XRP Price Forecast: Open Interest skyrockets as Volatility Shares to launch XRP futures ETF on NASDAQ

- XRP's uptrend gains steam, supported by a major comeback in Open Interest to $4.96 billion.

- Volatility Shares will debut XRP futures ETF on NASDAQ, allocating 80% of net assets to XRP instruments.

- XRP upholds a higher low pattern with the RSI at 56, signaling room for more growth before reaching overbought conditions.

Ripple's (XRP) price accelerates the uptrend to around $2.43 at the time of writing on Thursday, propelled by improving sentiment in the broader crypto market after Bitcoin (BTC) rapidly rallied to new all-time highs at approximately $111,880.

The impressive rally in Bitcoin's price, which has also triggered subsequent increases in altcoins like XRP and meme coins, comes amid concerns about the sustainability of United States (US) debt, as discussed in the top gainers analysis.

Volatility Shares set to launch XRP futures ETF on NASDAQ

As XRP's price edges higher, Volatility Shares, a registered investment advisor, is preparing to launch the first-ever XRP futures Exchange-Traded Fund (ETF) on the Nasdaq stock market on Thursday.

According to a post-effective amendment filed with the Securities & Exchange Commission (SEC), the fund, part of the Volatility Shares Trust, will trade under the ticker XRPI.

Volatility Shares outlined in a press release on Wednesday that it will allocate at least 80% of its net assets to XRP-linked instruments, offering investors unlevelled exposure to XRP futures through a Cayman Islands-based subsidiary.

Moreover, the company announced plans to launch a 2x XRP futures ETF that pledges twice the daily appreciation of XRP via double the leveraged exposure to XRP futures contracts.

This development follows Teucrium Investment Advisors' launch of a leveraged XRP ETF in April, signaling swelling institutional interest in XRP-related financial products.

XRP's market dynamics have improved in the last few months with the Chicago Mercantile Exchange (CME) recently introducing regulated XRP futures contracts.

The longstanding lawsuit is also nearing its end after Ripple and the SEC agreed on a $50 million settlement, subsequently filing a joint motion to drop the appeals. Despite the Court denying the motion, Ripple and the Commission are committed to working together to meet the requirements for an indicative ruling.

XRP reignites bullish momentum as Open Interest surges

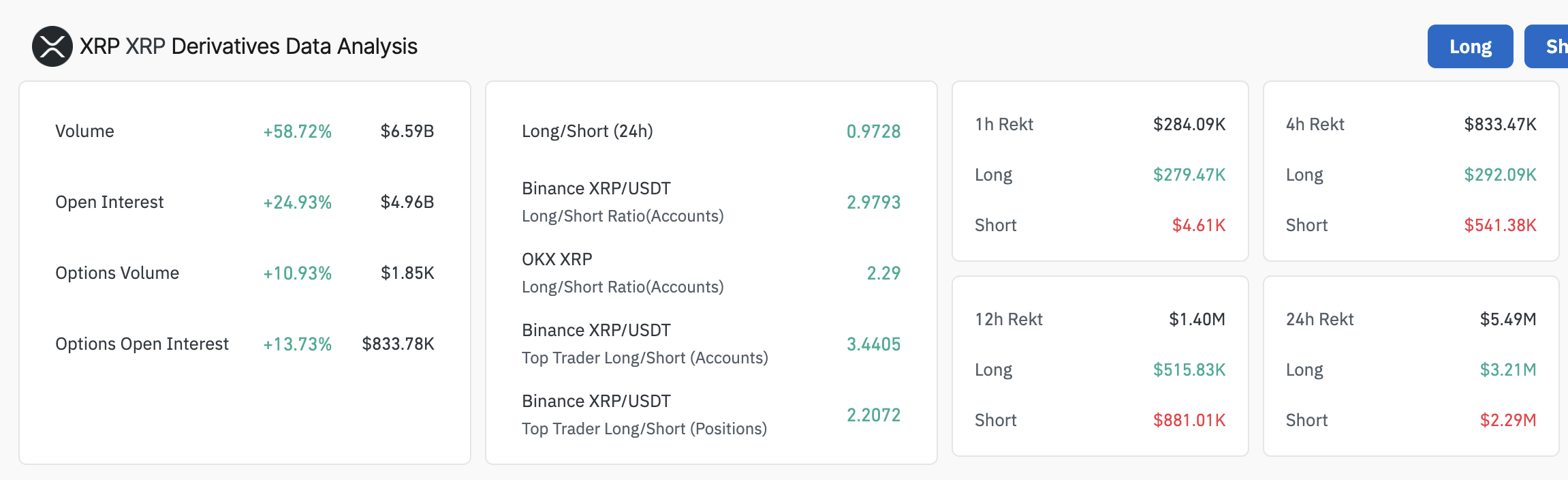

XRP's uptrend is gaining traction with Open Interest (OI) surging nearly 25% to $4.96 billion. This increase signals a robust comeback in market participation combined with the trading volume rising approximately 59% to $6.59 billion over the past 24 hours.

XRP derivatives data | Source: CoinGlass

The colossal influx of capital alongside heightened trader interest supports a potential push toward $3.00. The daily chart below highlights this potential with XRP sitting above key moving averages, ranging from the 50-day Exponential Moving Average (EMA) at $2.29, the 100-day EMA at $2.26, and the 200-day EMA at $2.05.

A trendline (dotted) drawn from the tariff-triggered crash at $1.61 affirms the uptrend's strength, forming a higher low pattern.

XRP/USDT daily chart

With the Relative Strength Index (RSI) at 56 and climbing toward the overbought region above 70, XRP is building strength for its $3.00 mid-term target. Since it's not overbought yet, bulls have room to push higher before profit-taking changes dynamics, potentially triggering a reversal.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.