Crypto Today: Solana, Litecoin, XRP gain $88B as Trump hints at Bitcoin strategic reserve

- Cryptocurrencies aggregate market capitalization consolidated at $3.5 trillion on Thursday rising by $152 billion within the last 24 hours.

- Altcoin markets (TOTAL3) rose by 9%, with the likes of Solana, Litecoin and XRP all posting double-digit gains.

- The two major bullish catalysts were positive speculation on 2025 ETF approvals and Donald Trump hinting at Bitcoin strategic reserve adoption.

Bitcoin Market Updates: BTC edges closer to $101K as ETFs end four-day selling frenzy

Bitcoin’s weak price rally attempt on Thursday halted at the $100,866 mark, as traders increasingly lean towards the altcoin markets.

Bitcoin ETFs Performance, January 15 2025 | Source: SosoValue

After four consecutive days of outflows, Bitcoin ETFs finally recorded $755 million inflows on Wednesday, hinting at a potential accumulation race ahead of Trump’s inauguration.

Altcoin market updates: XRP, Solana, and LTC lead $88B altcoin market rally

While Bitcoin price stalled below $101,000 on Thursday, the altcoin markets were agog with intense speculative trading activity.

TOTAL3 (Cryptocurrency market cap excluding BTC and ETH) | Source: TradingView

TOTAL3 (Cryptocurrency market cap excluding BTC and ETH) | Source: TradingView

TradingView’s TOTAL3 represents the global cryptocurrency market cap growth, excluding Bitcoin and Ethereum. The chart above shows the altcoin market cap grew by $88 billion on Thursday, while BTC and ETH stagnated.

This emphasizes that the majority of crypto investors are currently switching focus toward altcoins, signaling high risk trading and speculative demand.

- XRP Surpasses $3, Reaching Seven-Year High

XRP's price surged past the $3 mark, reaching $3.36, a 16% increase over the past 24 hours.

This rally is attributed to declining U.S. core inflation, increasing expectations for Federal Reserve interest rate cuts, and anticipation of new spot exchange-traded funds (ETFs) that would directly own cryptocurrencies. Additionally, positive developments in the SEC's legal case against Ripple have bolstered investor confidence.

- Solana Targets $220 Amid Growing Interest

Solana (SOL) has experienced a notable price increase, currently trading at $210.25, with an intraday high of $216.36.

- Litecoin Jumps 16% in 24 Hours

Litecoin (LTC) price has surged past $130 for the first time in 2025, marking a 16% increase in the last 24 hours. This bullish breakout is linked to rising hopes that the Securities and Exchange Commission will approve a spot LTC ETF by Canary Capital. Bloomberg Senior ETF Analyst Eric Balchunas noted that the SEC had sent comments to Canary, suggesting a potential approval.

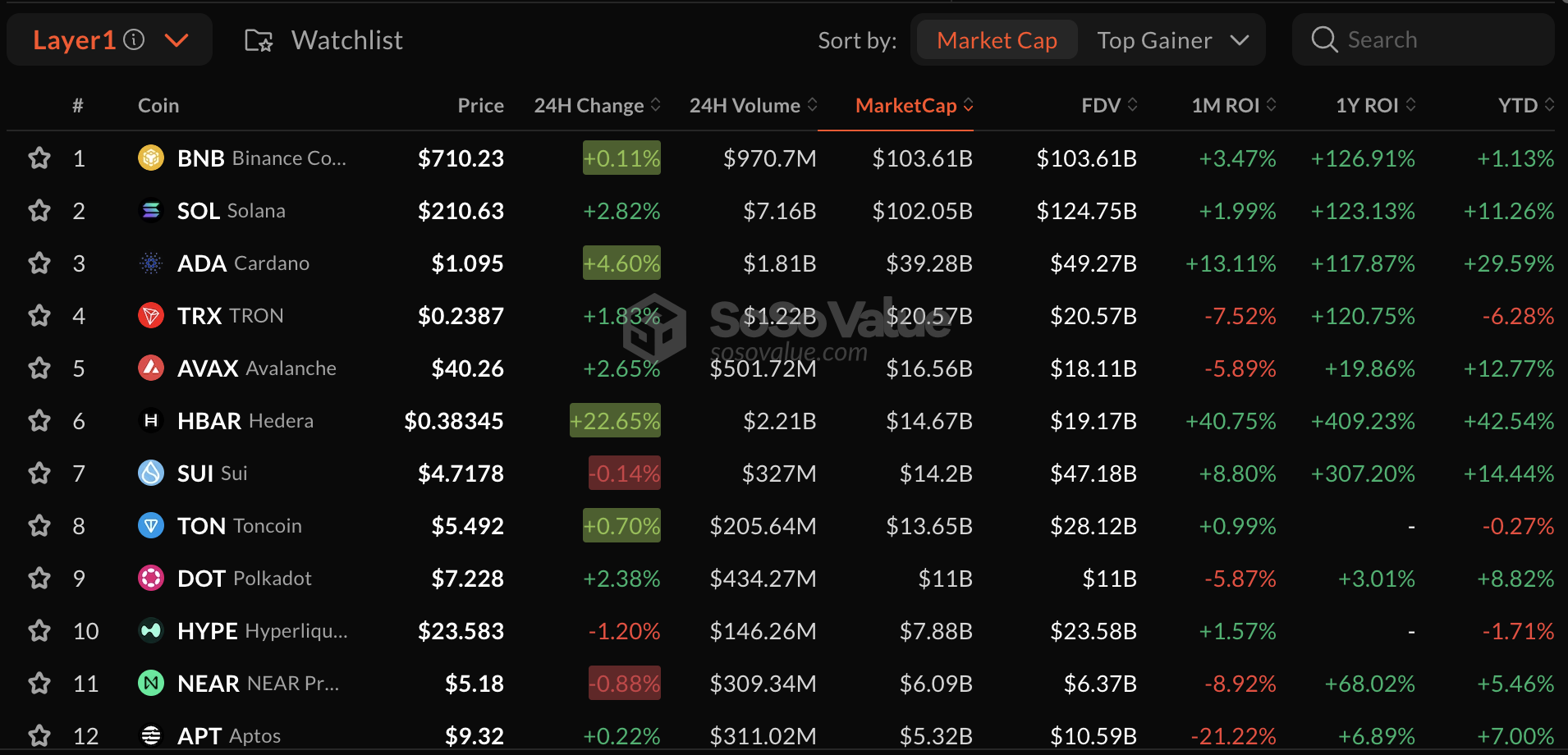

Chart of the day: Layer-1 Sector Surge 2% as Trader anticipate Altcoin ETFs

As speculation grows around the approval of altcoin ETFs, the Layer-1 sector has seen a 2% aggregate market cap increase. This surge comes amid reports from Bloomberg analysts highlighting the potential approval of Canary Capital's Litecoin (LTC) ETF.

Notably Solana and XRP also have ongoing ETF application filings with US regulators. Investors are optimistic that these developments could open the floodgates for institutional adoption of other Layer-1 altcoins, sparking bullish sentiment across the market.

Layer-1 Sector Performance | Source: SosoValue

Layer-1 Sector Performance | Source: SosoValue

Hedera (HBAR) led the sector's growth with an impressive 22.65% daily increase to reach $0.38345. Based on recent reports HBAR rally is largely driven by growing institutional partnerships and scalable enterprise solutions. Cardano (ADA) climbed 4.60% to $1.095, showcasing resilience in the broader market rally. With a focus on scaling and decentralized governance, ADA continues to attract developer and retail interest.

Avalanche (AVAX) gained 2.65%, trading at $40.26, as its Subnets framework draws institutional interest in blockchain scaling solutions.

The approval of a Litecoin ETF could significantly impact the broader Layer-1 ecosystem, potentially creating a ripple effect for other tokens like Solana and XRP, which have also filed ETF applications. This domino effect could bring Layer-1 projects into mainstream financial products, further driving adoption and investment. As speculation builds, the Layer-1 sector remains at the forefront of market activity, with potential for more gains in the days ahead.

The potential approval of a Litecoin ETF represents a pivotal moment for the cryptocurrency market, with the possibility of creating a domino effect for other Layer-1 tokens. Solana, XRP, and other projects with active ETF filings could benefit significantly, as these products pave the way for greater accessibility and adoption in traditional financial markets. This optimism has fueled investor sentiment across the Layer-1 ecosystem, highlighting the growing anticipation for regulatory breakthroughs.

Crypto News Updates:

- Phantom Wallet Raises $150 Million in Series C, Hits $3 Billion Valuation

Phantom Wallet has successfully raised $150 million in a Series C funding round, securing a $3 billion valuation.

The round was led by Sequoia Capital and Paradigm, with participation from a16z and Variant.

The funding highlights the increasing demand for digital wallets in the cryptocurrency space, with Phantom reporting 15 million monthly active users and $25 billion in self-custody assets under management.

- Senator Lummis Questions US Marshals Over Potential Bitcoin Sale

Wyoming Senator Cynthia Lummis has raised concerns with the US Marshals Service regarding the government’s potential sale of 69,370 Bitcoin seized from the Silk Road case.

In a letter, Lummis questioned how the sale aligns with plans to establish a national Bitcoin reserve, particularly amid the ongoing presidential transition.

The inquiry follows Judge Richard Seeborg’s recent decision to deny a petition aiming to block the forfeiture of the assets.

Lummis emphasized that selling the Bitcoin may undermine strategic reserve policies, highlighting the importance of preserving these assets for national interests.

- Oklahoma Introduces Bill to Use Bitcoin as Strategic Reserve Asset

Oklahoma state Representative Cody Maynard has introduced the Strategic Bitcoin Reserve Act, a bill that proposes allowing state pension funds and savings accounts to invest in Bitcoin.

The legislation positions Bitcoin as a hedge against inflation and a decentralized, non-governmental store of value, reflecting its growing role in institutional finance.

The bill underscores Bitcoin's potential to protect state financial assets and aligns with similar legislative efforts across other US states.

This initiative aims to integrate Bitcoin into state-level financial strategies amid its increasing adoption in institutional and governmental contexts.