Bitcoin Price Forecast: Amazon shareholders advocate for BTC adoption amid Microsoft’s investment vote

Bitcoin price today: $98,500

- Bitcoin price edges down, trading below $98,500 on Monday, after increasing 4% the previous week.

- According to an NCPPR report, Amazon shareholders are urging the company to consider investing in Bitcoin as a reserve asset to beat inflation and boost shareholder value.

- In an exclusive interview, Auros Managing Director Le Shi said Bitcoin is “relatively early” in the bullish cycle.

Bitcoin (BTC) edges down 2.5%, trading below $98,500 on Monday, after rallying 4% and reaching a new all-time high (ATH) of $104,088 last week. As BTC reached its $100K milestone, big corporates showed interest in the largest digital asset by market capitalization.

The National Center for Public Policy Research (NCPPR) shared over the weekend an Amazon (AMZN) shareholders’ proposal urging the company to consider investing in Bitcoin as a reserve asset to beat inflation and boost shareholder value. This comes after the NCPPR submitted a similar report from Microsoft (MSFT) shareholders last month that also called for the tech firm to invest in Bitcoin.

Bitcoin sees corporate interest from Amazon, Microsoft

Bitcoin price declines on Monday after hitting a significant milestone of $100K and reaching a new ATH of $104,088 on Thursday.

“For those who have been in the industry for some time, this feat seemed unimaginable in the early days,” analysts at the New York Digital Investment Group (NYDIG) said in a weekly report.

“Only two years ago, the entire industry was ailing in the wake of the collapse of foundational institutions, such as Genesis, FTX, BlockFi, Celsius, Three Arrows, and Voyager, as well as the LUNA/UST digital asset. Bitcoin had fallen to under $15.5K at its lowest point, well below the previous cycle’s high, something it had never done before,” they said.

The recent surge has caught the attention of big corporations like Microsoft and Amazon into Bitcoin. Last week, Michael Saylor, co-founder of MicroStrategy, presented to Microsoft’s board why the tech giant should buy Bitcoin.

Microsoft’s shareholders are scheduled to vote on a proposal to add BTC to its balance sheet on December 10, according to a report from QCP Capital. “If the proposal passes, it would be bullish not only for BTC but also for their other investments,” the report notes. Still, Microsoft’s board members are against the proposal.

Another big name has joined the move. According to a National Center for Public Policy Research (NCPPR) report, Amazon shareholders are urging the company to consider investing in Bitcoin as a reserve asset to beat inflation and boost shareholder value.

The report further explains how MicroStrategy (MSTR), which holds Bitcoin on its balance sheet, outperformed Amazon stock by 537% in the previous year.

“Though Bitcoin is currently a volatile asset – as Amazon stock has been at times throughout its history – corporations have a responsibility to maximize shareholder value over the long and short term. Diversifying the balance sheet by including some Bitcoin solves this problem without taking on too much volatility. At a minimum, Amazon should evaluate the benefits of holding some, even just 5%, of its assets in Bitcoin.” the report said.

Institutional demand for Bitcoin remains strong

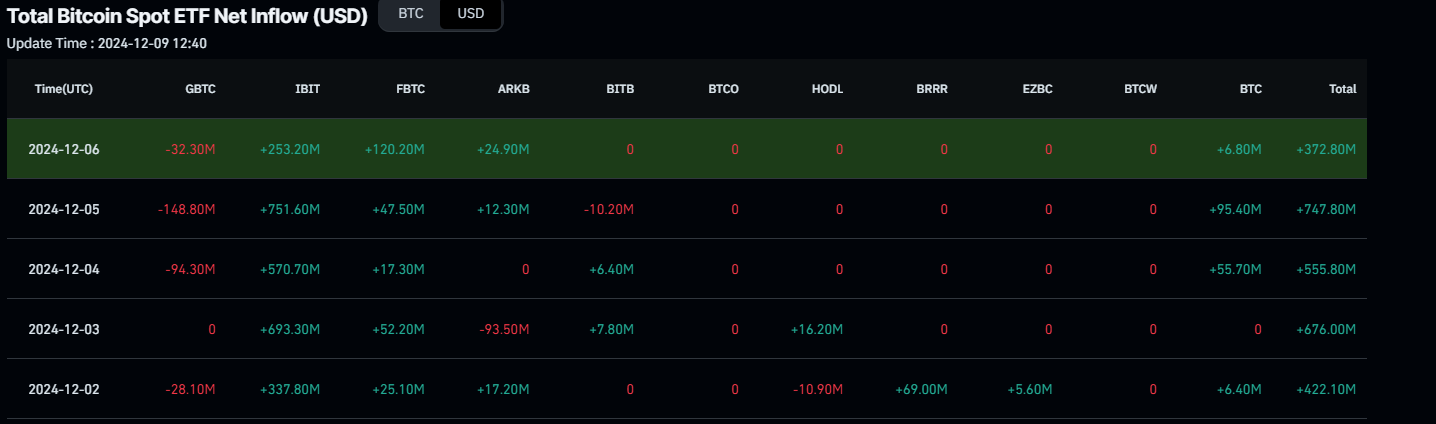

Looking at Bitcoin’s institutional flows, demand rose last week. According to Coinglass Bitcoin Spot Exchange Traded Funds (ETF) data, there was a total net inflow of $2.77 billion last week, compared to a $136.5 million outflow the previous week.

Total Bitcoin Spot ETF Net Inflow chart. Source: Coinglass

In an exclusive interview with FXStreet, market-making firm Auros Managing Director Le Shi said that, based on past trends, Bitcoin is “still relatively early on” in the bullish cycle when compared to other years in which there has been a halving event.

“I can’t predict that timing, but there are plenty of reasons to be very bullish for the remainder of this year – the three weeks remaining – as well as going into 2025,” he said.

Bitcoin Price Forecast: Price action suggests downturn ahead

Bitcoin price has retreated to around $98,500 on Monday after reaching a new all-time high (ATH) of $104,088 last Thursday.

Bitcoin’s Relative Strength Index (RSI) flashes warning signs. The higher high formed on Thursday does not reflect the RSI chart for the same period, indicating a formation of a bearish divergence, which often leads to a short-term correction.

If this bearish divergence unfolds, traders could expect a small rise towards the recent high of $104,088 (grabbing liquidity or trapping longs), to then fall sharply towards the $90,000 support level. A close below this level could extend an additional decline towards the next support level of $85,000.

BTC/USDT daily chart

On the other hand, if BTC continues its uptrend and closes above $104,088, it could extend the rally toward a new all-time high of $119,510. This level aligns with the 141.4% Fibonacci extension line drawn from the November 4 low of $66,835 to Thursday’s all-time high of $104,088.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.