USD/JPY tumbles toward 145.50 as Fed cut and dovish guidance sink Dollar

- USD/JPY drops sharply within 147.00–145.50 range after Fed decision fuels risk-off flows against the Dollar.

- Fed statement highlights rising labor market risks, elevated inflation, and slowing growth in first half of 2025.

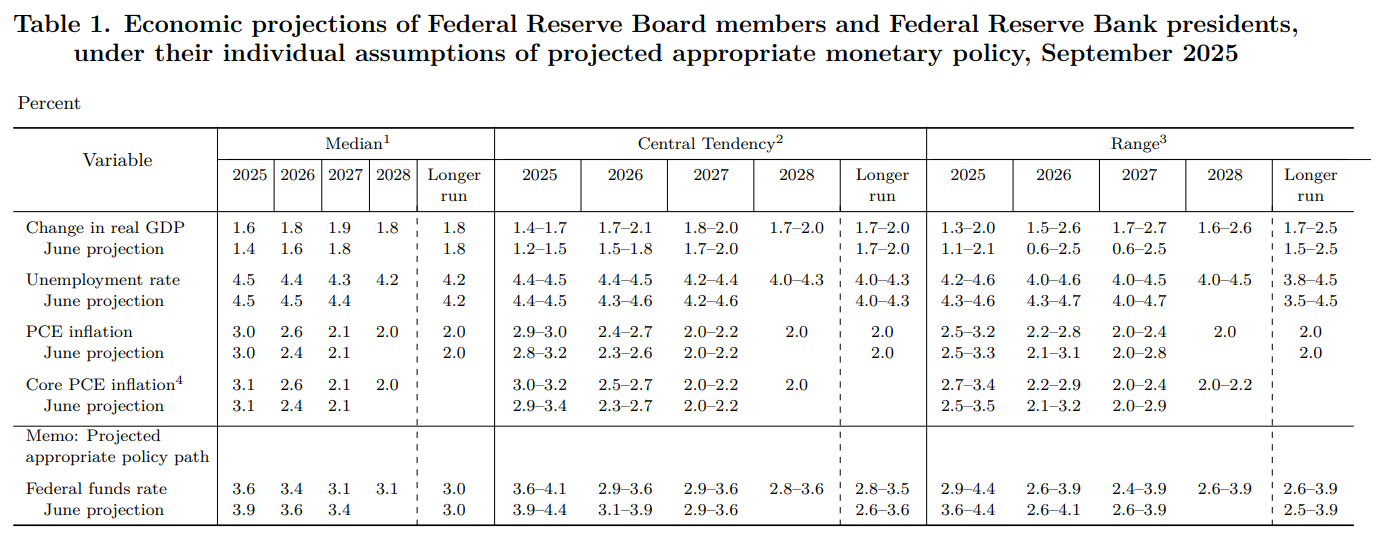

- SEP projections point to another 50 bps cuts this year; dissent from Miran favored larger 50 bps move immediately.

USD/JPY plunges after the Federal Reserve decided to cut rates by 25 basis points, while providing a dovish forward guidance, paving the way for further easing. At the time of writing, the pair trades volatile within the 146.70-145.50 range.

US Dollar tumbles vs. Yen as Fed delivers 25 bps cut, signals 50 bps more easing by year-end.

The Federal Reserve highlighted rising downside risks to employment, noting that while joblessness remains relatively low, it has inched higher. The rate decision was split, with Governor Stephen Miran dissenting in favor of a 50-basis-point cut, matching some market expectations.

Policymakers acknowledged that inflation has “moved up” and remains “somewhat elevated,” while economic growth slowed during the first half of 2025. The Summary of Economic Projections (SEP) pointed to another 50 bps of easing by year-end.

Japanese Yen Price Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.23% | -0.36% | -0.51% | 0.02% | -0.15% | -0.18% | -0.25% | |

| EUR | 0.23% | -0.14% | -0.26% | 0.27% | 0.21% | 0.18% | -0.02% | |

| GBP | 0.36% | 0.14% | -0.12% | 0.42% | 0.19% | 0.18% | 0.04% | |

| JPY | 0.51% | 0.26% | 0.12% | 0.50% | 0.43% | 0.32% | 0.10% | |

| CAD | -0.02% | -0.27% | -0.42% | -0.50% | -0.10% | -0.14% | -0.30% | |

| AUD | 0.15% | -0.21% | -0.19% | -0.43% | 0.10% | -0.02% | -0.23% | |

| NZD | 0.18% | -0.18% | -0.18% | -0.32% | 0.14% | 0.02% | -0.18% | |

| CHF | 0.25% | 0.02% | -0.04% | -0.10% | 0.30% | 0.23% | 0.18% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.