ADP Employment Change projected to show US job growth gaining in March

- It will be another key week for the US labour market with the ADP and NFP releases.

- The US private sector is expected to add 105K new jobs in March.

- The US Dollar Index appears to have embarked on a consolidative phase.

The US labor market is poised to steal the spotlight this week as concerns over a potential slowdown in economic momentum remain on the rise — an unease fueled by recent signs of slower growth and troubling underlying data, aggravated by the ongoing uncertainty surrounding US tariffs.

All eyes will be on the ADP Research Institute, which is set to unveil its March Employment Change report on Wednesday, offering a glimpse into private sector job gains.

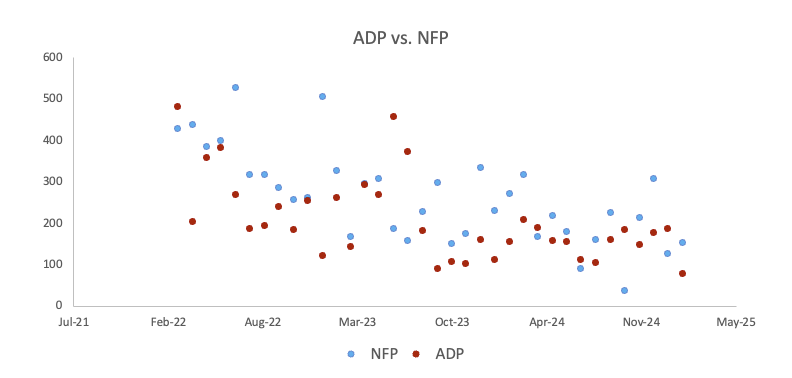

Traditionally released a couple of days ahead of the official Nonfarm Payrolls (NFP) report, the ADP survey is often regarded as a sneak peek into the trends that might appear in the Bureau of Labor Statistics jobs report, even though the two don’t always tell the same story.

Under pressure: Employment, inflation, and Fed strategy

Employment is a cornerstone of the Federal Reserve’s (Fed) dual mandate, alongside maintaining price stability.

With inflationary pressures proving stubborn, attention has temporarily shifted to the US labour market following the Fed’s hawkish hold at its March 18–19 meeting. Meanwhile, investors are keeping a close eye on the White House’s trade policies — especially on developments from US President Donald Trump’s so-called “Liberation Day”. Concerns that these tariffs could spark renewed inflation have contributed to the Fed’s cautious approach and the guarded tone of its policymakers.

Recent weaker-than-expected results from key fundamentals, which challenge the notion of US “exceptionalism,” have led market participants to predict 50 basis points of rate cuts by the Fed this year.

Against a backdrop of tariff tensions, a slowing economy, and persistent consumer price pressures, the upcoming ADP report — and particularly Friday’s NFP report — has taken on renewed significance, potentially guiding the Fed’s next move.

When will the ADP report be released, and how could it affect the US Dollar Index?

The ADP Employment Change report for March is scheduled for release on Wednesday at 12:15 GMT, with forecasts predicting an addition of 105K new jobs after February’s lacklustre gain of 77K. In anticipation of the report, the US Dollar Index (DXY) is holding a defensive stance amid intense trade concerns and jitters over the health of the US economy.

Should the ADP figures exceed expectations, they could help ease current concerns about an economic slowdown. Conversely, if the numbers fall short, it might intensify worries that the economy is losing steam — potentially prompting the Fed to reconsider an earlier restart of its easing cycle.

Pablo Piovano, Senior Analyst at FXStreet, explains that if the recovery picks up momentum, the DXY should initially retest its weekly peak of 104.68 from March 26, which precedes its critical 200-day Simple Moving Average (SMA). Once this area is cleared, the index is expected to face its next provisional hurdle at its 100-day SMA in the 106.70 region, prior to the weekly top of 107.66 reached on February 28, all ahead of the February high of 109.88 hit on February 3.

“On the flip side, if sellers gain control, the index might initially find support at the yearly floor of 103.25 from March 19, ahead of the 2024 bottom of 100.15 from September 27”, Piovano adds.

“Accentuating the current bearish stance, the index continues to trade below its 200-day SMA and the Ichimoku cloud. Maintaining levels below these thresholds should leave the door open to extra weakness for the time being”, Piovano concludes.

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Apr 02, 2025 12:15

Frequency: Monthly

Consensus: 105K

Previous: 77K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.