Binance PoR Shows BTC Pile-Up, Rising Over-Reserves, and Bitcoin Rally Signals

Binance’s latest Proof of Reserves reveals a major shift in user positioning, where Bitcoin balances are climbing, while ETH and USDT fall.

At the same time, Binance’s stablecoin over-reserves hit six-month highs, strengthening liquidity during ongoing market volatility.

Bitcoin Accumulation Jumps as User Behavior Shifts

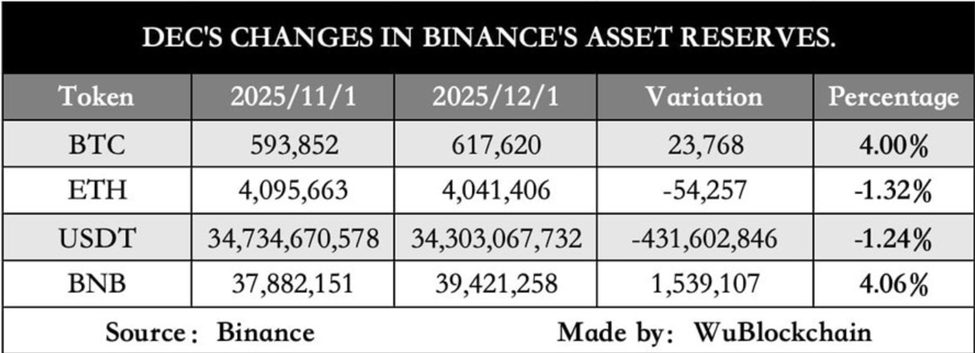

Binance users increased their Bitcoin balances by 4% month-over-month, reaching 617,620 BTC, according to the exchange’s 37th Proof of Reserves snapshot. That’s an addition of 23,768 BTC since November 1.

The exchange utilizes Merkle trees and zk-SNARKs to enable users to verify their balances without disclosing personal information. Current reserve ratios include:

- BTC: 102.11%

- ETH: 100%

- USDT: 109.16%

- USDC: 137.7%

- BNB: 112.32%

This system offers real-time transparency, unlike traditional audits, which are episodic and rely on third-party trust.

As of November 30, Binance reserves were hovering near $120 billion, with USDT (ERC-20) reaching a record $42.8 billion. Despite volatility, Binance remains the second-largest holder of global Bitcoin reserves.

General sentiment on X (Twitter) is that this trend is bullish for Bitcoin, with users stacking the pioneer crypto as ETH and stablecoin balances decline.

User Ethereum holdings dropped 1.32% to 4.04 million ETH (-54,257 ETH), while USDT balances slipped 1.24% to 34.3 billion USDT (-430 million USDT).

Binance Asset Reserves. Source: Wu Blockchain

Binance Asset Reserves. Source: Wu Blockchain

The pattern suggests rebalancing rather than a broad withdrawal, with users migrating into Bitcoin during periods of uncertainty.

Stablecoin Over-Reserves Hit Six-Month Highs

Analyst AB Kuai Dong highlighted a sharp rise in Binance’s stablecoin buffers:

- USDT over-reserve ratio: 109.16% (up from 101.52% in June)

- USDC over-reserve ratio: 137.7%

- Overall platform over-reserves: 12.32% above user funds

- BNB over-reserve ratio: 112.32%, highest among major assets

He added that rising over-reserves “enhance the platform’s risk resistance capabilities,” especially for stablecoins. The Binance exchange reiterated that all user assets remain backed 1:1.

The consistent build-up, from June to December, signals stronger liquidity management. It also aligns with regulatory expectations that reserves remain fully available for redemptions rather than internal trading.

Signals for Possible Future Moves?

CryptoQuant noted that Binance’s Bitcoin reserve ratio recently touched its lowest level since 2018. This condition has historically preceded powerful Bitcoin rallies due to reduced sell-side liquidity.

“History shows that hitting such lows often precedes powerful Bitcoin rallies, simply because the liquidity required to fuel a price surge is now fully available on the exchange,” wrote CryptoQuant analysts.

Yet, recent market data shows that Bitcoin is leaving exchanges globally, even as Binance balances rise. This suggests that Binance is gaining market share from competitors rather than reversing the broader trend toward self-custody.

The combination of rising Bitcoin accumulation, expanding stablecoin over-reserves, and historically low reserve ratios creates a mixed but potentially constructive setup.

If macro conditions stabilize, Binance’s strengthened liquidity and growing buffers position the exchange to support higher trading activity in a future rally phase.