX, along with 200 other US-listed stocks and ETFs. OpenAI, in an official X post on Thursday, warned users that the tokenized stocks are unauthorized equity. While the market discusses Robinhood’s ownership in these companies via a Special Purpose Vehicle (SPV), Elon Musk, the CEO of SpaceX, candidly commented, “Your 'equity' is fake,” in response to OpenAI’s official warning post.

OpenAI warns on Robinhood tokenized equity offering

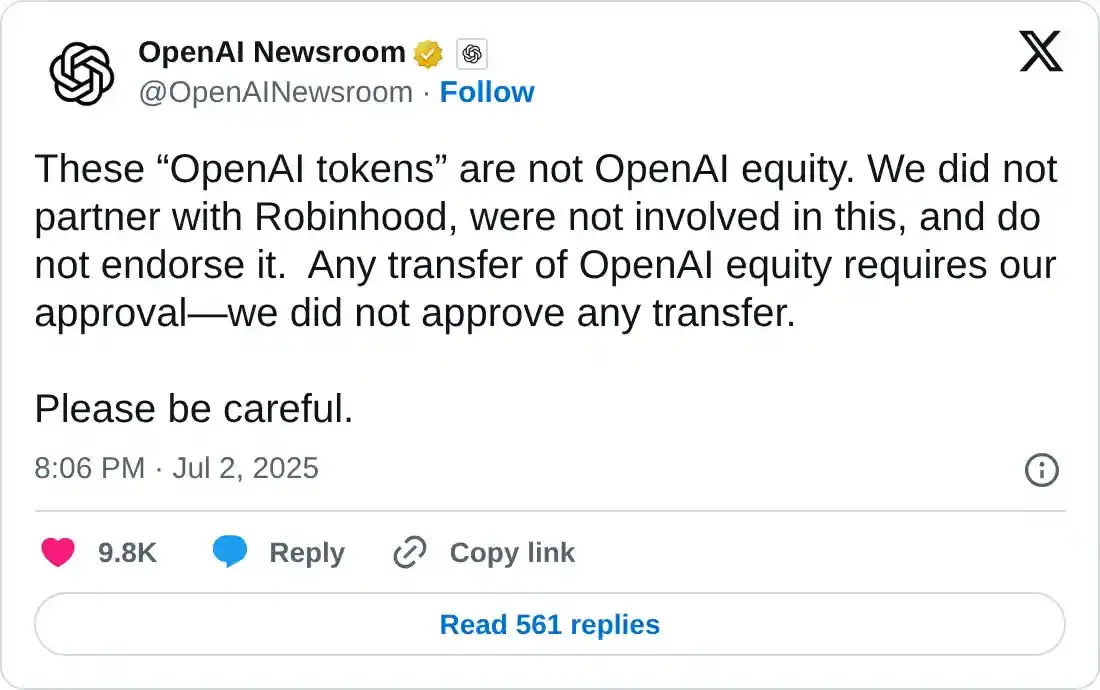

OpenAI, the parent company of ChatGPT, warns users against the tokenized stocks of its company, which were recently launched on Robinhood. The statement clarifies that no official partnership exists between the two companies, and OpenAI denies any official approval for the transfer of equity.

OpenAI does not endorse the tokenized equity and advises users to exercise caution.

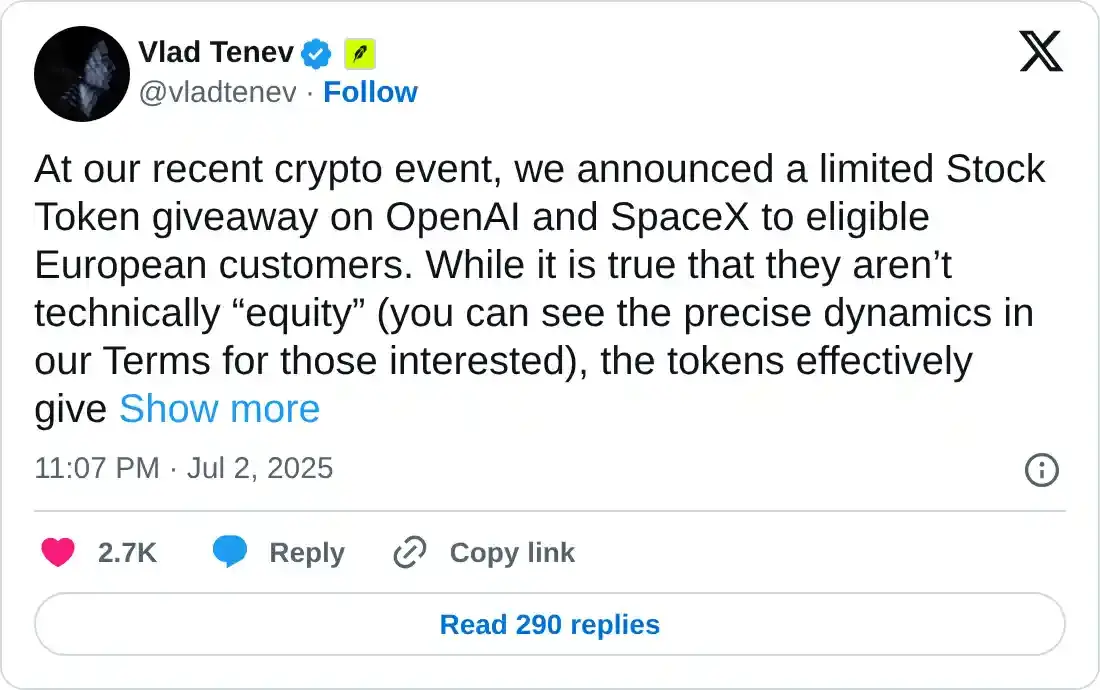

Robinhood announced the launch of tokenized equity for privately held shares of OpenAI and SpaceX to its European Union users. In an X post on Thursday, Robinhood provided exposure to private markets through its ownership stake in a Special Purpose Vehicle (SPV).

SPV is a legal entity, created by Robinhood in this case, as a common practice to isolate financial risk. Typically, in startups, SPVs provide exposure to retail investors, allowing them to pool capital.

Vlad Tenev, the CEO of Robinhood, clarified that the stock token giveaways are not technically equity, while they do provide retail investors with exposure to private assets.

Elon Musk remains nonchalant on SpaceX tokenized equity

Elon Musk, the founder and CEO of Tesla and SpaceX, maintains a calm demeanor as Robinhood offers tokenized equity in SpaceX and OpenAI. In a reply to the official X post, Musk commented, “Your ‘equity’ is fake.”

Equity in a company represents part ownership of it. However, to realize gains on it, investors would either sell it once it is listed on a stock exchange or acquire debt against it through banks.

Elon holds 54% of SpaceX shares, making him the largest shareholder and providing him with direct financial benefits from the company’s growth. The tokenized offering in EU markets opens up a gate for Elon to dilute shares, if needed, without making SpaceX public.