Cardano Price Forecast: ADA risks decline to $0.30 as whales begin selling

- Cardano wallets holding 10M-100M tokens have distributed more than 370M ADA over the past week.

- Cardano's open interest offers a glimmer of hope, rising 30% to 1.64 billion ADA in the past seven days.

- ADA could find support at $0.30 if it falls below the $0.45-$0.42 key range.

Cardano (ADA) is down 2% on Thursday as whales accelerate distribution. Despite the selling activity and price decline, ADA's open interest has grown steadily over the past month.

Sustained weak prices force whales to begin distribution

Cardano whales flipped from accumulation to selling over the past week following sustained risk-off sentiments across the crypto market.

Wallets holding 10M-100M tokens reduced their collective holdings by 370M ADA in the past seven days. This cohort had been buying the dip since mid-October, only to exhaust their momentum last week.

[19-1763664289955-1763664289957.43.33, 20 Nov, 2025].png)

In particular, selling pressure accelerated on Wednesday, as indicated by a spike in the Age Consumed metric, which tracks the movement of older tokens.

The move also coincided with a $19 million jump in profit-taking. However, the majority of ADA's selling activity in November has been from investors realizing losses. ADA is down nearly 30% since the beginning of the month.

Cardano's derivatives offer glimmer of hope

On the derivatives side, Cardano's open interest in ADA terms increased by 30% to 1.64 billion ADA over the past week, continuing its recovery path, which began a month ago despite declining prices.

The Binance Long to Short Ratio indicates the rise could be tilted toward bullish positioning, as the number of top accounts and positions longing ADA outpaces shorts by 2.8 and 1.7, respectively. However, ADA's Funding Rates remain moderate at 0.0077%, with negative flashes over the past week.

ADA risks decline to $0.30 if it fails to hold a key support range

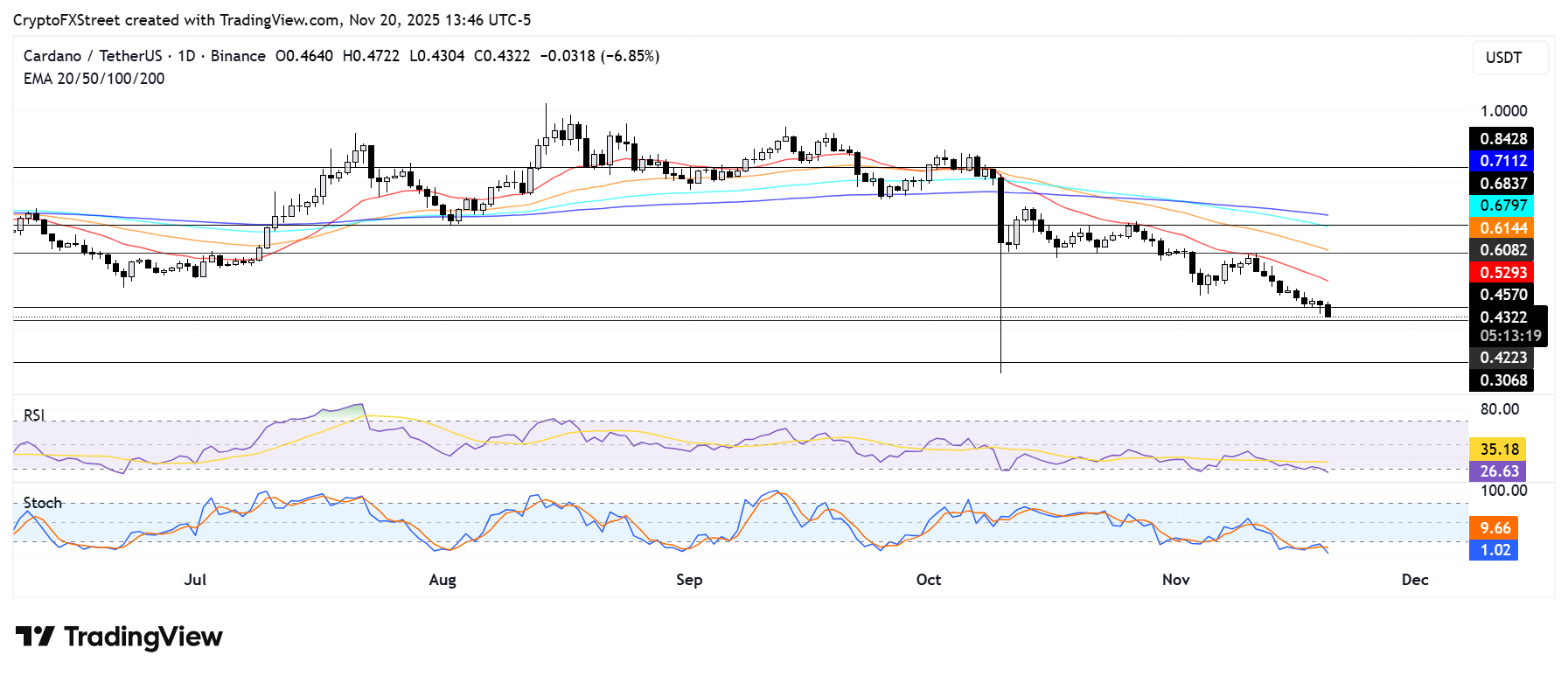

ADA has shaved 2% off its value, extending its weekly decline to 20% at the time of publication on Thursday.

The Layer 1 token is testing the key support range between $0.45-$0.42. A failure to hold $0.42 could see ADA find support around the $0.30 psychological level.

On the upside, ADA has to recover $0.45 and clear the 20-day Exponential Moving Average (EMA) resistance to retest the $0.60 psychological level.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are in oversold territory, indicating a strong bearish momentum. However, oversold conditions in the RSI and Stoch could spark a short-term reversal.