Bitcoin Weekly Forecast: BTC sets sight on fresh all-time highs after US passes key crypto bills

- Bitcoin price stabilizes around $118,000 on Friday after reaching a new all-time high of $123,218 earlier in the week.

- Corporate and institutional demand remains robust this week, with spot Bitcoin ETFs recording a total of $2.02 billion in inflows as of Thursday.

- US lawmakers passed the crypto-related GENIUS, CLARITY and Anti-CBDC bills.

Bitcoin (BTC) posted a strong performance this week, hitting a new all-time high of $123,218 to start the week before consolidating around $118,000 as of Friday. The surge in BTC was supported by rising corporate and institutional demand, with spot Bitcoin Exchange Traded Funds (ETFs) recording a total of $2.02 billion as of Thursday this week. Adding to this optimism is the passage of key crypto-related legislation in the United States (US), with GENIUS, CLARITY, and Anti-CBDC bills now moving to US President Donald Trump’s desk for final signing.

Bitcoin hits a new all-time high

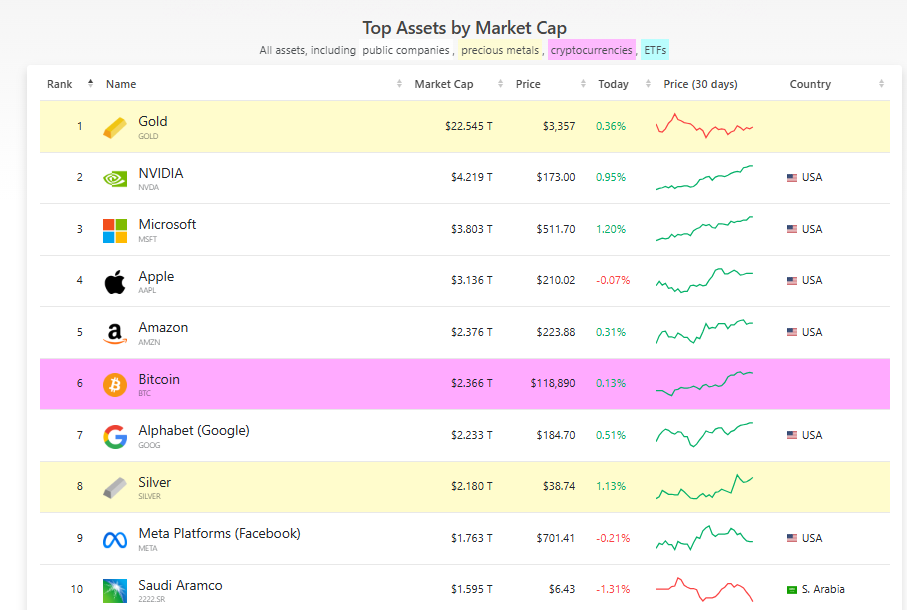

Bitcoin started the week on a positive note, reaching a new all-time high of $123,218 on Monday. CoinGeko data shows that the BTC market capitalization surpassed $2.4 trillion that day and currently hovers around $2.36 trillion.

As of Friday, BTC ranks as the sixth-largest asset globally by market capitalization, surpassing Alphabet (Google) and Silver, and nearing Amazon.

Regulatory clarity is on its way

The approval of several crypto-related bills in the US on Thursday further supports the BTC price. The US House of Representatives passed three pieces of crypto legislation, including the Guidance and Establishing Innovation for US Stablecoins (GENIUS) bill, the Digital Asset Market Clarity (CLARITY) bill, and the Anti-CBDC bill. All three crypto bills now move to President Trump’s desk for final signing.

The three bills aim to establish a clear US federal regulatory framework for digital assets, with the aim of boosting investor confidence, increasing regulatory clarity, and promoting wider adoption.

On the same day, the Financial Times reported that Donald Trump is preparing to sign an executive order that would pave the way for 401(k) accounts to invest in cryptocurrencies.

If passed, the order would allow for the provision of digital assets, precious metals such as Gold, and private loans in retirement plans to serve as alternatives to the traditional portfolio of Stocks and Bonds.

Institutional and corporate demand remain robust

Bitcoin price has been supported by rising corporate and institutional demand this week. According to SoSoValue data, Bitcoin Spot ETFs have recorded a total inflow of $2.02 billion as of Thursday, marking the sixth consecutive week of positive flows since mid-June.

Total Bitcoin spot ETF net inflow weekly chart. Source: SoSoValue

Apart from the institutional inflow, K33 Research reported that in the first half of 2025, 64 new BTC treasury company initiatives went live, and total BTC treasury companies acquired 244,991 BTC. Big corporations such as Softbank, Cantor Fitzgerald, and Bitfinex (XXI), as well as Donald Trump’s own media company, Trump Media & Technology Group Corp. (DJT), launched these initiatives.

Technical outlook suggests BTC is inching toward its all-time high

The Bitcoin price dipped, reaching a low of $115,736 on Tuesday after hitting a new all-time high of $123,218 to start the week. BTC recovered from this Tuesday’s dip over the next two days and, at the time of writing on Friday, stabilized at around $118,850.

If BTC closes above the $120,000 mark on a daily basis, it could extend the recovery toward the fresh all-time high at $123,218 and beyond.

The Relative Strength Index (RSI) indicator reads 69 on the daily chart, flattening around the overbought level of 70 after reaching a peak of 75 on Monday, indicating a pause in bullish momentum and growing indecision among traders. For the bullish momentum to be sustained, the RSI must continue to move upward, supporting the rally. However, traders should still be cautious, as the chances of a pullback remain high around the current levels.

The Moving Average Convergence Divergence (MACD) exhibited a bullish crossover at the end of June, which remains in effect. The declining green histogram bars above its neutral zero line suggest that bullish momentum is starting to fade.

BTC/USDT daily chart

If BTC faces a correction, it could extend the decline to find support around its Tuesday low of $115,736.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.