This Stock Is Up Over 90% in 2025 -- And You May Have Never Heard of It

Key Points

Nano Nuclear Energy is developing microreactors that could supply reliable power.

The young company has yet to receive regulatory approval for its designs.

It's also bleeding cash and trading at a $2 billion market valuation.

- 10 stocks we like better than Nano Nuclear Energy ›

The dawn of artificial intelligence (AI) has made a lot of companies household names. One might think of Nvidia or Palantir Technologies, for instance, both of which have skyrocketed over 1,100% and 2,600% respectively since ChatGPT was released at the end of 2022.

Chips and software companies, however, aren't the only ones growing exponentially from AI. Because AI is thirsty for power, energy companies are also now getting attention. Indeed, without energy -- and lots of it -- AI's projected growth rate could be severely stalled, which is why energy companies.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Nano Nuclear Energy (NASDAQ: NNE), for instance, is racing to invent novel technologies that can give it more juice. That promise alone has helped Nano's shares soar over 90% on the year. The nuclear company is designing something that could theoretically suit AI's energy needs the best.

But since Nano is still years away from being profitable, investors should look closely at the company's story before they load up. Let's dive in and have a look now.

Image source: Getty Images.

A new golden age of nuclear power

In case you haven't noticed, a global nuclear renaissance is underway. After decades of stagnation, nuclear power generation grew at a compound annual growth rate of 14% between 2020 and 2024, according to research by Goldman Sachs. That rate is expected to accelerate, especially with countries like the U.S. pledging to triple or quadruple nuclear capacity by 2050.

At the heart of this renaissance is novel nuclear technology. The power plants of old -- the hourglass cooling towers and steam lifting off them -- were expensive to build and could take a decade or more to construct. The power plants of the future, however, are looking smaller, more compact, and much less expensive to assemble.

That's where Nano comes in. True to its name, Nano Nuclear is developing portable and stationary microreactors. Its portfolio includes three epic designs: KRONOS, a stationary microreactor; ZEUS, a solid-core battery reactor that can be transported on a truck; and LOKI, a microreactor that's designed for both Earth and space deployment.

Alongside these micro modular reactors (MMRs), Nano also plans to produce high-assay low-enriched uranium (HALEU), a type of fuel that could power advanced reactors.

While Nano hasn't built a commercial reactor yet (more on that below), it recently started some site work for a KRONOS prototype at the University of Illinois Urbana-Champaign. A potential customer, BaRupOn, has also signaled interest in deploying Nano's MMRs for a 700-acre AI data center near Houston, Texas.

An epic promise, but nothing concrete to show for it

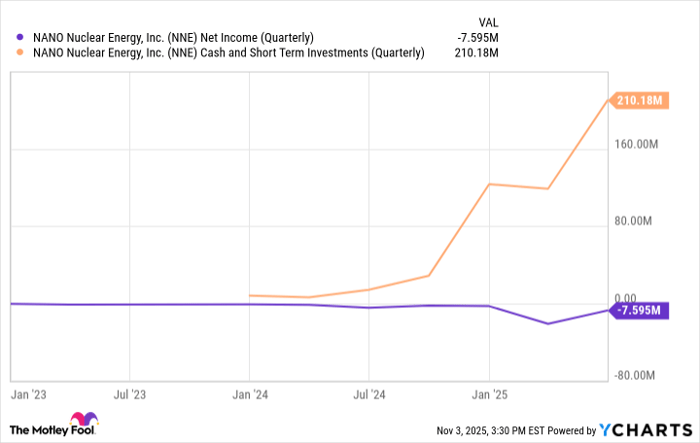

Nano Nuclear is very much a pre-revenue stock. It has no regulatory approval from the Nuclear Regulatory Commission (NRC), and it hasn't generated a dime of revenue. The company reported a third-quarter net loss of $7.6 million, about 63% wider than the year before.

NNE Net Income (Quarterly) data by YCharts

Regulation remains a tall hurdle. Licensing a new reactor design through the NRC could take years and tens of millions of dollars. Even Oklo, perhaps the most advanced microreactor developer, has yet to get regulatory approval for its powerhouse.

Speaking of Oklo, there's also the question of competition. Nano's designs may be innovative, but they're not unique. Oklo and NuScale Power are both pursuing small modular reactors, while Centrus Energy already holds the only U.S. license to produce HALEU.

Valuation-wise, Nano trades at a market cap north of $2 billion, which is hefty for a company with no sales. Shares have already shot up over 90% on the year, and the company will likely have to get one of its designs approved (or partner with a big name) to see substantial growth from here.

Should you buy Nano Nuclear?

If you believe the world will demand a lot more clean power and that microreactors will deliver it, then Nano Nuclear could be a high-leverage play on that thesis. Given its extreme risk profile, however, I would treat this growth stock at best as a small speculative play, not a core position.

Should you invest $1,000 in Nano Nuclear Energy right now?

Before you buy stock in Nano Nuclear Energy, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nano Nuclear Energy wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $595,194!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,153,334!*

Now, it’s worth noting Stock Advisor’s total average return is 1,036% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 3, 2025

Steven Porrello has positions in NuScale Power, Nvidia, and Oklo. The Motley Fool has positions in and recommends Goldman Sachs Group, Nvidia, and Palantir Technologies. The Motley Fool recommends NuScale Power. The Motley Fool has a disclosure policy.