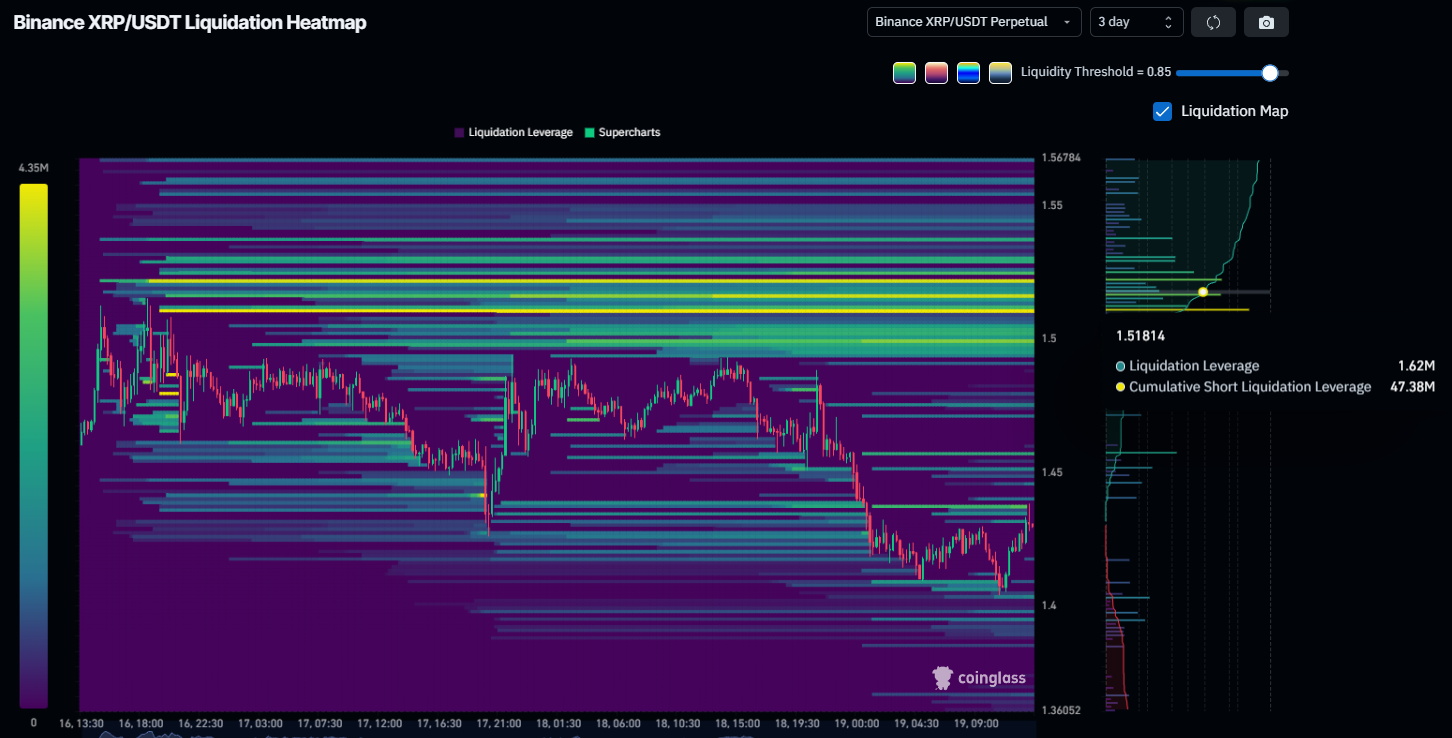

XRP Is Coiled Under $1.51—And $47 Million in Shorts Are on the Line

XRP has entered a prolonged consolidation phase, trading sideways beneath a key resistance zone. The muted price action is not random. Derivatives data suggest a heavy concentration of short contracts is capping upside attempts.

This resistance wall has created tension in the market, highlighting the question of whether XRP can trigger a short squeeze or remain suppressed below $1.50.

XRP Is Facing a Wall

Futures market data and liquidation heatmaps highlight a critical level near $1.51. At that price, approximately $47 million in XRP short positions face liquidation. This concentration has formed a visible barrier above current price action.

Traders holding short contracts are incentivized to defend this level. A sharp breakout could force rapid short covering, triggering a temporary price spike. However, such moves often exhaust buy-side liquidity quickly. Large players may sell into strength, turning the level into a short-term ceiling rather than sustained support.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

XRP Liquidation Heatmap. Source: Coinglass

XRP Liquidation Heatmap. Source: Coinglass

On-chain data reflects continued stress among XRP holders. Net realized profit and loss metrics show that investors are still selling at a loss. On February 17 alone, roughly $117 million in realized losses were recorded.

This level of capitulation indicates persistent fear. When holders exit positions at a loss, it signals reduced confidence in near-term recovery. Sustained loss realization can limit bullish momentum until selling pressure subsides.

XRP Realized Profit/Loss. Source: Glassnode

XRP Realized Profit/Loss. Source: Glassnode

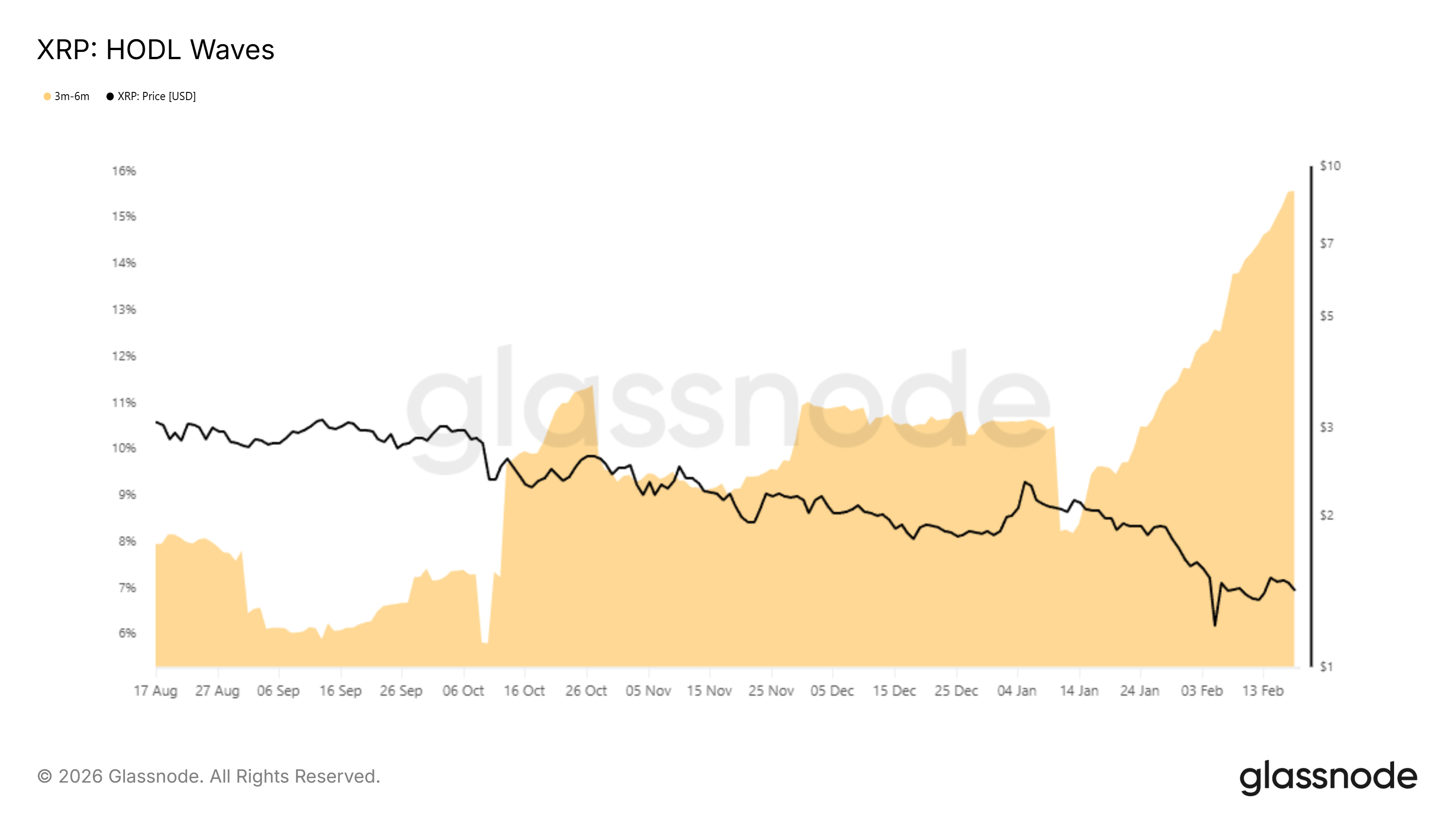

XRP Holders Mature

Despite ongoing distribution, another cohort is showing resilience. Many XRP holders remain underwater but are choosing to HODL rather than liquidate. This behavior suggests conviction among mid-term investors.

The three-month to six-month holding group has expanded notably. Their share of total XRP supply increased from 8% to 15%. As these wallets mature, their reluctance to sell may counterbalance panic-driven distribution and stabilize price action.

XRP HODL Waves. Source: Glassnode

XRP HODL Waves. Source: Glassnode

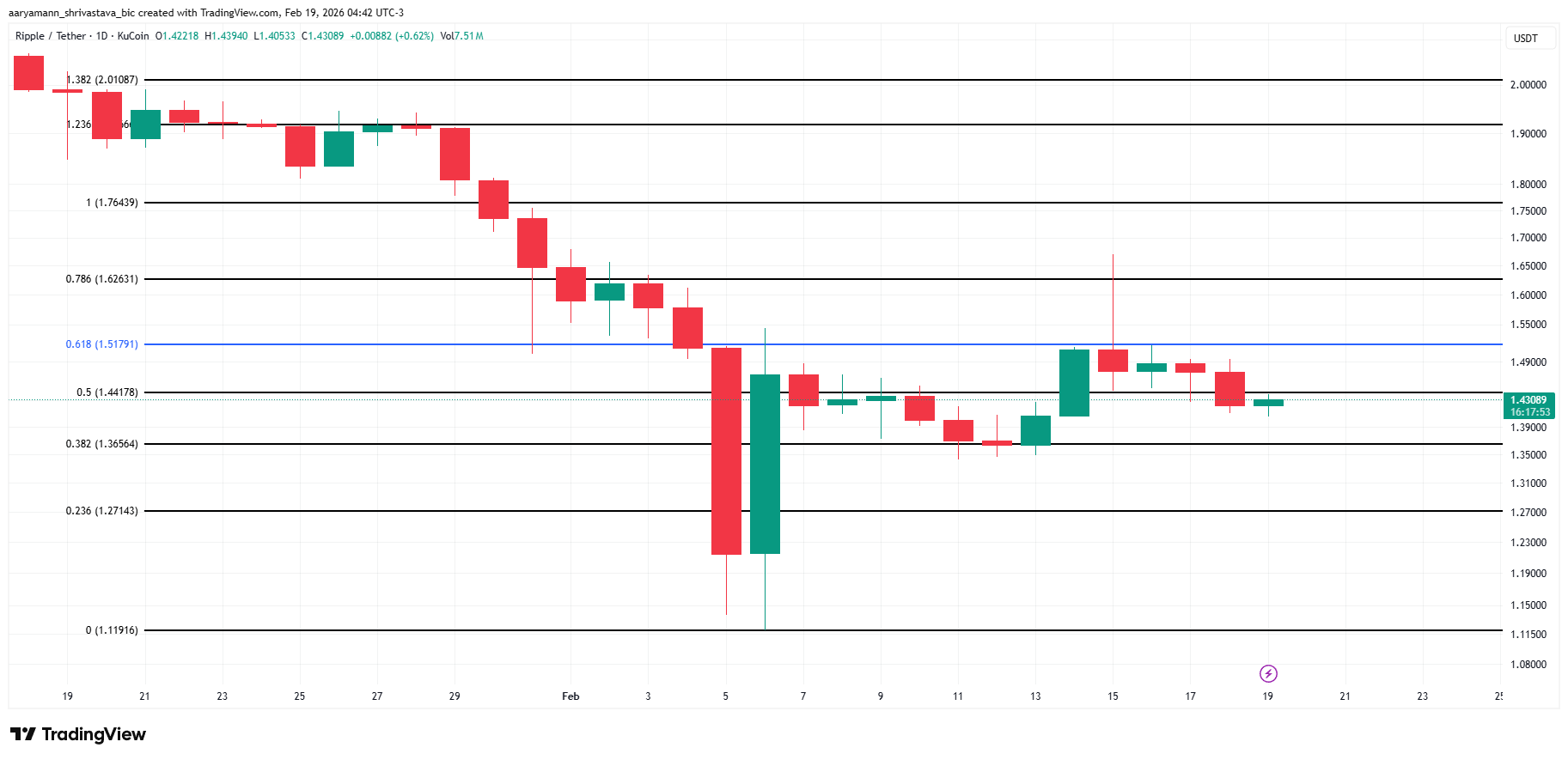

XRP Price To Likely Consolidate

XRP is trading at $1.43 at the time of writing. The token remains below the $1.51 resistance, which aligns with the 61.8% Fibonacci retracement level. Reclaiming this barrier as support would signal technical improvement and potentially ignite recovery.

For now, consolidation appears more likely. The $1.44 and $1.27 levels represent key support zones. Continued rejection near $1.51 may keep XRP range-bound between these thresholds. Selling pressure from loss-making investors could reinforce this sideways structure.

XRP Price Analysis. Source: TradingView

XRP Price Analysis. Source: TradingView

However, sentiment can shift quickly in crypto markets. If short sellers lose control and $1.51 flips into support, upside potential expands. A breakout could push XRP above $1.62 and attract momentum buyers. Such a move would invalidate the immediate bearish thesis and alter the short-term market structure.