Ethereum price scrapes $3,000 psychological threshold after 20 months, inspiring conjecture on altseason

- Ethereum price has tested the $3,000 psychological level, a threshold last hit in 2022.

- ETH could drop 10%, giving sidelined investors another entry before next leg up.

- The bearish thesis will be invalidated if the PoS token records a higher high above the $3,004 peak.

Ethereum (ETH) price has managed to test a crucial milestone for the first time in months, which is a remarkable show of strength considering Bitcoin (BTC) price has hinted at a fall. This means that Ether has managed to sidestep the BTC cue, causing markets to speculate on whether another alt season is underway.

Also Read: Ethereum outperforms Bitcoin with double-digit weekly gains and spike in Open Interest

Ethereum tests $3,000 after almost two years

Ethereum (ETH) price scrapped the $3,000 psychological level on Tuesday, a level last tested on April 26, 2022, almost two years ago. It comes a day after the Proof-of-Stake (PoS) token outperformed BTC with double-digit weekly gains and a spike in Open Interest.

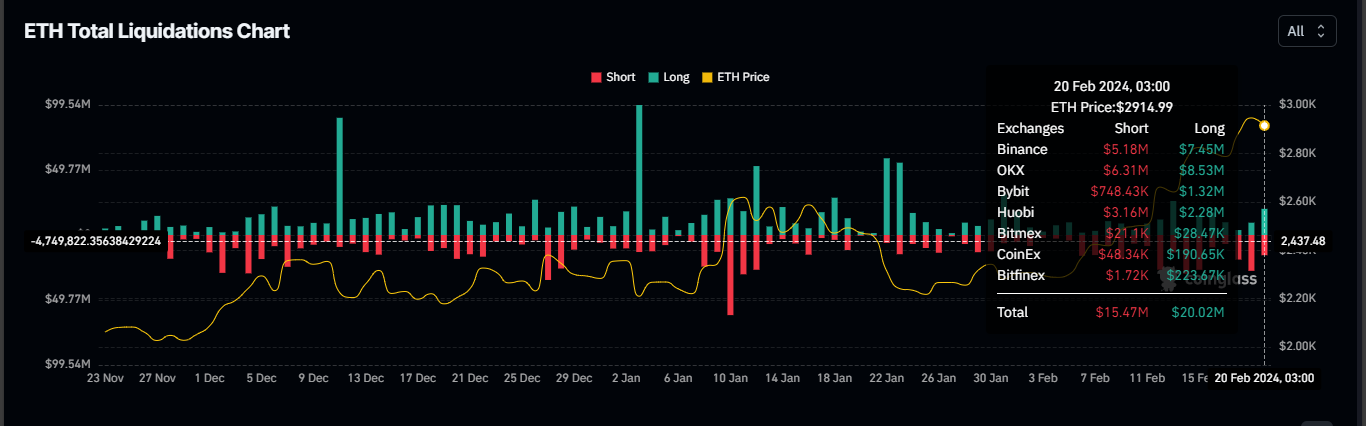

Over the last 24 hours, Ethereum price has slumped 0.78%, causing up to $15.47 million in short positions to be liquidated against $20 million of long positions. The disparity shows that most traders anticipated the surge in Ethereum price and took long positions, only that their take profits were higher such that their margin accounts could no longer support the open positions.

ETH liquidations

As it stands, Ethereum price is suffering the aftermath of an overbought asset, seen with the Relative Strength Index (RSI) above 70. Traders looking to take new long positions should probably wait as the ETH market is at high risk of a pullback to the south.

Such a directional bias could provide sidelined or late investors a buying opportunity around the $2,689 support level before the next leg up. This would denote a 10% fall below current levels.

In a dire case, Ethereum price could slip below the aforementioned level to test the $2,500 level. Or ETH could find support at the $2,388 critical support.

ETH/USDT 1-day chart

On the other hand, if ETH bulls show strength, Ethereum price could reclaim the $3,000 milestone, potentially going as high as to reclaim the $3,004 range high. A decisive candlestick close above this local top on the daily timeframe would invalidate the bearish thesis.

Is an alt season coming?

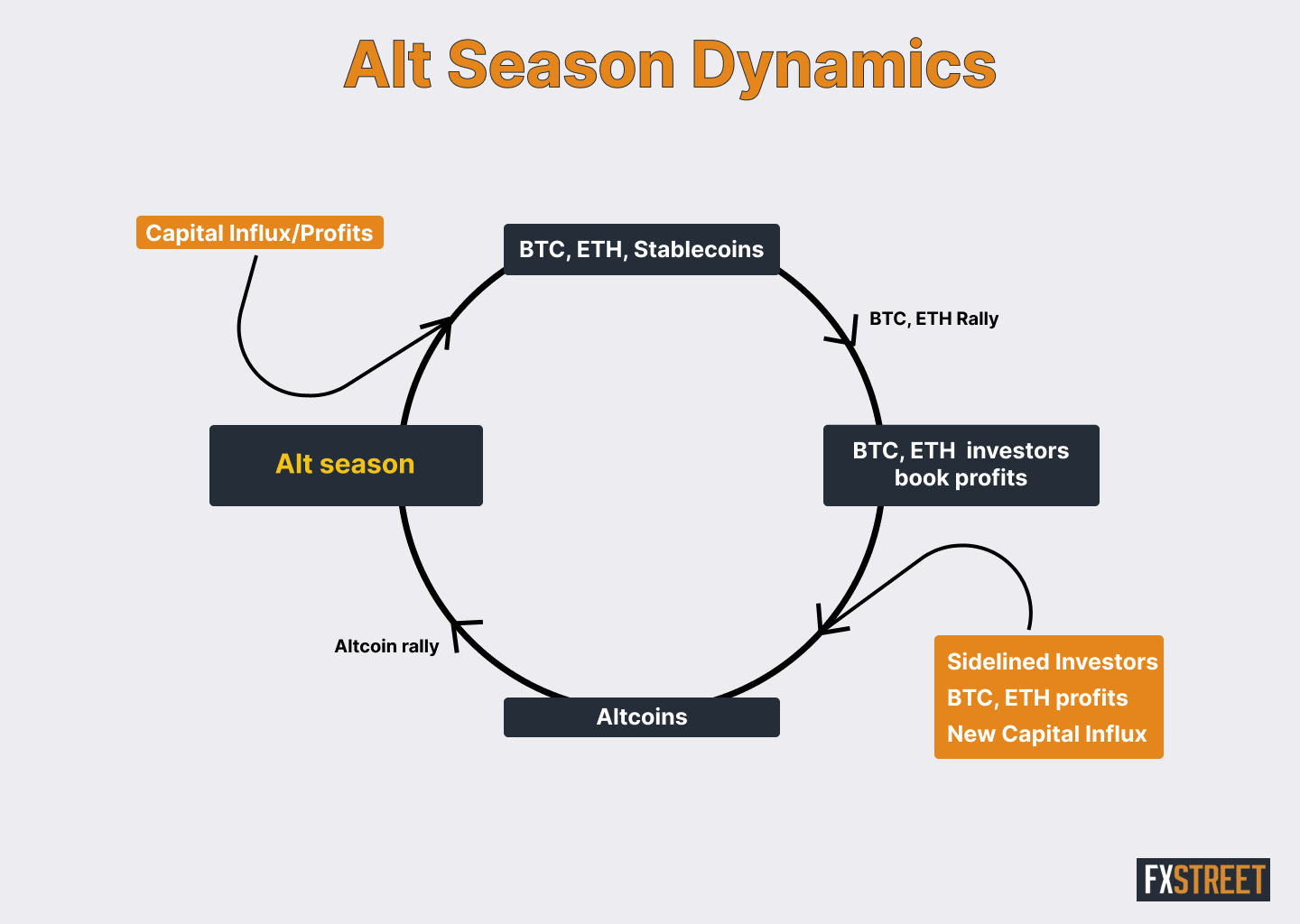

Meanwhile, speculation has it that the bold move by Ethereum price against BTC’s price consolidation could be the beginning of an alt season.

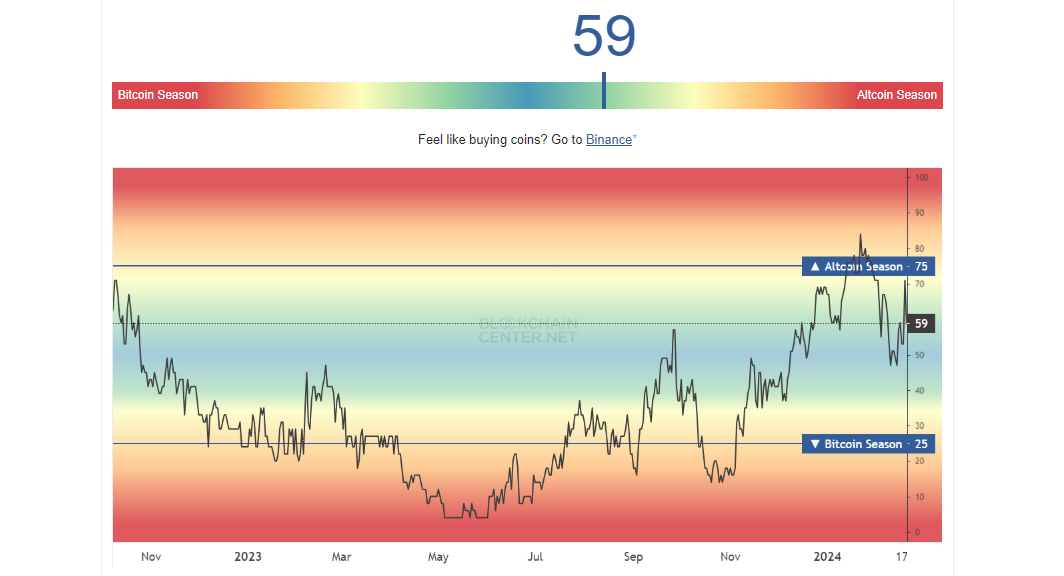

Alt season is a colloquial term that is used to describe a phase where investing in altcoins provides better returns compared to Bitcoin or Ethereum. Consequently, the dominance that Bitcoin holds in the market declines, and that of altcoins increases. The alt season indicator from BlockchainCenter is also leaning in favor of a potential altcoin season taking place as opposed to a Bitcoin season.

Alt season index

Quick summary of an alt season in play

- Fresh capital enters the cryptocurrency ecosystem, effectively flowing into stablecoins, Bitcoin or Ethereum on preference that they are relatively safe: check!

- Markets rally as a consequence of this capital influx: check!

- The profit from these ecosystems, along with the new capital, moves into altcoins: in progress

- This rotation of capital triggers an alt season: possible result!

The chart above provides a visual representation.

Ethereum FAQs

What is Ethereum?

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

What blockchain technology does Ethereum use?

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

What is staking?

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Why did Ethereum shift from Proof-of-Work to Proof-of-Stake?

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.