What Crypto Whales Are Buying Prior to FOMC

Crypto whales are accumulating NEET, PIN, and CHILLGUY ahead of the upcoming FOMC decision, signaling growing interest in select meme and DePIN tokens. NEET has surged over 41% in the past 24 hours, with whale holdings jumping 45% in just a week.

PIN is down nearly 13% this week, yet large wallets have increased their exposure by 18.5%, suggesting strategic buying during the dip. Meanwhile, CHILLGUY is up 38% in seven days, and despite recent price stability, whale holdings remain relevant, hinting at expectations of post-FOMC upside.

NotInEmploymentEducationTraining (NEET)

NEET has surged over 41% in the last 24 hours, standing out as one of the day’s most explosive meme coin moves. The token, which brands itself humorously as “the premier token for basement dwellers worldwide,” is based on the acronym “Not in Employment, Education, or Training.”

Originally launched on PumpFun and now trading on the Solana blockchain, NEET has quickly attracted attention with its mix of irony and momentum.

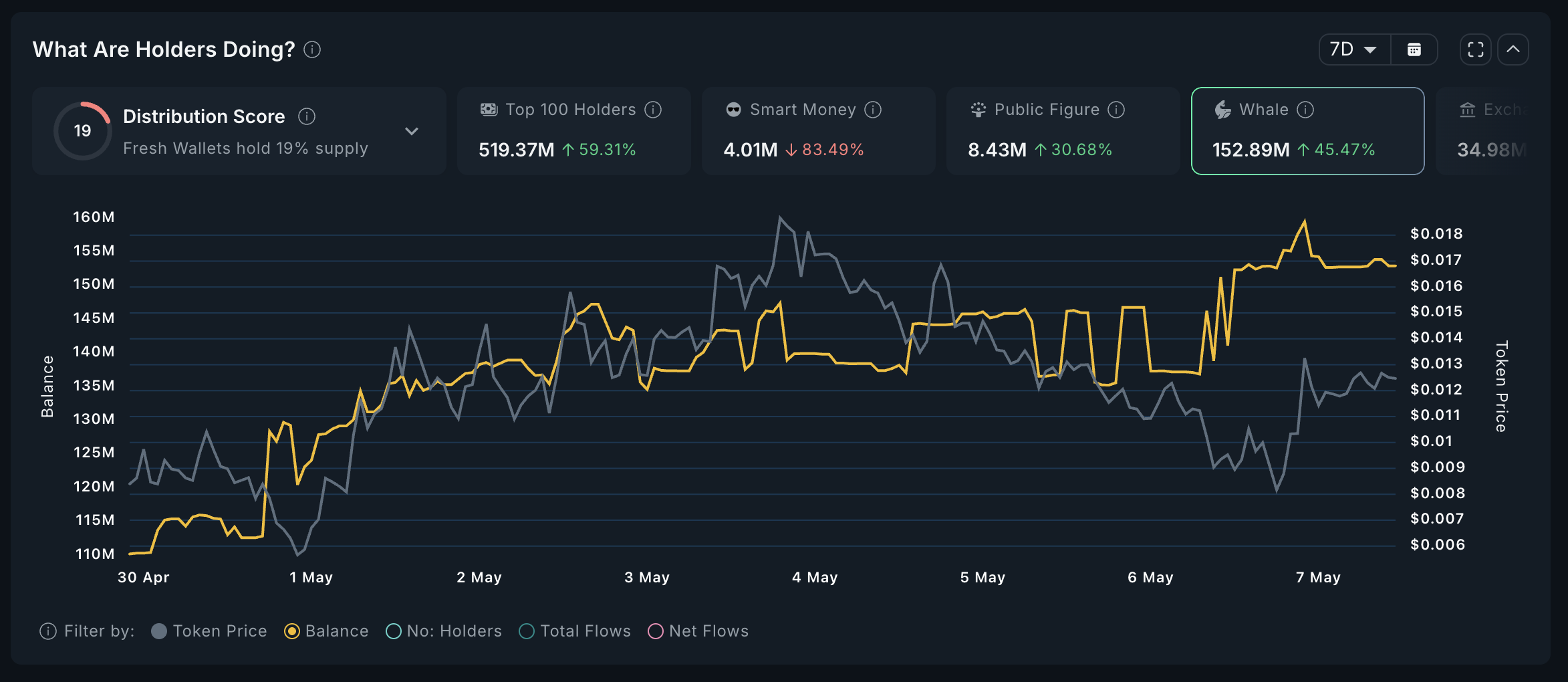

NEET Whales Analysis. Source: Nansen.

NEET Whales Analysis. Source: Nansen.

With over 6,300 holders and $5 million daily trading volume, the project is gaining real traction in the Solana meme coin space.

On-chain data reveals that crypto whales are also significantly accumulating NEET. In just the past seven days, the amount of NEET held by whales has jumped 45%, rising from 110 million to 153 million tokens.

PinLink (PIN)

PinLink is positioning itself as the first RWA-tokenized DePIN platform, aiming to offer crypto users fractionalized ownership of real-world physical infrastructure (DePIN assets).

Despite this promising concept, its native token, PIN, has dropped nearly 13% over the past seven days, reflecting broader market weakness or short-term selling pressure.

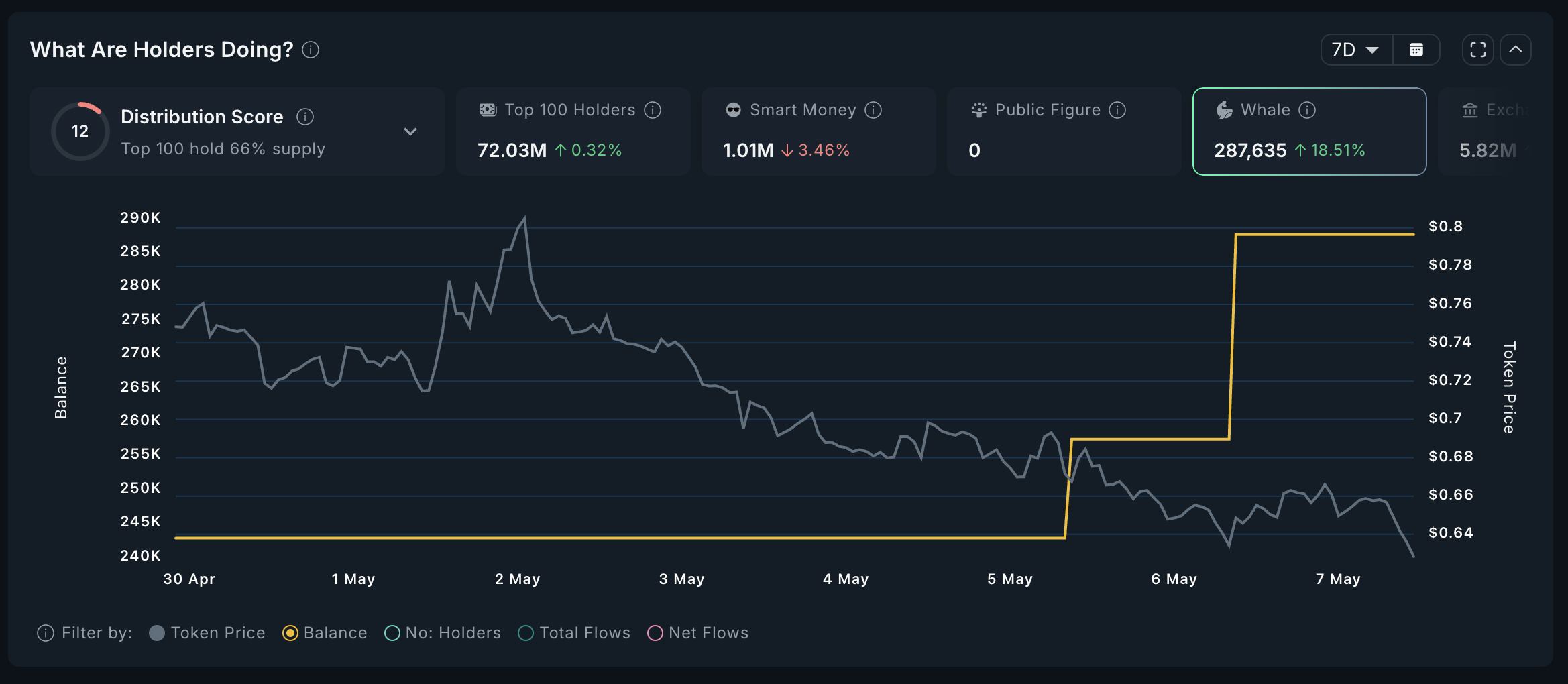

Interestingly, while the price corrects, crypto whales appear to be accumulating. Between May 5 and May 7, the amount of PIN held by large wallets increased from 242,717 to 287,635 tokens.

PIN Whales Analysis. Source: Nansen.

PIN Whales Analysis. Source: Nansen.

This 18.5% jump in crypto whales holdings during a downtrend could suggest strategic accumulation—often seen when larger players anticipate a rebound or view the current price as undervalued.

If this trend continues, it may support a future price recovery once broader sentiment stabilizes.

Just a chill guy (CHILLGUY)

CHILLGUY is up 38% over the past seven days, standing out as one of the stronger performers in the meme coin space this week.

Alongside its price surge, whale accumulation has intensified—on-chain data shows that holdings by large wallets grew 52% in the same period, rising from 56.2 million to 85.75 million tokens.

CHILLGUY Whales Analysis. Source: Nansen.

CHILLGUY Whales Analysis. Source: Nansen.

While price growth has stabilized in recent days, it’s notable that whales are not reducing their positions. This holding behavior implies that large holders may be anticipating further upside—possibly tied to macro events like the upcoming FOMC outcome.

If market sentiment shifts favorably and meme coins see renewed inflows, CHILLGUY could be among the beneficiaries, with whales already positioned to capitalize on any momentum shift.