Bitcoin Shorts Reach Most Extreme Level Since 2024 Bottom

Bitcoin price is attempting another breakout toward $70,000 after weeks of choppy consolidation. BTC trades at $69,815 at publication, sitting just below the $70,610 resistance level. The largest cryptocurrency is trying to recover recent losses, yet mixed on-chain and derivatives signals present an uncertain short-term outlook.

Market participants are closely watching this psychological threshold. A sustained move above $70,000 could shift sentiment decisively. However, persistent bearish positioning suggests that volatility may intensify before a clear trend emerges.

Bitcoin Shorts Resemble The Past

Aggregated funding rate data across major crypto exchanges shows an extreme surge in short positioning. Current negative funding levels are the deepest since August 2024. That period ultimately marked a significant Bitcoin bottom.

In August 2024, traders crowded into downside bets as funding rates plunged. Instead of continuing lower, Bitcoin reversed sharply. The reversal triggered widespread short liquidations and fueled an approximately 83% rally over the following four months.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin Shorts Note a Jump. Source: Santiment

Bitcoin Shorts Note a Jump. Source: Santiment

Deeply negative funding rates signal heavy bearish positioning and widespread fear, uncertainty, and doubt (FUD). While this setup does not guarantee immediate upside, it creates a fragile structure. If price rises, forced short-covering could amplify volatility and accelerate upward momentum.

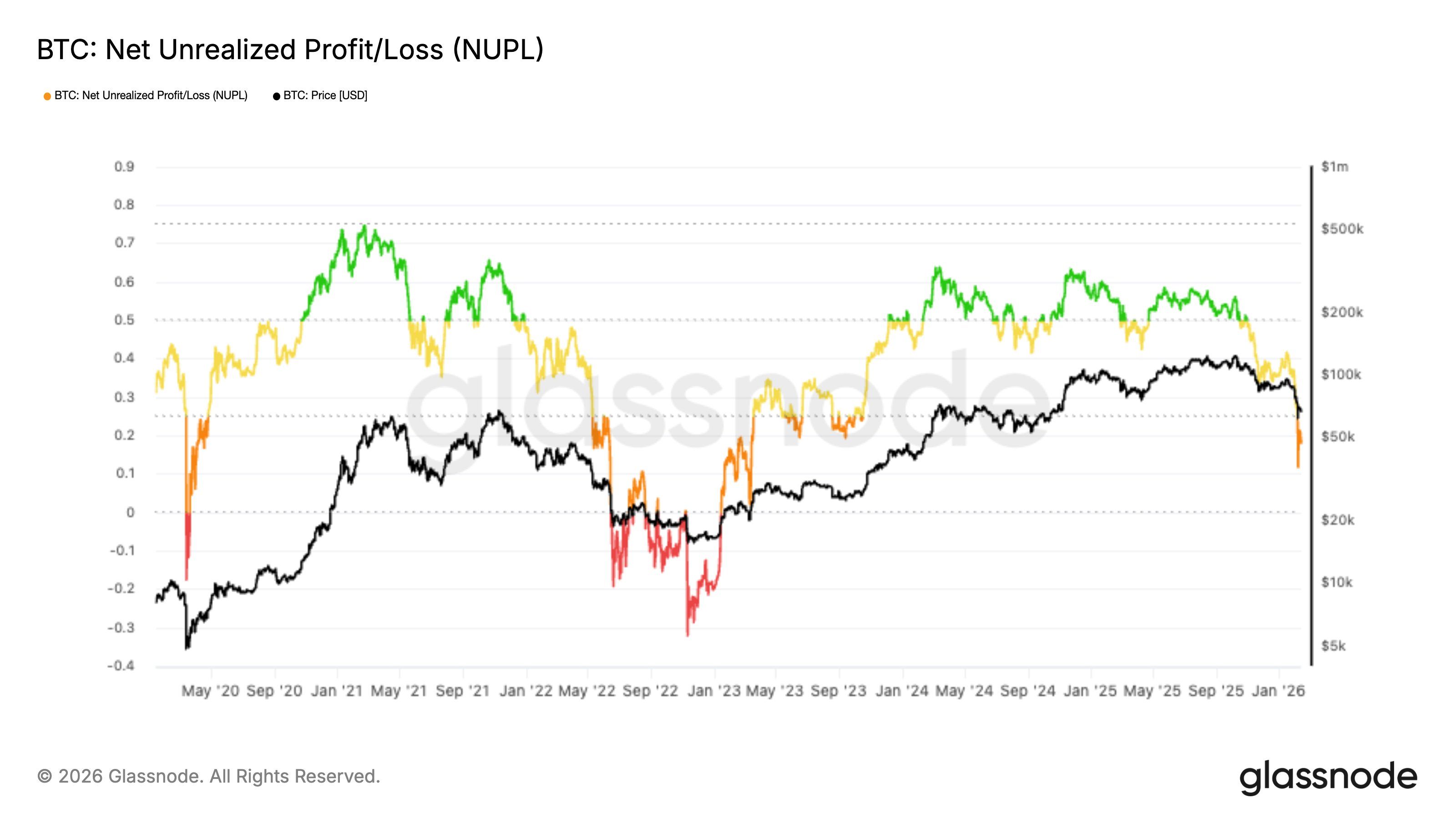

Bitcoin Towards Capitulation

The Net Unrealized Profit and Loss, or NUPL, indicator has returned to the Hope/Fear zone near 0.18. This reading shows that profit cushions among holders are thin. When NUPL enters this regime, market behavior tends to become reactive.

Historically, declines into this zone often preceded extended weakness. Panic selling typically intensifies before a durable bottom forms. Unless capitulation resets sentiment, Bitcoin may remain vulnerable to deeper pullbacks before stabilizing.

Bitcoin NUPL. Source: Glassnode

Bitcoin NUPL. Source: Glassnode

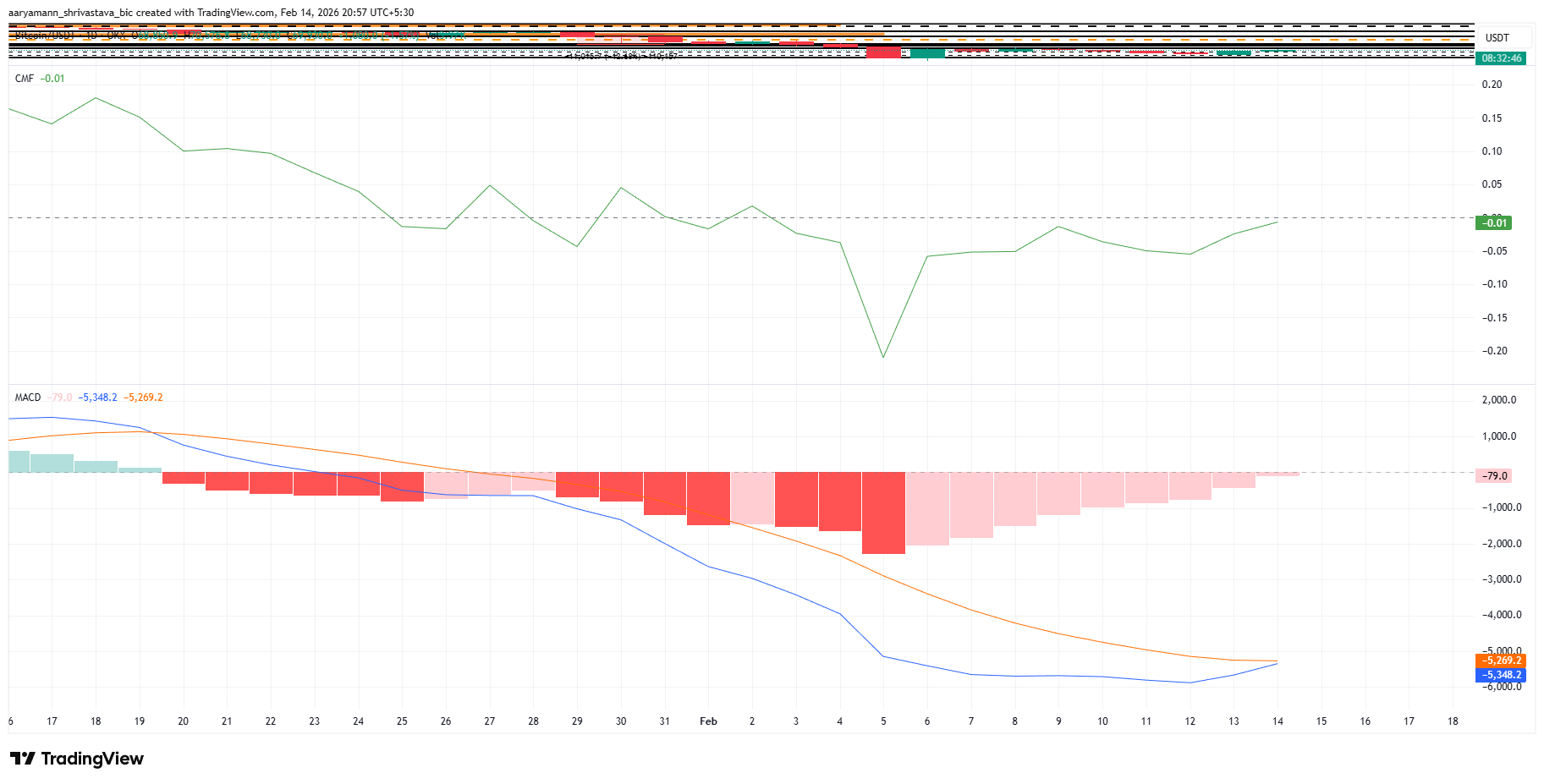

What Does The Short-Term Outlook Look Like?

Short-term technical cues suggest improving momentum. The Chaikin Money Flow, which measures capital inflows and outflows, is approaching the zero line. A confirmed move into positive territory would signal renewed demand for Bitcoin.

Simultaneously, the Moving Average Convergence Divergence indicator is nearing a bullish crossover. A confirmed crossover would indicate a shift from bearish to bullish momentum. However, early signals require validation through sustained price strength.

Bitcoin Netflows And Market Momentum. Source: TradingView

Bitcoin Netflows And Market Momentum. Source: TradingView

Even with improving indicators, broader sentiment remains cautious. Shorts are unlikely to close voluntarily under weak conditions. This dynamic increases the probability that a price-driven liquidation event becomes the catalyst for recovery.

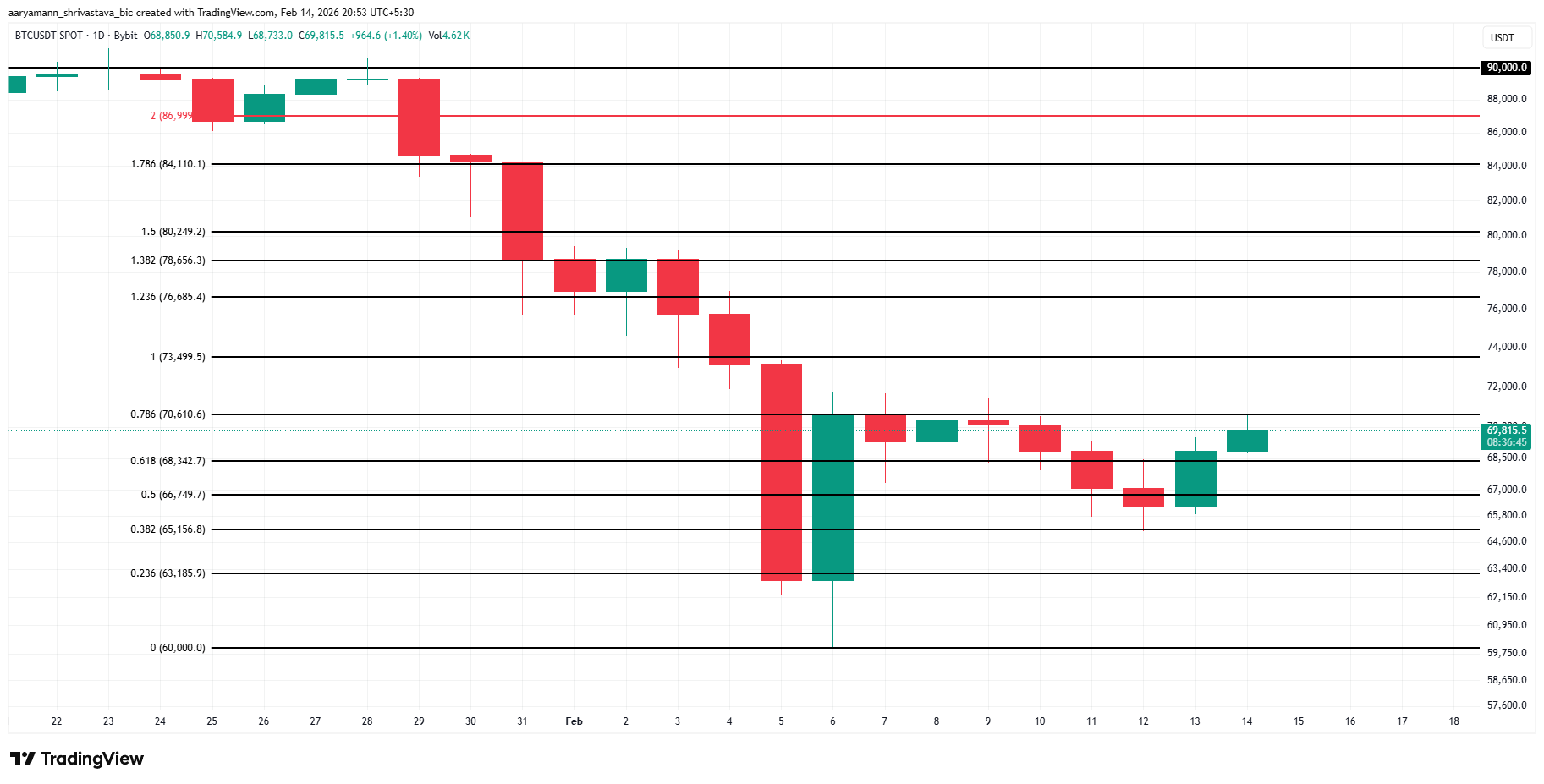

BTC Price Needs a Strong Push

Bitcoin trades at $69,815 and remains capped below $70,610 resistance. The $70,000 level represents a critical psychological barrier. A decisive close above this threshold could trigger renewed bullish momentum and attract fresh capital inflows.

However, bearish pressure persists in derivatives markets. Continued dominance of short contracts could keep BTC below $70,000. A breakdown below $65,156 support may trigger long liquidations and intensify downside volatility.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

If Bitcoin secures strong investor support and overcomes selling pressure above $70,000, upside targets emerge. A rally toward $73,499 could develop quickly.

Sustained strength may extend gains toward $76,685, invalidating the bearish thesis and confirming a broader recovery attempt.