Ripple stablecoin should benefit XRP since it uses latter for gas: crypto analyst

- Ripple stablecoin prepares for launch in the next few weeks, according to CEO Brad Garlinghouse.

- RLUSD could benefit XRP through stablecoin gas transaction activity, says analyst.

- XRP trades at $0.53, corrects slightly on Tuesday.

Ripple (XRP) recently announced the launch of its stablecoin project, Ripple USD (RLUSD). In an interview at Korea Blockchain Week in the first week of September, CEO Brad Garlinghouse said that the asset’s launch is weeks away.

XRP exchanges hands at $0.5387, and traders are keeping their eyes peeled for an RLUSD launch date.

Daily digest market movers: Analyst predicts XRP stands to gain from RLUSD

- Crypto analyst behind the X handle @Sentosumosaba said in a recent tweet that XRP Ledger’s native token stands to gain from Ripple stablecoin launch.

- RLUSD launch could benefit the altcoin as it would contribute to higher activity on the ledger and XRP is the gas token.

- Analyst expects XRP to gain from higher demand for the altcoin.

Just as #ETH is used for gas, #XRP is also used for gas (among other things). Since the SEC Docs explained ODL is price neutral, bring on as much of that stablecoin gas transaction activity on the #XRPL Mainnet as possible. Trillions please.

— Crypto Eri Carpe Diem (@sentosumosaba) September 8, 2024

Every currency would be nice.

- While on-demand liquidity provided to institutional investors does not typically influence price, demand for the gas token could catalyze gains.

- In a September 4 fireside chat at Korea Blockchain Week, Brad Garlinghouse said that the launch of Ripple stablecoin is only weeks away.

- CTO David Schwartz informed crypto market participants in a recent tweet that RLUSD will be available to institutions exclusively, compared it to Circle’s stablecoin, USD Coin (USDC), and Tether’s USD Tether (USDT).

Technical analysis: XRP corrects slightly on Tuesday

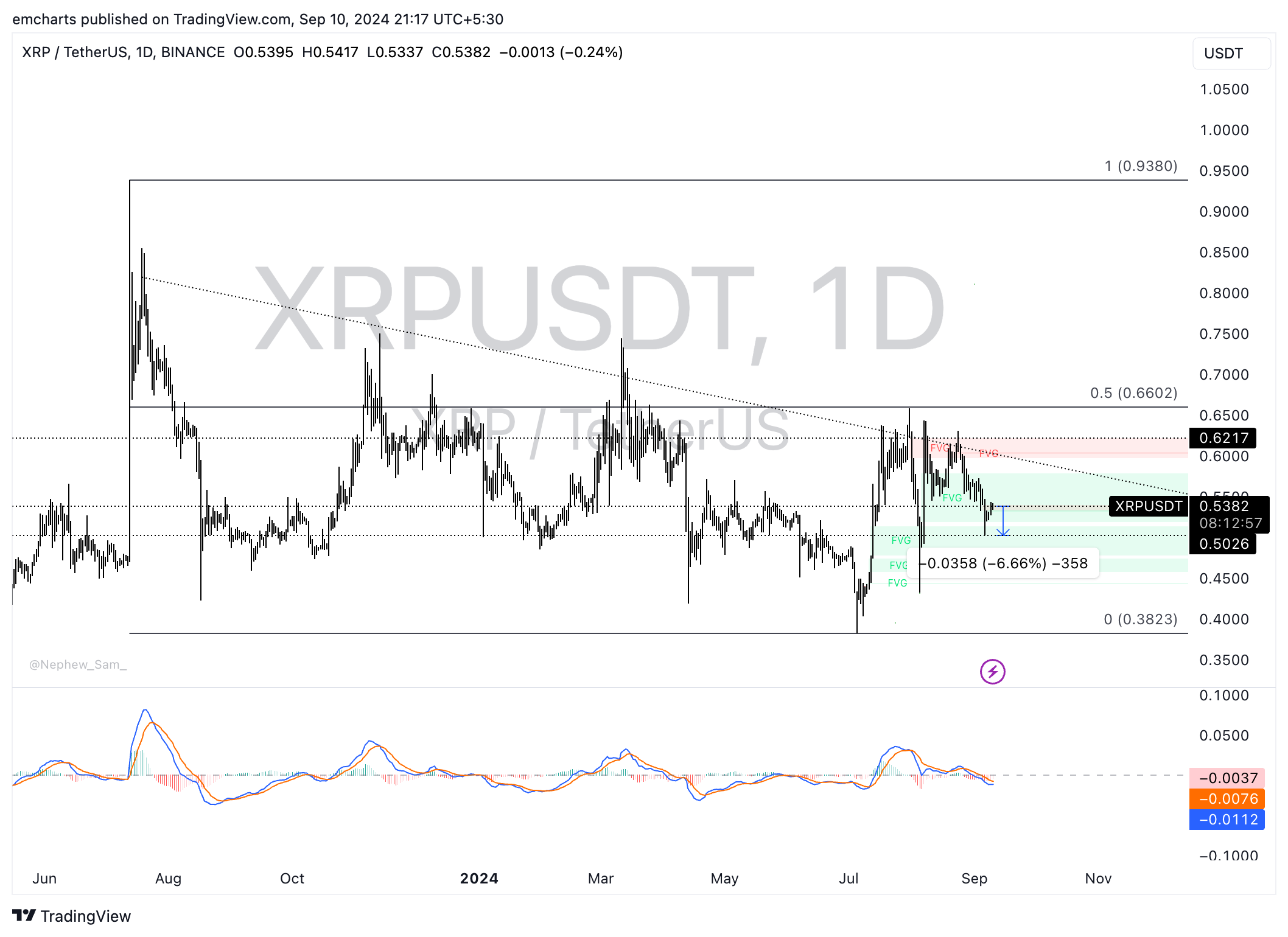

Ripple is currently in a downward trend. The altcoin could extend its losses to the September 6 low of $0.5026. This marks a 6.7% decline in XRP from the current price level. The Moving Average Convergence Divergence (MACD), a momentum indicator, supports the bearish thesis.

The red histogram bars under the neutral line on MACD are indicative of an underlying negative momentum in XRP price.

XRP/USDT daily chart

A daily candlestick close above $0.6000, a key psychological level for XRP, could invalidate the bearish thesis. XRP could target the upper boundary of the Fair Value Gap (FVG) at $0.6217, the July 31 low for the altcoin.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.