Ripple Price Forecast: XRP sell-side pressure intensifies despite surge in addresses transacting on-chain

- XRP extends sell-off as risk-off sentiment weighs across the broader crypto market.

- The XRP Ledger records a significant increase in active addresses above 32,000.

- Mild institutional support via spot ETFs fails to absorb selling pressure, leaving XRP vulnerable to a weak retail market.

Ripple (XRP) is edging lower around $1.36 at the time of writing on Wednesday, weighed down by low retail interest and macroeconomic uncertainty, which is accelerating risk-off sentiment.

The remittance token has corrected so far by 19% in February, 7% this week and approximately 3% intraday. Unless the short-term technical structure stabilizes and is supported by steady institutional interest, the path of least resistance would remain downcast toward the October 10 low at $1.25 and Friday’s support at $1.12.

XRP Ledger’s on-chain activity soars

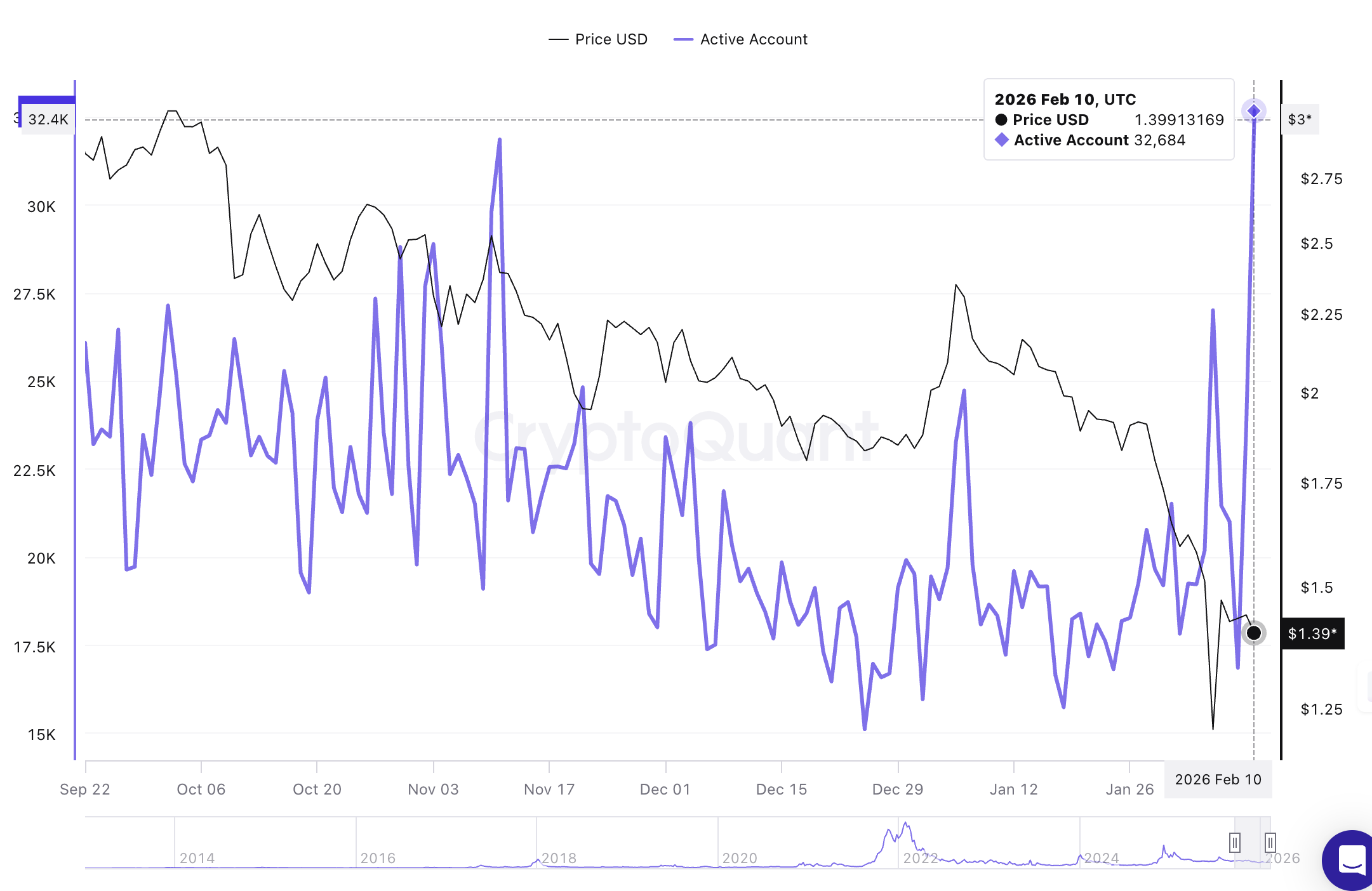

The XRP Ledger (XRPL) has since Monday recorded a significant increase in the number of active addresses transacting on-chain. According to CryptoQuant’s data, the Active Addresses metric nearly doubled from approximately 17,000 addresses on Sunday to 32,700 on Wednesday.

The surge in addresses transacting on the XRPL indicates greater engagement with the protocol and reflects growing interest in XRP. Moreover, it signals rising confidence among holders as sentiment gradually improves.

However, investors should temper expectations, as the same increase may signal volatility, leading to instability and price fluctuations.

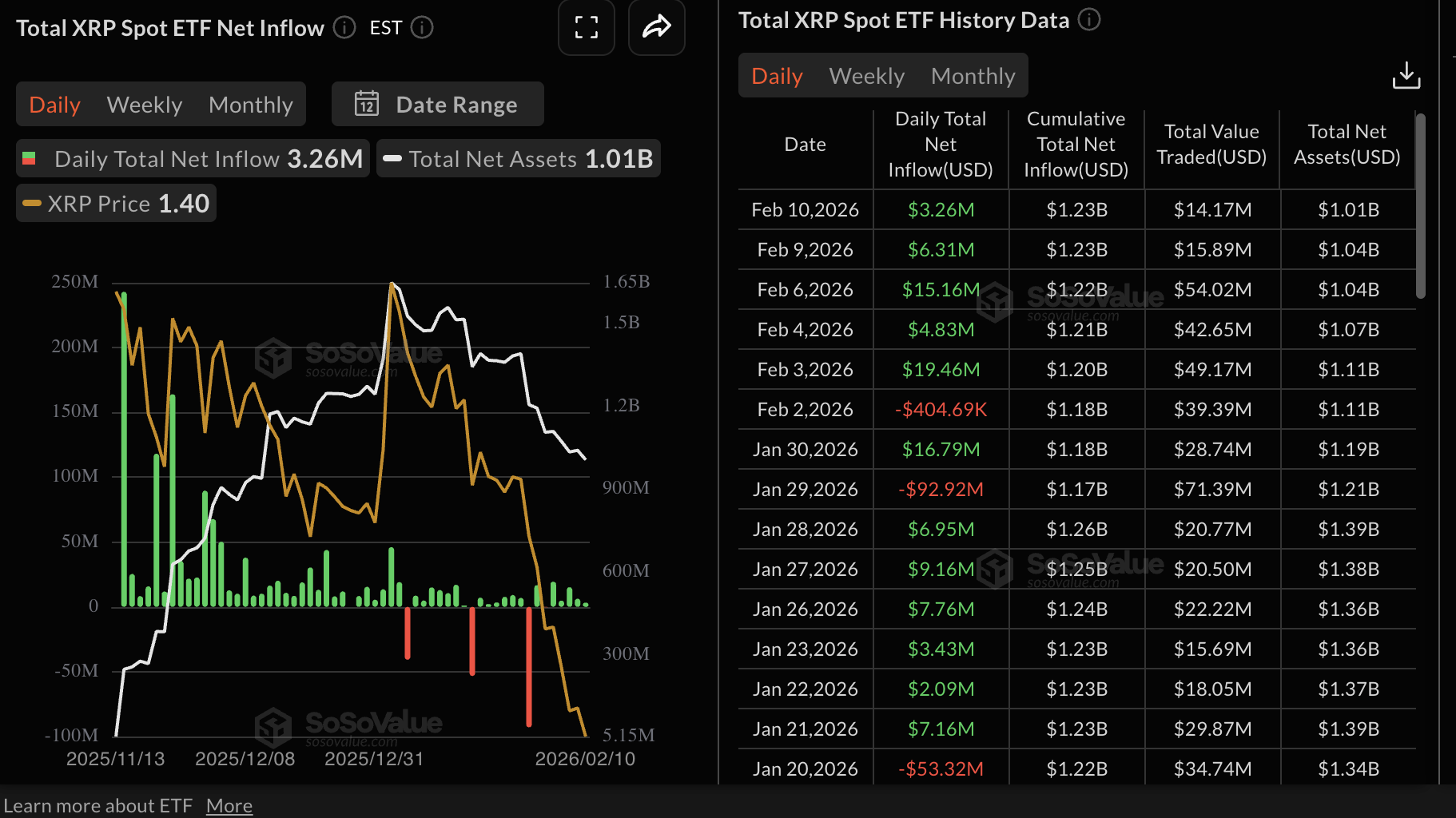

Meanwhile, institutional interest in XRP remains steady, albeit with mild inflows into XRP spot Exchange-Traded Funds (ETFs). For five consecutive days, US-listed XRP ETFs have recorded inflows, with $3.26 million deposited on Tuesday.

The cumulative inflow stands at $1.23 billion, and the net assets under management at $1.01 billion, according to SoSoValue. Steady inflows into ETFs suggest positive sentiment around the underlying asset.

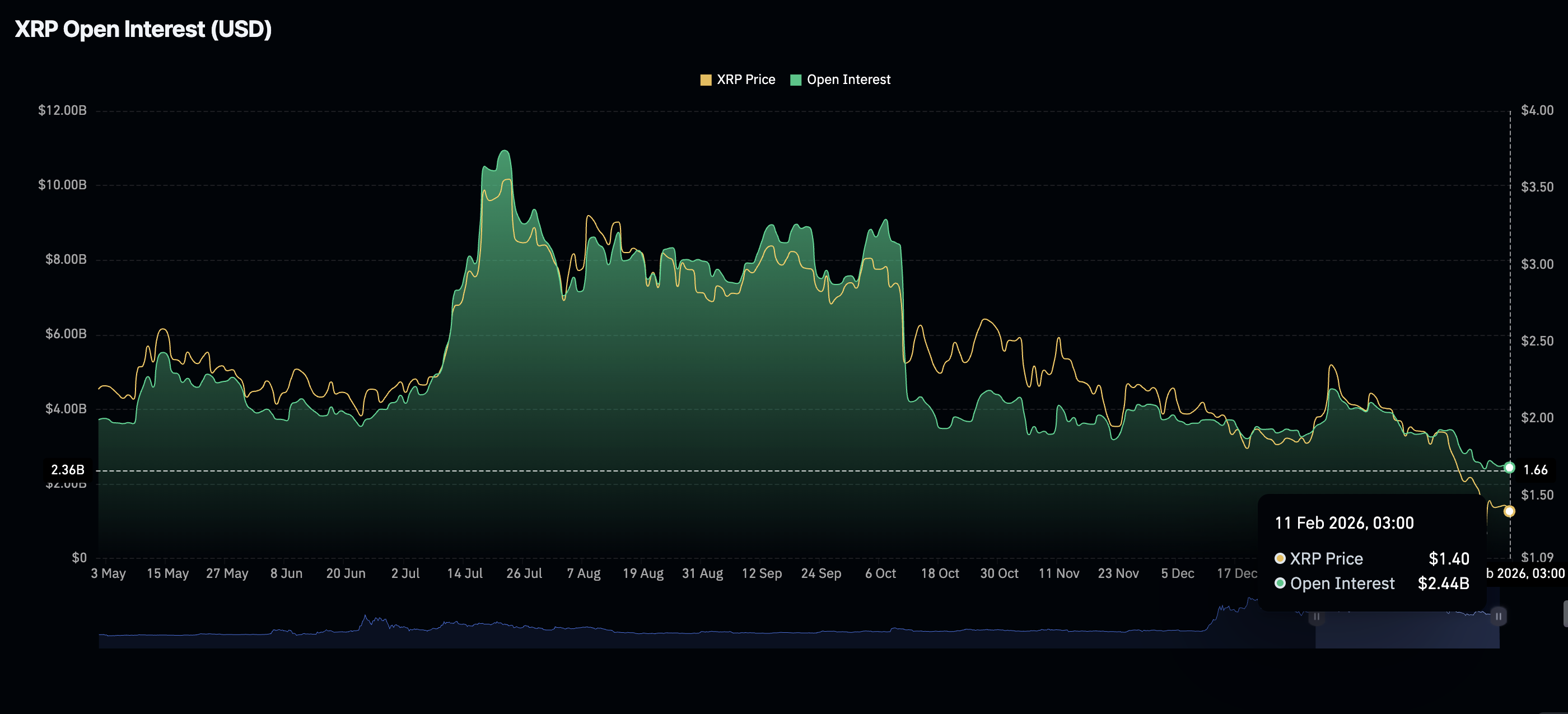

Despite stable institutional demand, retail interest in XRP is on the back foot, as futures Open Interest (OI) falls to $2.44 billion on Wednesday, slightly below $2.5 billon the previous day. OI has generally stayed in a downtrend since the record high of $10.94 billion in July, suggesting that investors lack confidence in XRP’s ability to recover and sustain an uptrend.

Technical outlook: XRP edges lower amid weak technicals

XRP is trading well below the 50-day Exponential Moving Average (EMA) at $1.80, the 100-day EMA at $1.99 and the 200-day EMA at $2.18. All three moving averages are sloping downward, indicating a bearish momentum bias.

The Relative Strength Index (RSI) at 32 is poised to enter oversold territory on the daily chart, proposing sellers have the upper hand. Meanwhile, the support-turned-resistance at $1.40 limits XRP’s upside, putting the demand zone at $1.25 in focus. Below this level, losses may escalate to retest Friday’s low at $1.12.

Conversely, a knee-jerk reversal would not be a pipe dream if the Moving Average Convergence Divergence (MACD) indicator lifts above the signal line on the same chart. The red histogram bars should continue their contract to usher in a bullish transition that may push XRP above Friday’s high at $1.54.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.