2 Unstoppable Growth Stocks to Buy Right Now for Less Than $1,000

Key Points

The current memory shortage isn’t just limited to DRAM. NAND memory is in short supply as well, with one pure-play company clearly reaping the benefit.

Like it or not, most chipmakers rely on the very same company for the equipment needed to make high-performance silicon. That's why the AI revolution is proving a boon for that outfit.

- 10 stocks we like better than Sandisk ›

Most investors already know that a bunch of growth stocks are struggling right now, as their underlying companies run straight into the headwinds of fiscal reality. Now and then, though, some growth trends are too big and too strong to be derailed. Stocks of these companies often defy broad market weakness.

Here's a rundown of two such growth stocks you can buy right now for less than $1,000. Their persistent bullishness may mean you're paying a bit of a premium to own either one. But these prices may end up being worth it in the long run.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Sandisk

You're probably already aware there's currently a serious shortage of DRAM computer memory made by names like Micron Technology and Samsung. Blame insatiable demand from artificial intelligence (AI) data centers, mostly.

It's not just DRAM, though. Disk drives and flash drives are also in short supply, and likely will be for a while. That's why NAND memory prices have nearly doubled just since the end of last year, and are expected to keep climbing through the second quarter.

What's painful for consumers and corporations that use computer technology, however, isn't all bad. This frustrating dynamic is great news for the companies that make these disc drives and flash drives. And perhaps the name with the most to gain from this shortage is pure-play memory manufacturer Sandisk (NASDAQ: SNDK). Analysts expect its revenue to essentially double during the fiscal year ending in June, pushing it out of the red and back into the black.

Sure, the stock's 130% rally from its 2025 low makes it a bit uncomfortable to step into now; these big run-ups usually invite equally big profit-taking.

Just take a step back and look at the bigger picture. The NAND memory shortage is not only a boon for Sandisk right now, but should prove to be even more lucrative once it levels off in 2027. The analyst community is calling for this fiscal year's per-share earnings of $39.76 to more than double to $80.90 next year. Priced at only 8 times that latter figure, there's still plenty of room for SNDK to keep running.

ASML

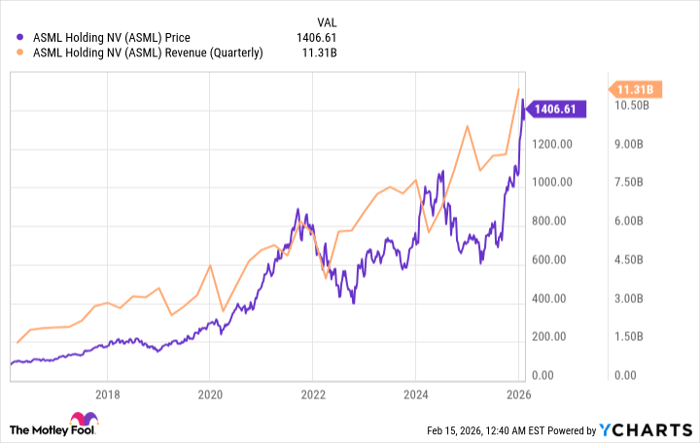

The other top growth stock to consider buying right now is ASML (NASDAQ: ASML).

It's not a household name, but that doesn't mean it isn't a crucial company. Netherlands-based ASML doesn't just make the equipment required to manufacture computer chips. It effectively enjoys a patent-protected monopoly on the ultraviolet lithographic equipment needed to make high-performance silicon; most estimates put its market share of this sliver of the microchip market in excess of 80%. Taiwan Semiconductor Manufacturing, the aforementioned Samsung, and Intel are among its biggest customers, although most of the major semiconductor names rely on its wares.

The chief challenge here is price. ASML's newest state-of-the-art lithography machines sell for about $400 million apiece, and their buyers will of course need more than one. This sort of capital outlay requires some planning. Sometimes, a would-be buyer decides to put a purchase of this size on hold, and the company's occasional revenue swoon shows it.

Data by YCharts.

As with Sandisk, though, take a step back and look at the bigger picture here. The one thing no technology company can really afford to do in the long run is let a competitor gain an edge -- they'll pay for ASML's tech sooner or later simply because they have to, particularly when it comes to artificial intelligence. That's why Global Market Insights expects the worldwide AI hardware market to grow at an average annual pace of 18% through 2034, a pace that ASML's top line is expected to at least match for the next couple of years. And that's why its stock's sizable advance since early last year may still be well away from its top.

Should you buy stock in Sandisk right now?

Before you buy stock in Sandisk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sandisk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $420,595!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,152,356!*

Now, it’s worth noting Stock Advisor’s total average return is 899% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 19, 2026.

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Intel, Micron Technology, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.