GBP/USD sinks nearly 100 pips as UK jobless rate hits decade high

- GBP/USD drops 0.71% as UK unemployment climbs to 5.2%, highest in a decade.

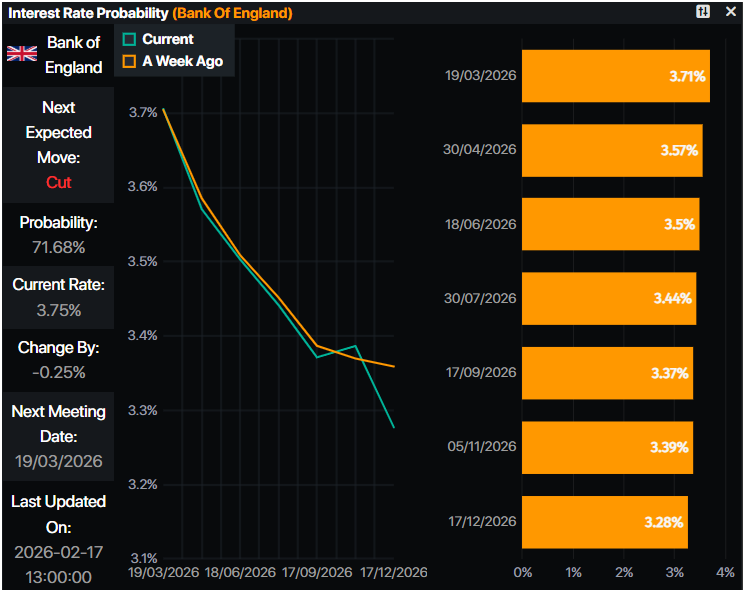

- Cooling wage growth boosts expectations of a March cut by the Bank of England.

- Rate differential favors Dollar strength as markets price nearly 50 bps of UK easing this year.

The Pound Sterling dives during the North American session as traders got back to their desks following the US President’s Day holiday. A weaker than expected UK jobs report, weighed on GBP/USD which is down 0.71% or nearly 100 pips at 1.3529.

Sterling tumbles after weak UK labor data fuels bets on a March rate cut by the Bank of England

The Office for National Statistics (ONS) revealed that the ILO Unemployment Rate in the three months to December rose to its highest level in a decade —excluding the pandemic, hitting 5.2% up from 5.1% in November and estimates. Also, Average Earnings Excluding Bonus for the same period in December dipped from 4.4% to 4.2%, showing signs of cooling, which fueled speculation that the Bank of England would cut rates at the March 19 meeting.

Data from Prime Market Terminal shows odds for a BoE 25 bps rate cut at 71%. Meanwhile, for the full year, money markets had priced in 49 bps of easing.

Ahead in the week, traders are eyeing the release of inflation data on Wednesday for the UK, with the CPI expected to dip from 3.4% in December to 3%.

Data in the US remains scarce, yet the New York Empire State Manufacturing Index in January increased to 7.10 exceeding estimates of 7 but below December’s 7.70 print.

Richard Deitz, Economic Research Advisor at the New York Fed, wrote “After a small dip in December, manufacturing activity increased modestly in New York State in January. Selling prices rose at the slowest pace in nearly a year. Firms remained fairly optimistic that conditions would improve.”

Regarding labor market data, the ADP Employment Change 4-week average rose from 7.8K to 10.3K.

Fed officials remain hawkish

The Chicago Fed President Austan Goolsbee said that inflation was pulled down by base effects and that further easing lies ahead, if inflation heads down. He sees the neutral rate at 3% and wants to see evidence that prices are headed back to 2%.

Given the fundamental backdrop updated on Tuesday and the interest rates differential to favor the US if the BoE cut rates in March, favors further GBP/USD downside.

Ahead in the US, traders are eyeing housing data, speeches by Fed policymakers, GDP figures and the release of the Fed’s preferred inflation gauge, the core PCE.

GBP/USD Price Forecast: Technical outlook

In the daily chart, GBP/USD trades at 1.3502. The simple moving averages slope higher, reinforcing a medium-term bullish bias. Price sits just beneath the nearest average at 1.3522, which caps immediate rebounds. A daily close above that barrier would improve upside traction and revive the advance.

The rising trend line from 1.3035 underpins the broader structure, with support aligning near 1.3511. A clear break below the line would signal a loss of momentum and could shift the tone toward consolidation, while holding above it keeps the path of least resistance pointed higher.

(The technical analysis of this story was written with the help of an AI tool.)

Pound Sterling Price This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.56% | 1.10% | 0.77% | 0.59% | 0.57% | 0.39% | 0.67% | |

| EUR | -0.56% | 0.52% | 0.24% | 0.03% | -0.01% | -0.17% | 0.11% | |

| GBP | -1.10% | -0.52% | -0.56% | -0.50% | -0.53% | -0.70% | -0.42% | |

| JPY | -0.77% | -0.24% | 0.56% | -0.20% | -0.21% | -0.40% | -0.07% | |

| CAD | -0.59% | -0.03% | 0.50% | 0.20% | -0.07% | -0.21% | 0.08% | |

| AUD | -0.57% | 0.00% | 0.53% | 0.21% | 0.07% | -0.17% | 0.11% | |

| NZD | -0.39% | 0.17% | 0.70% | 0.40% | 0.21% | 0.17% | 0.29% | |

| CHF | -0.67% | -0.11% | 0.42% | 0.07% | -0.08% | -0.11% | -0.29% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).