1 Growth Stock Down 32% to Buy Hand Over Fist in February, According to Wall Street

Key Points

Datadog is a leader in the cloud observability industry, and it's using its expertise to enter the AI space.

Datadog's latest tools help businesses track the costs, usage, and quality of their AI models to ensure they serve customers as intended.

Wall Street is bullish on Datadog's prospects from here, and analysts forecast significant upside in its stock.

- 10 stocks we like better than Datadog ›

Datadog (NASDAQ: DDOG) developed an industry-leading cloud observability platform, which alerts businesses to technical issues with their digital infrastructure and sales channels before customers are negatively impacted.

Datadog is now using its expertise in this field to help businesses deploy artificial intelligence (AI) software as effectively as possible. The products it has launched in this space so far are attracting significant demand, and it has even more in the pipeline. In fact, the company just reported its full-year operating results for 2025, and its revenue growth accelerated, partly thanks to its AI products.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Datadog stock is trading almost 37% below its November 2025 record high, but Wall Street thinks this might be an opportunity. The majority of the analysts tracked by The Wall Street Journal have given the stock a buy rating, and their consensus price target points to significant potential returns. Here's why their bullishness might be justified.

Image source: Getty Images.

Datadog's AI products are seeing significant demand

In mid-2024, Datadog launched a product called LLM Observability, which helps developers track costs, uncover technical issues, and monitor the quality of the outputs of their large language models (LLMs). These models sit at the foundation of customer-facing AI software, so it is critical that they maintain the highest standard of quality.

But not every business has the financial or technical resources to build an LLM from scratch, so some of them adopt models from third-party developers like OpenAI as a shortcut. Datadog looks after these customers with a product called OpenAI Monitoring, which allows businesses to keep track of their usage, costs, response times, and error rates.

But Datadog isn't stopping there. It's gearing up to launch a series of new observability tools to track the usage and performance of AI agents and coding assistants, which could be extremely popular as more businesses and developers lean on these technologies to help improve their productivity.

Datadog said 5,500 of its 32,700 customers were using at least one of its AI products at the end of 2025, which was up by a whopping 57% from the year-ago period. The company also said its Model Context Protocol (MCP) server, which is the bridge between Datadog observability data and customer AI models and software, saw a staggering 11-fold increase in requests compared to the third quarter just three months earlier. In simpler terms, usage of Datadog's AI integrations is exploding.

Revenue growth accelerated in 2025

Datadog generated $3.43 billion in total revenue during 2025, which was a 28% increase from the year before. It marked an acceleration from the 26% growth the company produced in 2024, and a lot of this momentum is attributable to AI customers.

During the fourth quarter, for example, Datadog's revenue grew by 29% overall, but by 23% if you exclude AI-native customers (these are AI-first companies like OpenAI and Anthropic). That means this very small cohort of just 650 customers accounted for six percentage points of Datadog's total revenue growth for the period -- and this doesn't include the thousands of other customers that are also using the company's various AI tools.

Datadog also had another strong year at the bottom line, bringing in $363.4 million in generally accepted accounting principles (GAAP) net income. That was up only marginally compared to 2024, mainly because the company spent aggressively in areas like research and development throughout the year to expand its AI product portfolio.

Wall Street is bullish on Datadog stock

The Wall Street Journal tracks 48 analysts who cover Datadog stock, and 36 of them have given it a buy rating. Eight others are in the overweight (bullish) camp, while three recommend holding, and just one recommends selling.

The analysts have an average share price target of $185.92, implying Datadog stock could climb by 47% over the next 12 to 18 months. However, the Street-high target of $260 suggests the stock could more than double instead.

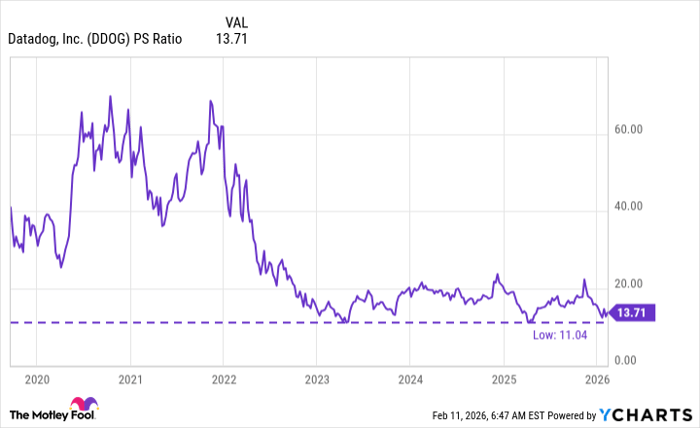

I think those targets are achievable if Datadog's revenue growth continues to accelerate, especially because its stock is trading at a price-to-sales (P/S) ratio of 13.7, which is near the cheapest valuation since it went public in 2019.

Data by YCharts.

Last year, Datadog valued its addressable market in the observability segment alone at $52 billion, and it expects that figure to grow by 9% per year through 2029. Based on the company's current revenue, it has barely scratched the surface of that opportunity. But remember, Datadog will soon launch entirely new products in this space for AI agents and coding assistants, which could expand the size of its observability opportunity even further than expected.

As a result, I think Wall Street analysts are right to be bullish on Datadog stock, especially at its current price.

Should you buy stock in Datadog right now?

Before you buy stock in Datadog, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Datadog wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $409,108!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,145,980!*

Now, it’s worth noting Stock Advisor’s total average return is 886% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 13, 2026.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Datadog. The Motley Fool has a disclosure policy.