Bitcoin Price Forecast: BTC recovers above $109,000 as Fed rate cut bets offset cautious sentiment

- Bitcoin price recovers above $109,000 on Monday, following a nearly 5% decline in the previous week.

- Metaplanet adds 1,009 BTC to its treasury while ETFs recorded fresh weekly inflows of over $440 million.

- Markets remain cautious, although traders are still betting that the Fed will reduce interest rates this month.

Bitcoin (BTC) begins the week in recovery mode, trading above $109,000 at the time of writing on Monday, following a nearly 5% decline in the previous week. The institutional demand helps BTC cushion downside pressure as Metaplanet added 1,009 BTC on Monday, while US spot Exchange Traded Funds (ETFs) logged more than $440 million in weekly inflows. Despite lingering caution across markets, traders continue to bet on the US Federal Reserve (Fed) interest rate cut this month, offering support to risk assets such as BTC.

Fed rate cut expectations might boost BTC recovery

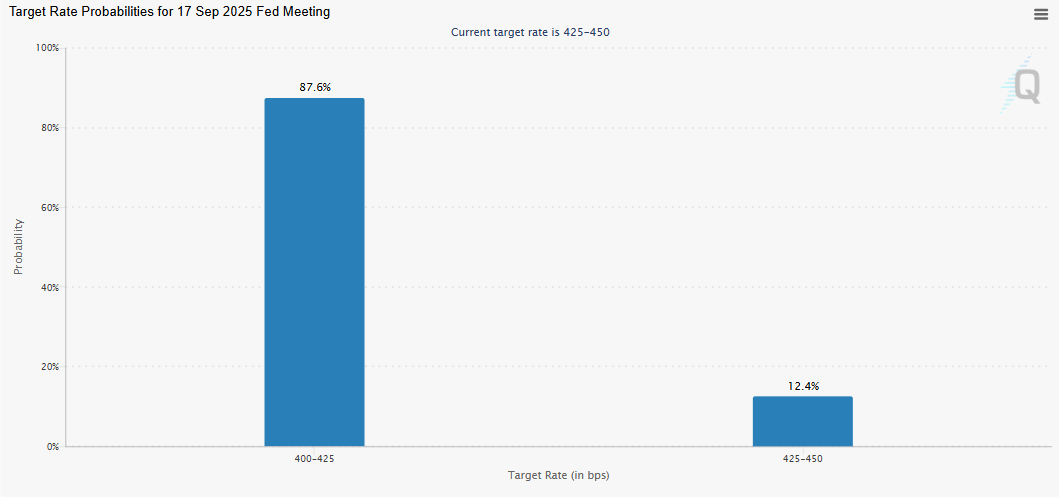

Bitcoin price has fallen nearly 14% from its record high of $124,474 on August 14 to a low of $107,350 on Saturday. This price correction was mostly fueled by the hot US Personal Consumption Expenditures (PCE) Price Index report for July released last week. However, traders still ramp up their bets of a Fed rate reduction this month, with the CME FedWatch tool graph below showing an 87.6% possibility of a 25 basis points (bps) rate cut by the central bank at September's meeting, up from an 85% chance before the US PCE data publication. Fed rate cut expectations may weigh on the US Dollar (USD) and boost risk-on sentiment, supporting a recovery in riskier assets, such as BTC.

Following a 6.49% decline in BTC returns in August, CoinGlass historical data indicate that Bitcoin generally yields a negative return for traders in September, with an average loss of 3.50%.

However, if the Fed decides to cut interest rates in September, followed by a rise in ETFs and corporate demand for BTC, traders could see positive returns in that month.

Institutional demand helps BTC cushion downside pressure

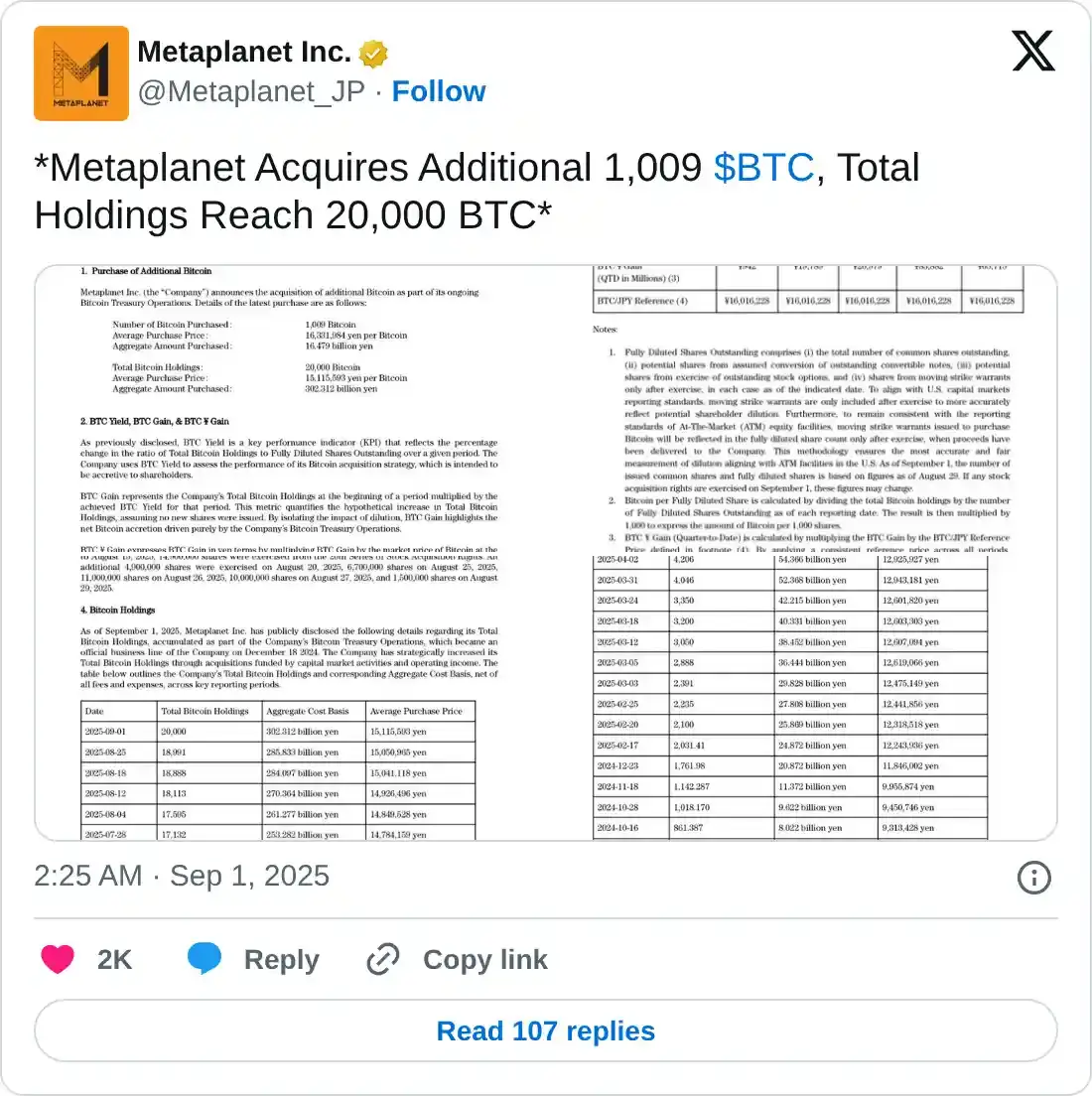

The demand from corporate companies and institutions for Bitcoin strengthened despite its price correction. Japanese investment firm Metaplanet announced on Monday that it has purchased an additional 1,009 BTC, bringing the firm’s total holdings to 20,000 BTC.

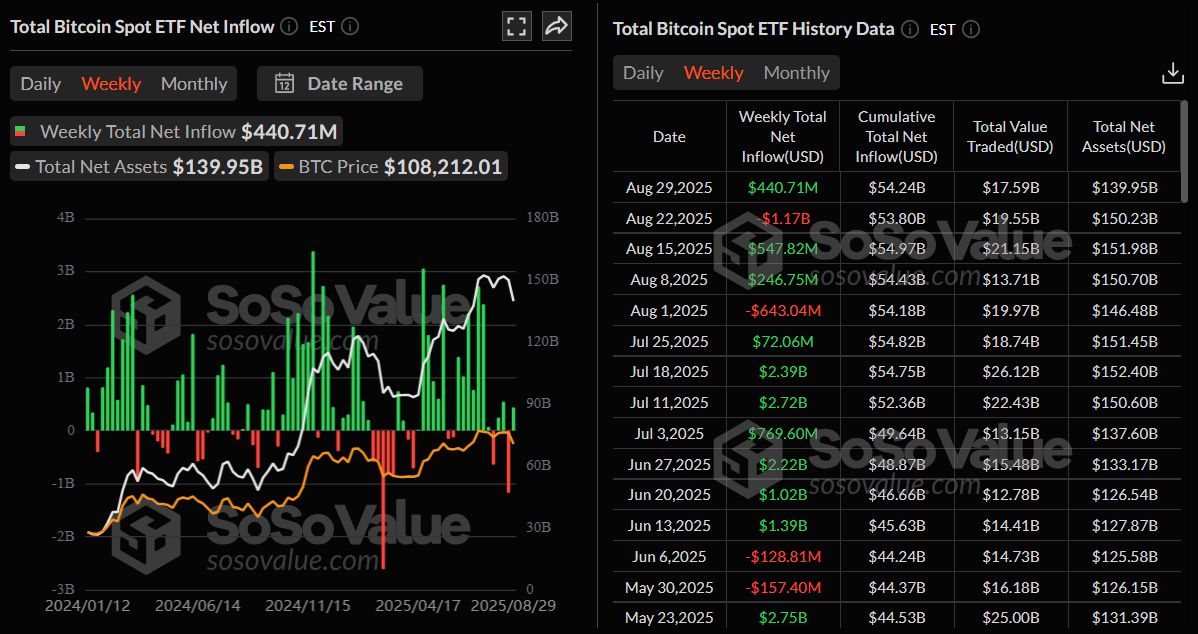

On the institutional front, SoSoValue data show that Bitcoin Spot ETFs recorded a total inflow of $440.71 million last week, compared to a $1.17 billion outflow in the previous week. If the inflows continue and intensify, BTC could see a recovery ahead.

Total Bitcoin Spot ETFs weekly inflow chart. Source: Coinglass

Bitcoin Price Forecast: BTC could recover if the support level holds

Bitcoin price faced rejection from its previously broken ascending trendline on August 23 and declined by 7.43% until Sunday. At the time of writing on Monday, it recovers slightly, trading around $109,600.

If BTC finds support around its daily level at $105,573, which also roughly coincides with the 61.8% Fibonacci retracement level at $105,386 (drawn from the April low of $74,508 to the August high of $124,474), it could recover towards its daily resistance at $116,000.

However, the Relative Strength Index (RSI) reads 41 on the daily chart, below its neutral level of 50, indicating bearish momentum. For the recovery rally to be sustained, the RSI must move above its neutral level.

BTC/USDT daily chart

On the 4-hour chart, BTC displays a bullish RSI divergence in play. The formation of a lower low on Monday contrasts with the RSI’s higher highs during the same period. This development is referred to as a bullish divergence and often signals a trend reversal or a short-term rally.

If BTC recovers, it could extend the advance toward its 50-day Exponential Moving Average (EMA) on the 4-hour chart at $110,650. A successful close above this level could extend the gains toward its Friday 22 high of $117,429.

BTC/USDT 4-hour chart

However, if BTC faces a correction, it could extend the decline toward its weekly support at $104,463.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.