Bitcoin Price Forecast: BTC retreats as focus turns to Ukraine-Russia peace talks

- Bitcoin price stabilizes near $103,500 on Wednesday after repeated rejections at the $105,000 resistance over the past four days.

- Ukraine-Russia negotiations in Istanbul this week could act as a bullish catalyst for risk assets, including BTC, if talks bear fruit.

- Market structure remains constructive, with BTC funding rates turning mildly positive, echoing healthy risk sentiment as seen in past bull phases like October 2023–2024.

Bitcoin (BTC) is stabilizing near $103,500 at the time of writing on Wednesday, following multiple failed attempts to break above the $105,000 resistance level. Ukraine-Russia negotiations in Istanbul starting on Thursday could act as a bullish catalyst for risk assets, including BTC, if talks bear fruit. Meanwhile, BTC’s market structure stays healthy, with funding rates turning mildly positive, mirroring the constructive conditions seen during previous bull runs like October 2023–2024.

Ukraine-Russia high-level talks could boost risky assets

The Washington Post report on Wednesday highlights that Russia and Ukraine are set to hold their first high-level, face-to-face negotiations since 2022, taking place this Thursday in Istanbul.

President of Russia Vladimir Putin proposed the talks, partly in response to increasing Western pressure for a 30-day ceasefire as a step toward lasting peace. US Secretary of State Marco Rubio and envoys Steve Witkoff and Keith Kellogg are expected to attend, marking renewed diplomatic engagement. Ukrainian President Volodymyr Zelensky accepted the offer at face value and pushed to elevate the talks to a presidential level, challenging Putin to meet directly.

While a direct meeting between the two leaders remains uncertain, the outcome of Thursday’s negotiations could prove pivotal. If the talks yield meaningful progress toward ending the Russia-Ukraine war, it could restore investor confidence, trigger a risk-on sentiment across markets, and potentially drive up prices of risk assets like Bitcoin.

Bitcoin recovers on US–Saudi trade deal, softer US CPI

Bitcoin price recovered slightly on Tuesday and closed above $104,000. This recovery was fueled by Washington signing a $600 billion trade pact with Saudi Arabia, prompting a rollback in tariffs and sparking a fresh wave of risk-on sentiment, according to QCP Capital’s report.

Additionally, the US Consumer Price Index (CPI) data came in below expectations, reinforcing rate-cut bets by the US Federal Reserve (Fed). However, the Fed still appears to be concerned about the lingering effects of tariffs on inflation and employment.

“The first cut is currently priced in for July, but in our view, September is more realistic given the Fed’s desire for further clarity. Market pricing has also adjusted accordingly, with two rate cuts now expected for 2025, down from four just a month prior,” say QCP analysts.

Bitcoin rally looks healthy

Despite the consolidation seen this week, a K33 Research report suggests that the current rally in Bitcoin looks healthy and suggests constructive conditions for a continuation.

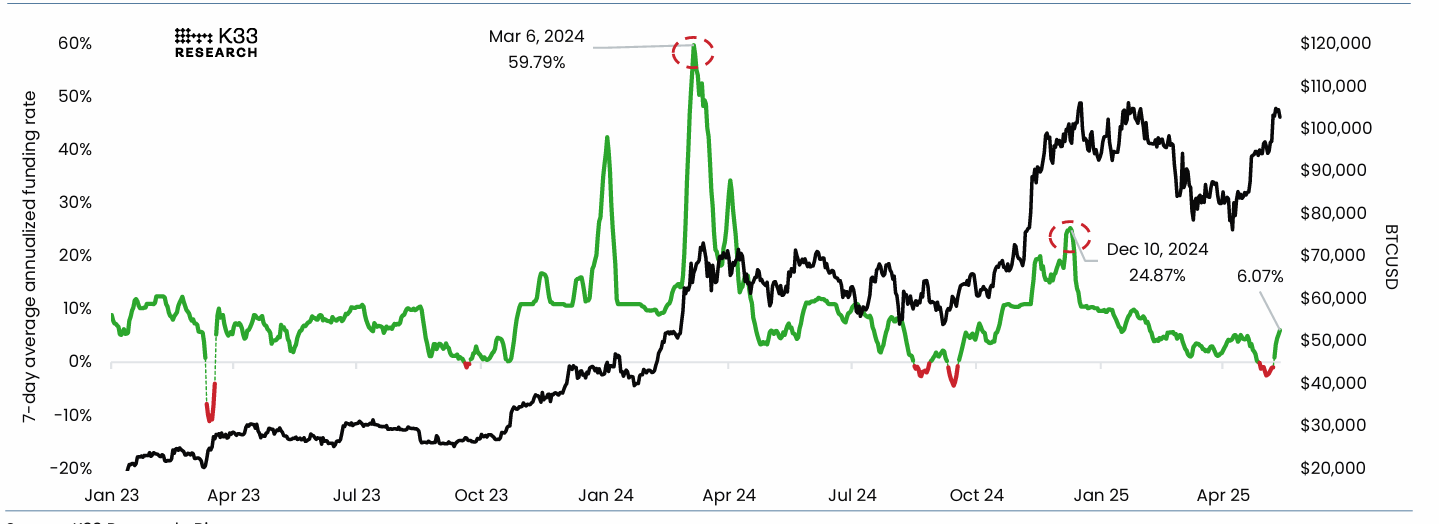

The report explains that Binance – BTCUSDT Perpetual 7-day avg annualized funding rates recently moved from negative to slightly above positive. This move resembles and echoes healthy risk sentiment as seen in past bull phases like October 2023–2024.

Binance: BTCUSDT Perpetual 7-day avg annualized funding rates chart. Source: K33 Research

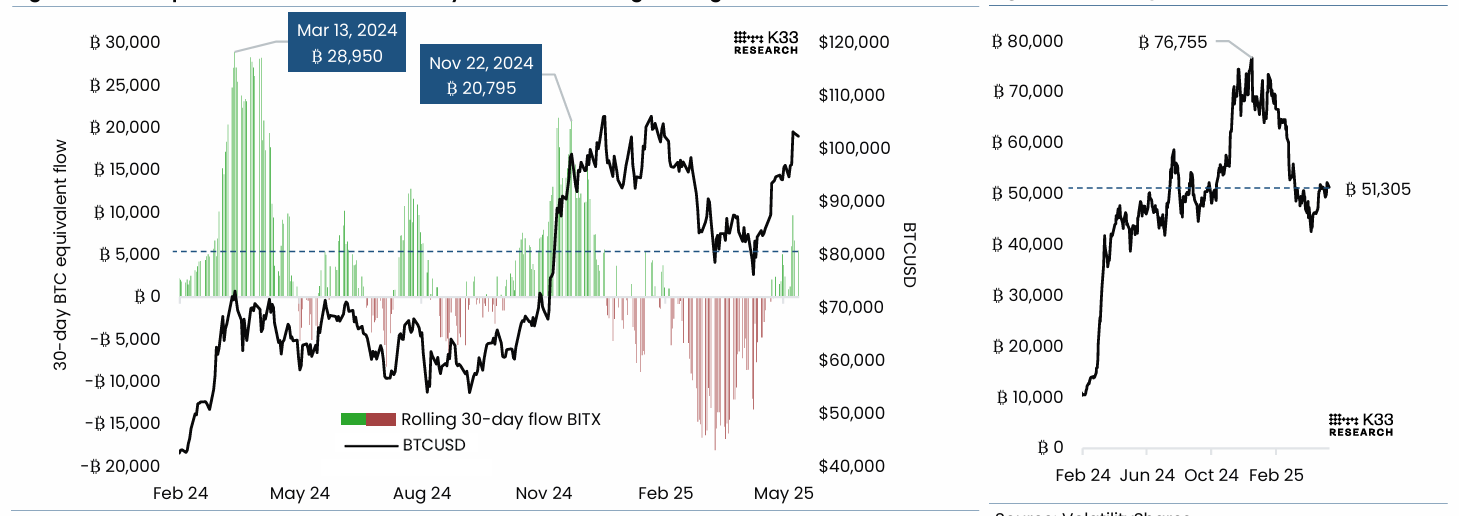

Additionally, the analysts see dampened froth in 2x leveraged long BTC ETFs compared to past market rallies, reflecting another constructive observation for BTC ahead.

Further evidence of defensive and risk-averse traders is shown in the graph below. The 2x leveraged long BTC ETF BITX currently holds BTC equivalent exposure of 51,305 BTC (down by 25,450 BTC) from its December 17 peak of 76,755 BTC. Contrary to the 2024 rallies of March and November, inflows to this instrument have yet to accelerate, indicative of traders remaining relatively risk-averse.

“We remain bullish as these signals highlight a healthy rally. All in all, these are constructive observations for a lasting momentum, potentially setting the stage for new all-time highs,” says K33’s report.

BTC Equivalent 30d Flow - VolatilityShares 2x Leveraged Long BTC ETF (Left) chart. BTC Exposure, BITX (Right) chart. Source: K33 Research

Bitcoin Price Forecast: BTC’s key resistance at $105,000 may decide the next move

Bitcoin faced resistance at around $105,000 on Sunday, declining by 2% until the next day. BTC recovered slightly on Tuesday and the time of writing on Wednesday it trades slightly down to around $103,600.

If BTC continues its pullback, it could extend the decline to retest the psychological support level at $100,000.

The Relative Strength Index (RSI) on the daily chart reads 69, slipping below its overbought level of 70 and pointing downwards, indicating a weakening bullish momentum. If the RSI continues to decline and moves below the neutral level of 50, it would clearly give a sell signal that could lead to a sharp fall in prices.

BTC/USDT daily chart

However, if BTC recovers and closes above the $105,000 resistance level, it could open the door for a rally toward the all-time high of $109,588 set on January 20.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.