Worldcoin Price Forecast: WLD eyes breakout as whale buying and trading volume hit yearly highs

- Worldcoin price trades near $0.49 on Thursday, consolidating within a falling wedge pattern.

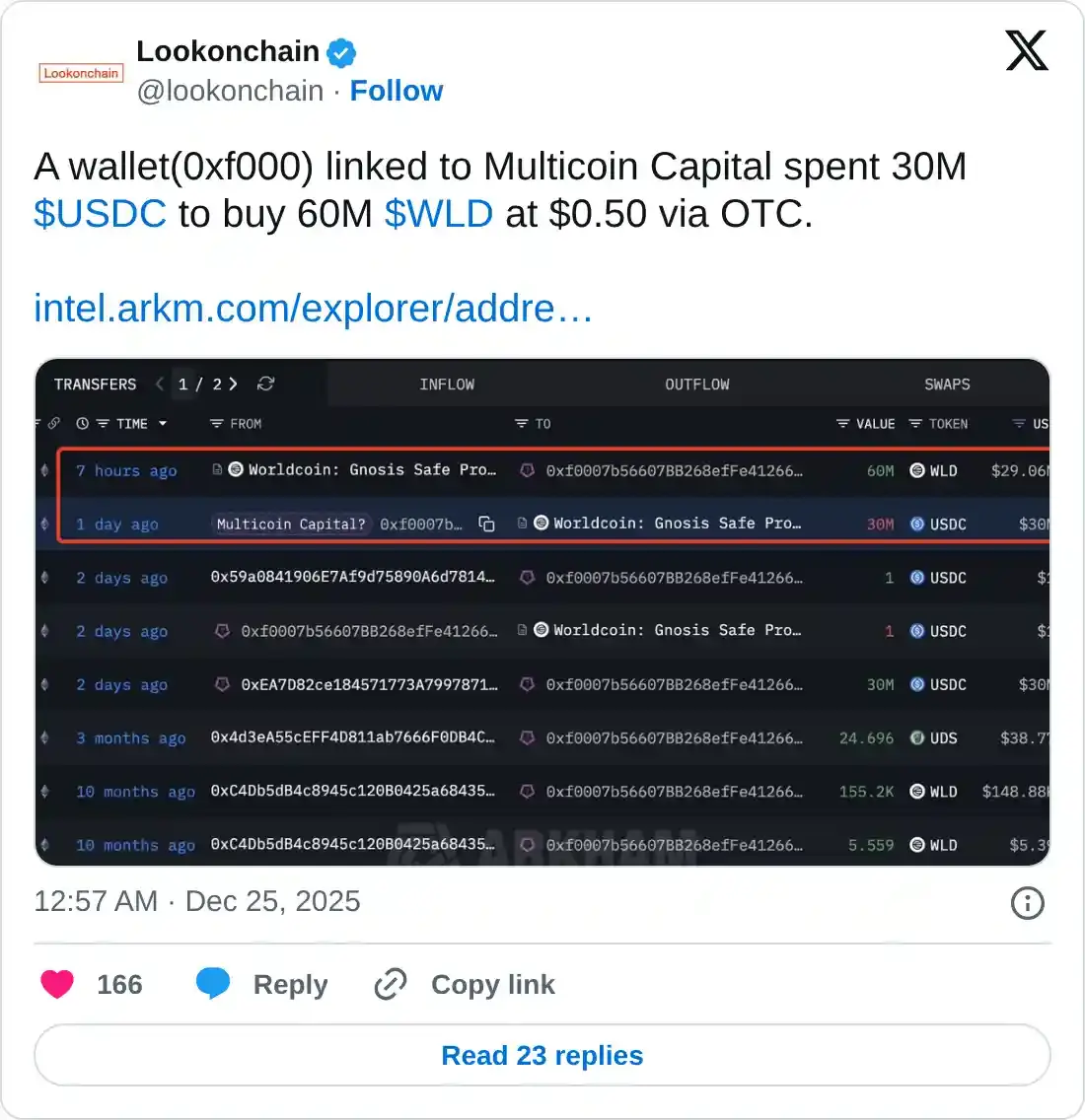

- Lookonchain data reports that a wallet linked to Multicoin Capital spent 30 million USDC on Thursday to buy 60 million WLD tokens.

- On-chain metrics indicate that whales are accumulating, and trading volume is at its highest level of the year, reinforcing upside potential.

Worldcoin (WLD) hovers around $0.49 at the time of writing on Thursday, consolidating within a falling wedge pattern. Lookonchain data shows that a wallet linked to Multicoin Capital bought 60 million WLD tokens on Thursday. Meanwhile, bullish momentum is building, as on-chain data show whale accumulation and rising trading volume, hinting at an upside move ahead.

Multicoin Capital link wallet buys 60 million WLD tokens

Lookonchain data on Thursday show that a wallet linked to Multicoin Capital, a thesis-driven investment firm, has spent 30 million USDC stablecoin to buy 60 million Worldcoin tokens at an average price of $0.50 through an over-the-counter (OTC), highlighting strong whale interest.

Worldcoin’s on-chain data shows bullish bias

Santiment data indicate that the WLD ecosystem’s trading volume (the aggregate trading volume generated by all exchange applications on the chain) reached $1.46 billion on Wednesday, the highest yearly level and trading volume not seen since July 2024. This volume rise indicates a surge in traders’ interest and liquidity in Worldcoin, boosting its bullish outlook.

[09-1766640732581-1766640732582.28.50, 25 Dec, 2025].png)

In addition, Santiment’s Supply Distribution data show that certain whales are buying WLD at recent price dips.

The metric indicates that whales holding between 10 million and 100 million WLD tokens (blue line) and 1 million and 10 million WLD tokens (yellow line) have accumulated a total of 150.59 million WLD tokens from Sunday to Thursday. This indicates that the whales seized the opportunity and accumulated Worldcoin at a discount.

[09-1766640758581-1766640758583.29.33, 25 Dec, 2025].png)

Worldcoin Price Forecast: WLD trades within the falling wedge pattern

Worldcoin price has been trading within a falling wedge (drawn by connecting multiple highs and lows with two trendlines) for over a month. At the time of writing on Thursday, WLD is trading higher at around $0.49.

If WLD breaks and closes above the falling wedge, it could extend the rally toward the daily resistance at $0.56. A successful close above this could extend additional gains toward the 50-day Exponential Moving Average (EMA) at $0.63.

The Relative Strength Index (RSI) on the daily chart is at 36, pointing upward toward its neutral level of 50, indicating fading bearish momentum. However, for the bullish momentum to be sustained, the RSI must move above the neutral level. Meanwhile, the MACD lines are converging, indicating indecision among traders.

On the other hand, if WLD faces a correction, it could extend the decline toward the December 18 low of $0.47.