Billionaire Ray Dalio Warns Wall Street of a "Bearish Force" Just as This Stock Market Alarm Bell Rings.

Key Points

Ray Dalio warns that a looming "capital war" between nations could disrupt global money flows and force painful economic trade-offs.

Companies with strong cash flows and minimal debt dependency are best positioned to weather potential market turbulence.

- 10 stocks we like better than S&P 500 Index ›

As investors cheer the S&P 500's (SNPINDEX: ^GSPC) ascent to historic highs, Ray Dalio, founder of the world's largest hedge fund, has some concerns. In a recent interview, the billionaire flagged a growing "bearish force" that he believes could have a profound impact on the market in the near future.

This comes just as an important gauge of how richly valued the stock market is hits levels only seen in the lead-up to the dotcom crash. Here's what investors need to know.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

Image source: Getty Images.

What is a capital war?

At the heart of Ray Dalio's argument is what he calls a looming "capital war." Unlike a trade war fought with tariffs on goods, a capital war weaponizes money itself through sanctions, asset freezes, and capital controls. Dalio believes rising geopolitical tensions, especially between the U.S. and China, are pushing the world in this direction, undermining the free flow of capital we've grown accustomed to having.

How would that actually affect the stock market?

The U.S. government runs large deficits each year and borrows money to cover the gap by selling Treasury bonds. Traditionally, foreign buyers purchased a significant portion of these bonds. But as tensions rise, these buyers are growing cautious, fearing their assets could one day be sanctioned or frozen. This reduced demand creates a dilemma, and the government faces two choices:

- Higher yields: The government offer higher interest rates on bonds to make them more attractive. This ripples through the entire economy, making borrowing more expensive for businesses and consumers alike, which slows economic growth.

- Currency "debasement": The government can print more money to purchase its own debt. This erodes the dollar's real value over time via the basic law of supply and demand -- more dollars for the same demand.

Governments are forced into a corner where they must choose the lesser of two evils -- or most likely, some painful combination of both. While some of this is already present, Dalio sees the potential for something much more stark -- and much more impactful for the stock market.

The CAPE Ratio just hit a historic high

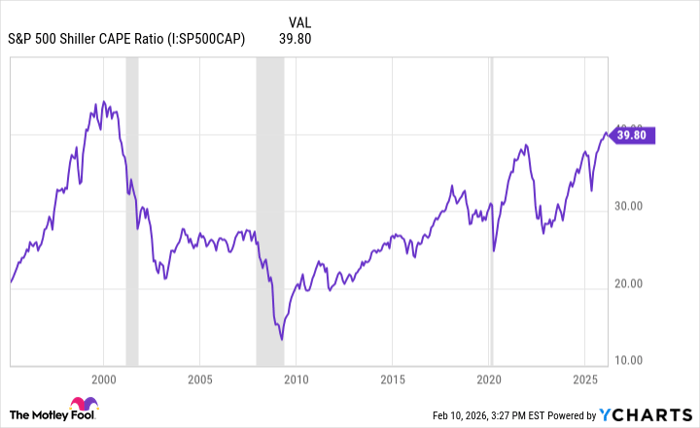

The cyclically adjusted price-to-earnings (CAPE) ratio is a valuation metric that compares stock prices to average earnings over the past 10 years, adjusted for inflation. Think of it as a smoothed-out, birds-eye-view version of a traditional P/E ratio.

It's not a perfect metric -- none are -- but it is a useful gauge to compare today's market to the past. By adjusting for inflation and averaging earnings over a long period, it eliminates some of the short-term "noise" and helps make historical comparisons as apples to apples as can be.

So it's no wonder that many investors are nervous to see the S&P 500's CAPE ratio at historic highs, just shy of 40. The only time it has exceeded this, as you can see in the chart below, was in 1999.

S&P 500 Shiller CAPE Ratio data by YCharts

Now, as I said, it's not a perfect metric. It's easy to take it as confirmation that we are in a bubble, but that would be a mistake. No single metric or data point can tell you that, but it's concerning nonetheless -- especially when you take into account that the artificial intelligence (AI) boom fueling these rich valuations is heavily reliant on capital continuing to flow freely -- and debt to remain relatively cheap. If Dalio's warnings prove true, the boom could turn to bust.

The takeaway

So what should investors do? If you're holding stocks that depend heavily on debt to fuel their growth, ask yourself what will happen if that funding slows down or dries up. It also wouldn't be a bad idea to have some cash on the sidelines to take advantage of a potential downturn.

But most of all, focus on investing in high-conviction stocks with strong competitive advantages and healthy cash flows -- companies that can fund their growth from operations rather than borrowed money. These are the kinds of stocks that can weather storms and keep compounding your wealth over decades.

Playing the long game has always been the best approach.

Should you buy stock in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $414,554!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,120,663!*

Now, it’s worth noting Stock Advisor’s total average return is 884% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 14, 2026.

Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.