Pi Network Price Forecast: Confident whale commits aggressively amid correction

- An extremely confident whale has been acquiring large quantities of PI tokens for the last two months.

- Pi Network price forms a short-term consolidation range after sharp movements last month.

- The technical outlook shares mixed signals as momentum fades within the consolidation range.

Pi Network (PI) extends consolidation around $0.6500 at the time of writing on Monday after falling over 17% the previous week, while an optimistic whale shrugs off the sharp moves to expand its PI coin holding. However, the technical outlook shares potential downside risk as the altcoin remains at a crossroads.

Whale acquires 276 million PI coins in two months

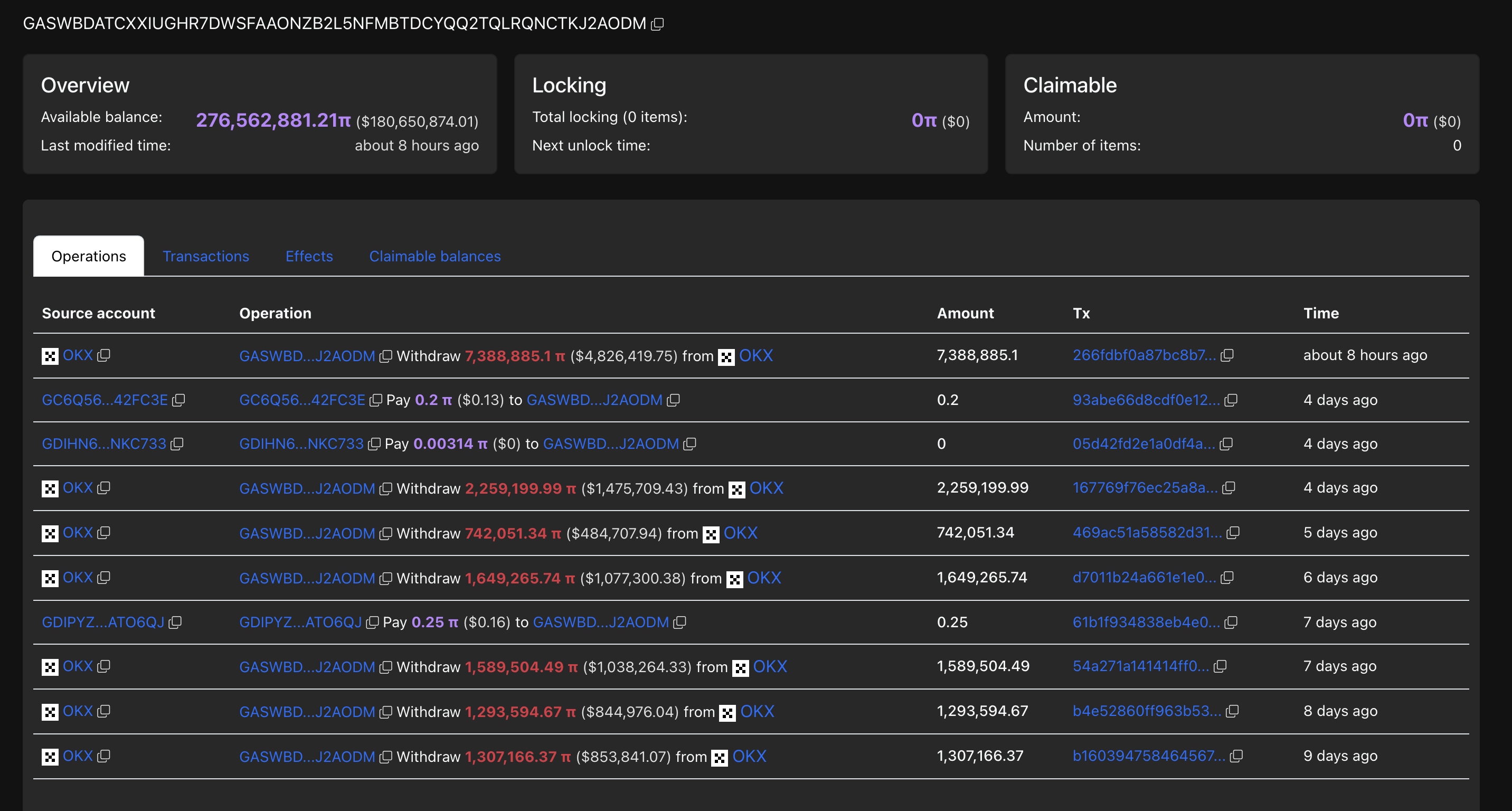

According to Pi Scan, a whale with blinders on has been constantly acquiring PI tokens for the last two months. The whale’s holdings have reached 276 million PI coins worth nearly $180 million.

Whale account. Source: PIScan.io

Over the last seven days, multiple withdrawals from the OKX exchange have recorded an inflow of 13.62 million tokens. The most recent withdrawal of 7.38 million coins from OKX happened over 8 hours ago.

Pi Network lacks momentum for a range breakout

Pi Network’s sharp correction last week prolonged the fall from May’s high at $1.6700. The downswing accounts for 60% in just over three weeks and breaks under the $0.6500 support level.

Pi Network price marked its weekly low at $0.6106 on Saturday before taking a swing at the $0.6600 resistance level. At the time of writing, PI is trapped within a sideways range between $0.6285 and $0.6586, and trades at $0.6515.

The momentum indicators imply a mild surge in momentum, as the short-term recovery from $0.6106 has led to consolidation. The Relative Strength Index (RSI), which reads 47 on the 4-hour timeframe, suggests that the bearish momentum is gradually fading. Investors must remain prudent as RSI flattens out below the halfway line, alerting to a potential reversal.

The Moving Average Convergence/Divergence (MACD) indicator and its signal line rise towards the center line, signaling a gradual bullish shift in the underlying trend. However, similar to RSI, reversal risk looms as the positive histogram bars decline in intensity, often a precursor to bearish crossover.

The declining 4-hour, 50-period, 100-period, and 200-period Exponential Moving Averages (EMAs) have achieved bearish alignment with negative crossovers last week. A potential range breakout could face dynamic resistance at the 50-period EMA at $0.6779 before testing the $0.7137 resistance level, aligning with the 100-period EMA.

PI/USDT 4-hour price chart. Source: Tradingview

Conversely, a loss in momentum pushing a closing price below $0.6285, the range’s lower boundary, could risk a $0.6106 breakdown. In such a case, sideline traders could witness Pi Network price declining to the $0.5788 support floor.