Yuan at 14-Month High as Fed-BOJ-PBOC Split — Crypto Impact

China’s yuan climbed to a fresh 14-month high against the dollar on Monday, adding another layer of complexity to an already turbulent macro environment for risk assets, including cryptocurrencies.

The world’s three largest central banks are now moving in distinctly different directions. The Federal Reserve just delivered a hawkish rate cut, the Bank of Japan is poised to raise rates this week, and China’s PBOC is navigating yuan strength amid a slowing domestic economy. For crypto markets caught in the crosscurrents of global liquidity flows, the stakes have rarely been higher.

Yuan Surges on Dollar Weakness

The onshore yuan rose to 7.0498 per dollar as of 08:30 am UTC, its strongest level since October 2024. The currency extended gains throughout Monday’s Asian session, strengthening from 7.0508 in early trade.

The move came despite softer-than-expected guidance from the People’s Bank of China, which set its daily fixing at 7.0656 — weaker than market estimates — in an apparent bid to slow the currency’s appreciation.

Analysts attributed the yuan’s strength primarily to broad dollar weakness rather than domestic factors. Year-end seasonal demand also played a role, as Chinese exporters typically convert a larger share of foreign exchange receipts to meet various payment and administrative requirements.

The yuan is expected to hold near 7.05 through year-end but see limited room for further appreciation, as the PBOC is unlikely to tolerate sharp gains. At the same time, exports remain a key driver of economic growth.

BOJ Rate Hike Looms Large as US Fed’s Hawkish Cut Adds to Uncertainty

The yuan’s move comes just days before the Bank of Japan’s policy meeting on December 18-19, where officials are reportedly finalizing a 25-basis-point rate hike that would bring the policy rate to 0.75%.

The potential hike has reignited concerns about the unwinding of the yen carry trade. In early August, a similar dynamic triggered a sharp selloff across global markets, with Bitcoin plunging over 15% in a single day as leveraged positions were liquidated.

Market participants will be closely watching BOJ Governor Kazuo Ueda’s post-meeting comments. A dovish tone on future rate increases could help cushion any market impact.

Last week, the Federal Reserve delivered its third consecutive rate cut, lowering the federal funds rate to 3.50%-3.75%. However, the decision was notably hawkish, with the dot plot signaling just one additional cut in 2026.

Fed Chair Jerome Powell cited tariffs as a primary driver of inflation concerns, while three committee members dissented — the most since September 2019.

Crypto Market Implications

For cryptocurrency markets, the diverging central bank policies present a mixed picture. Dollar weakness typically supports Bitcoin and other digital assets as alternative stores of value. However, potential liquidity contraction from unwinding yen carry trades could offset these gains.

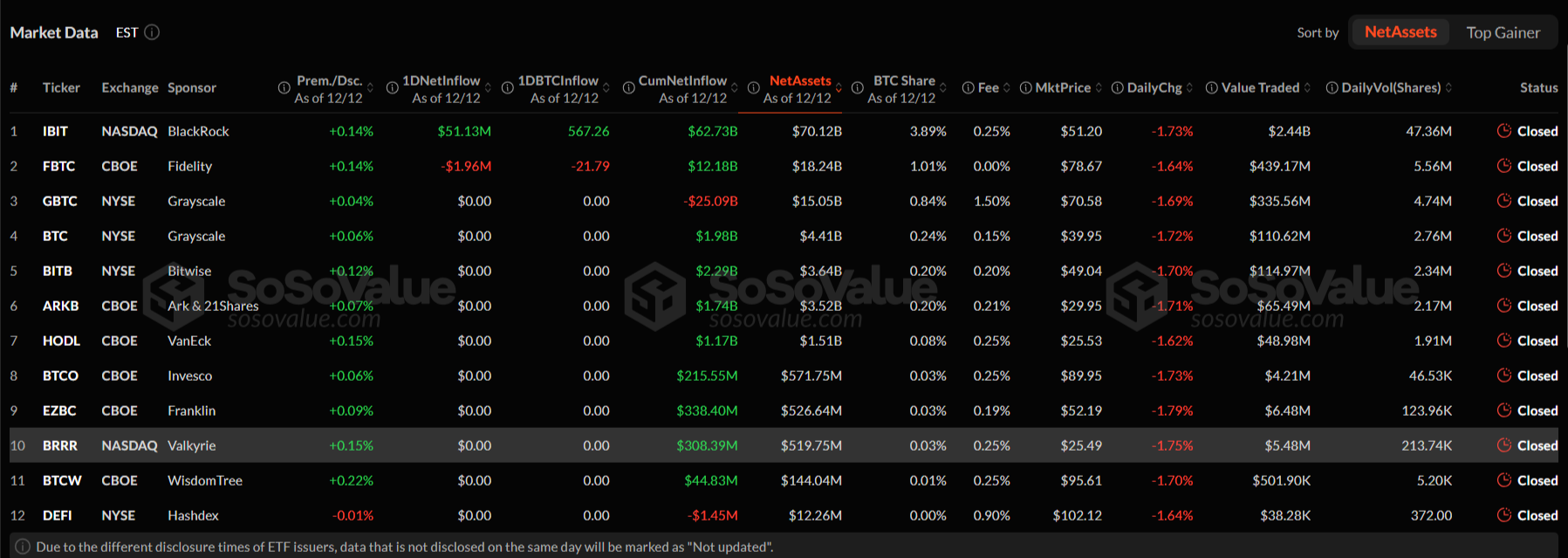

ETF Inflow/Outflow. Source: sosovalue

ETF Inflow/Outflow. Source: sosovalue

Recent ETF flow data suggests limited buying momentum. On December 12, spot Bitcoin ETFs recorded net inflows of just $49 million, with BlackRock’s IBIT accounting for essentially all purchases at $51 million. The remaining 11 ETFs saw either zero flows or slight outflows.

This marks a significant slowdown from November’s peak daily inflows of more than $500 million, raising questions about whether institutional demand can provide adequate support if macro-driven selling intensifies.

With the BOJ decision due mid-week and year-end liquidity conditions thinning, crypto traders should brace for elevated volatility in the sessions ahead.