Bitcoin price recovers to $42,000, bouncing off recent lows

- Bitcoin ETF race continues as Bloomberg ETF analyst speculates Charles Schwab’s entry.

- Bitcoin exchange balances have nosedived by over one million BTC since 2020.

- BTC price sustained above the $42,000 level as Bitcoin eyes a recovery.

Bitcoin ETF race likely to intensify as Bloomberg ETF specialist Eric Balchunas speculates $8.5 trillion asset manager Charles Schwab’s entry into the race. BTC exchange balances are on a decline and a recovery in Bitcoin price is likely in the short term.

Also read: Lido price sustains above $3 despite massive surge in profit-taking by LDO traders

Daily Digest Market Movers: Bitcoin balance on exchanges in a downtrend

- Bloomberg ETF specialist Eric Balchunas has predicted multi-trillion dollar asset manager, Charles Schwab’s entry in the Bitcoin ETF race with a competitively priced product.

- Balchunas believes that the investment giant’s entry could intensify the ETF race. According to sources, the giant is yet to develop its spot Bitcoin ETF.

- Crypto analyst Joe Burnett reports that Bitcoin exchange balances have declined by over a million since 2020. This is a significant on-chain development since BTC has a limited supply of 21 million. One million BTC leaving exchange wallets adds to the bullish thesis for the asset.

- The Bitcoin halving event where the reward for mining a BTC block will be slashed in half, from 6.25 to 3.125 is nearly 80 days away.

- The BTC halving is considered a catalyst for the asset, as Bitcoin price hit a new all-time high post halving in previous instances.

- Another key on-chain metric that supports the bullish thesis for BTC is addresses with less than 1 BTC.

- According to Glassnode data, wallet addresses with less than 1 BTC have been in a downward trend since the asset hit its $49,000 local top. This seems to have bottomed out with more signs of consolidation around the $40,000 level.

-638421048576263911.jpeg)

Bitcoin wallet addresses with less than 1 BTC. Source: Glassnode

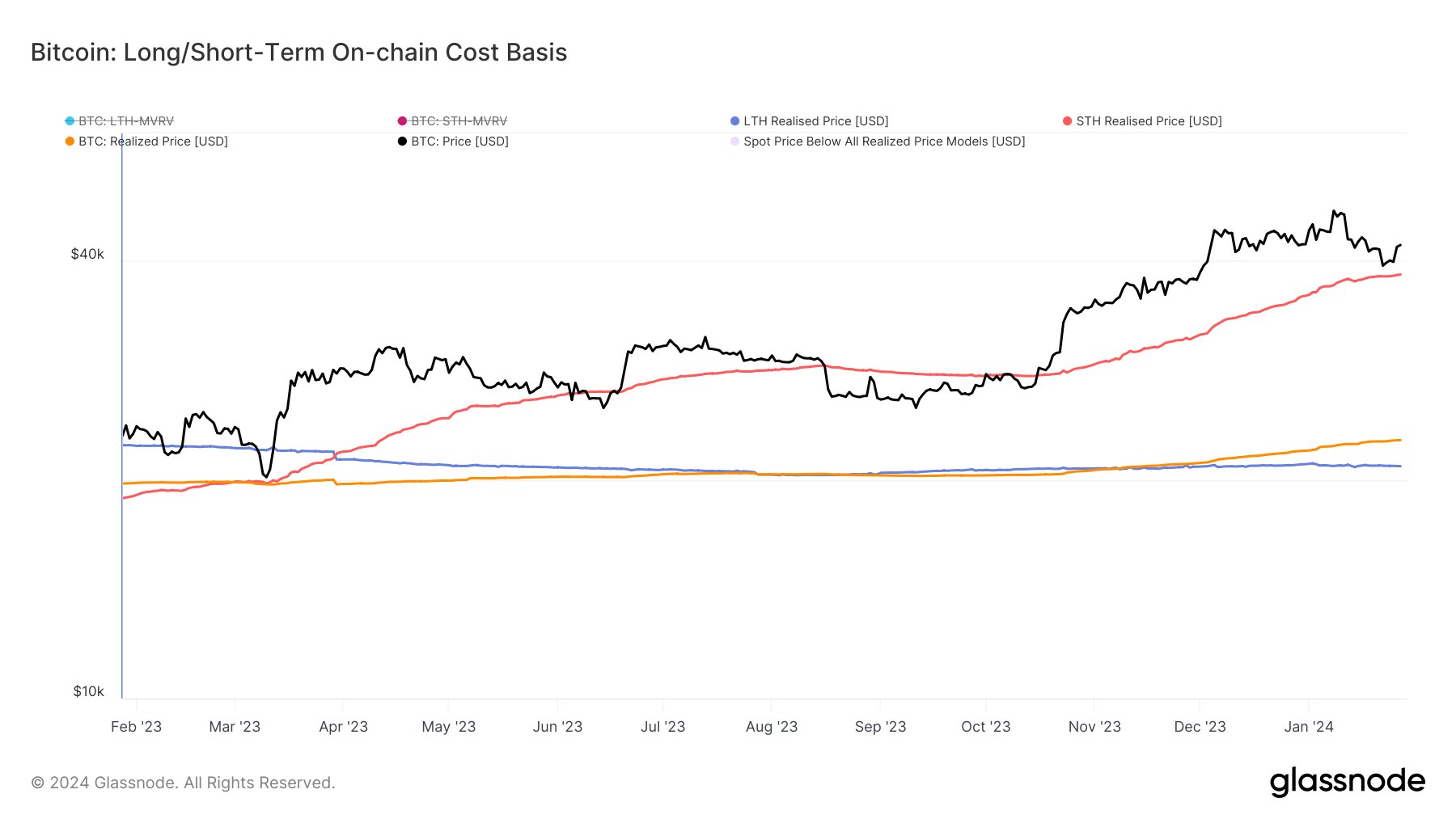

- Bitcoin’s ongoing bull run is likely sustainable as Glassnode data reveals that Bitcoin’s short-term holder realized price continues to climb. This indicates BTC is getting acquired at a higher price, supporting Bitcoin’s uptrend and the thesis for BTC recovery.

Bitcoin: Long/Short-term on-chain cost basis. Source: Glassnode

- Bitcoin’s Spot ETF product is gaining popularity among traders. On January 26, Harvest Hong Kong, one of China’s largest fund companies, filed an application for a BTC Spot ETF, the first application of its kind, submitted to the Hong Kong Securities and Futures Commission.

Technical Analysis: Bitcoin price likely to recover from slump

Bitcoin price sustained above the $42,000 level on Monday, recovering from its weekend slump. BTC price climbed above the $40,000 psychological level. BTC price is likely to face resistance at $43,600 and $45,589, two key levels in its uptrend.

Bitcoin price recovery to the $45,000 level becomes increasingly likely as the asset breaks out of its slump and rebounds from the psychologically important level of $40,000.

BTC/USDT 1-day chart

A daily candlestick close below $40,000 could invalidate the bullish thesis and BTC price could decline to support zone between $38,155 and $38,555.

SEC vs Ripple lawsuit FAQs

Is XRP a security?

It depends on the transaction, according to a court ruling released on July 14:

For institutional investors or over-the-counter sales, XRP is a security.

For retail investors who bought the token via programmatic sales on exchanges, on-demand liquidity services and other platforms, XRP is not a security.

How does the ruling affect Ripple in its legal battle against the SEC?

The United States Securities & Exchange Commission (SEC) accused Ripple and its executives of raising more than $1.3 billion through an unregistered asset offering of the XRP token.

While the judge ruled that programmatic sales aren’t considered securities, sales of XRP tokens to institutional investors are indeed investment contracts. In this last case, Ripple did breach the US securities law and will need to keep litigating over the around $729 million it received under written contracts.

What are the implications of the ruling for the overall crypto industry?

The ruling offers a partial win for both Ripple and the SEC, depending on what one looks at.

Ripple gets a big win over the fact that programmatic sales aren’t considered securities, and this could bode well for the broader crypto sector as most of the assets eyed by the SEC’s crackdown are handled by decentralized entities that sold their tokens mostly to retail investors via exchange platforms, experts say.

Still, the ruling doesn’t help much to answer the key question of what makes a digital asset a security, so it isn’t clear yet if this lawsuit will set precedent for other open cases that affect dozens of digital assets. Topics such as which is the right degree of decentralization to avoid the “security” label or where to draw the line between institutional and programmatic sales are likely to persist.

Is the SEC stance toward crypto assets likely to change after the ruling?

The SEC has stepped up its enforcement actions toward the blockchain and digital assets industry, filing charges against platforms such as Coinbase or Binance for allegedly violating the US Securities law. The SEC claims that the majority of crypto assets are securities and thus subject to strict regulation.

While defendants can use parts of Ripple’s ruling in their favor, the SEC can also find reasons in it to keep its current strategy of regulation by enforcement.

Can the court ruling be overturned?

The court decision is a partial summary judgment. The ruling can be appealed once a final judgment is issued or if the judge allows it before then. The case is in a pretrial phase, in which both Ripple and the SEC still have the chance to settle.