Gold slips as strong US data supports Fed hold

- Gold trims early losses as US Jobless Claims and retail sales dent rate cut hopes.

- US data beats estimates, reinforcing Fed's steady policy stance ahead of the July meeting.

- Fed officials signal patience, with inflation still above the target range.

Gold price dropped by over 0.26% during the North American session on Thursday, trimming some of its earlier losses of nearly 1%. The release of solid economic data from the United States, which supports the Federal Reserve’s (Fed) stance to hold rates unchanged at the upcoming July meeting, contributed to this decline. At the time of writing, XAU/USD trades at $3,340.

The market mood remains positive throughout the trading day, which serves as a headwind for Gold prices, as investors digest the latest job and consumer data. Initial Jobless Claims for the last week continued to show improvement in the labor market. At the same time, Retail Sales data indicated that American households remain resilient, although the data suggest that the jump in sales is mainly attributed to higher prices.

After the data, some Fed officials crossed the wires. Governor Adriana Kugler commented that monetary policy needs to remain steady for quite some time. San Francisco Fed President Mary Daly stated that there’s some work to be done on inflation, as they have not yet achieved price stability.

In the meantime, investors continued to price in less easing by the Fed as further data became available, which dampens the demand for the non-yielding metal. The December 2025 fed funds rates futures contract shows that traders expect 42 basis points (bps) of easing, as revealed by the CBOT.

On the trade side, Japan’s negotiator Ryosei Akazawa held talks with the US Commerce Secretary Howard Lutnick in efforts to avert or diminish 25% tariffs imposed on Japanese products.

Ahead this week, traders will eye Fed speeches and the University of Michigan Consumer Sentiment report.

Gold daily market movers: Extends losses on upbeat US jobs data

- US Initial Jobless Claims for the week ending July 12 dipped from 228K on the previous print to 221K, below forecasts of 235K. The data support the Fed’s cautious stance, as the labor market remains healthy, although it hasn’t been cited as a cause for inflation.

- Retail Sales in June exceeded forecasts of 0.1% MoM, rose by 0.6% MoM and crushed May’s 0.9% plunge as some of the increase is a reflection of higher prices due to tariffs. Inflation on the consumer side revealed earlier in the week that prices are edging higher

- Fed Governor Adriana Kugler added to her hawkish remarks that inflation remains above target, while the labor market remains stable and resilient. She added that CPI inflation is broadening to core goods.

- San Francisco Fed President Mary Daly commented that the economy is in a good place and that, despite restrictive rates, the June CPI began to show the effect of tariffs. Despite this, she added that duties might have a muted impact on inflation and that she still favors two rate cuts.

- US Treasury yields remain flat on Thursday, with the US 10-year Treasury yield, which typically correlates negatively with Gold, steady at 4.461%. However, Bullion prices remain weighed by the strength of the Dollar. The US Dollar Index (DXY), which tracks the buck’s performance value against a basket of six currencies, is up 0.45% at 98.72.

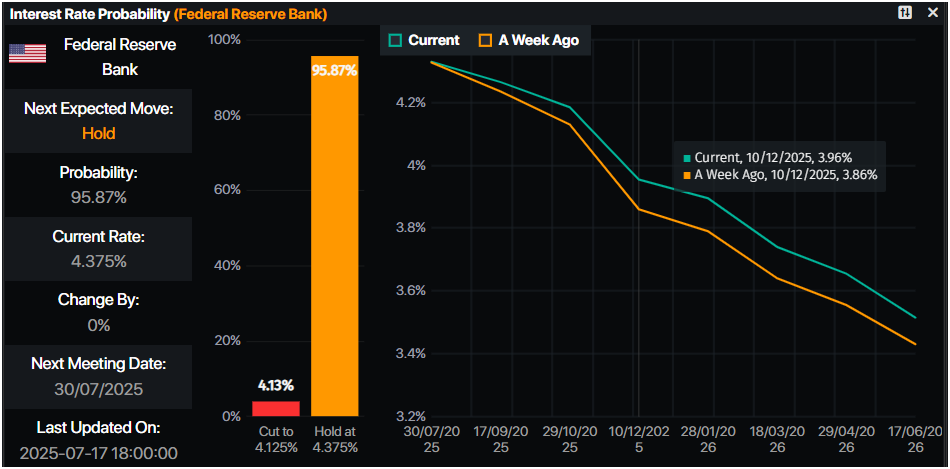

- Interest rate probability indicates that the Federal Reserve will maintain its current rates, with odds standing at 95% for a hold and 5% for a 25-basis-point rate cut at the July 30 meeting.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold remains directionless, trapped within the $3,300-$3,400 range

Consolidation is the name of the game, as depicted by Gold’s daily chart. The Relative Strength Index (RSI) is above its neutral line, but its slope remains flat, indicating further sideways action. However, from a price action standpoint, bulls remain in control, but they need to clear key resistance levels.

For a bullish continuation, XAU/USD must climb past $3,400, which will expose the June 16 high of $3,452, ahead of the record high of $3,500. Conversely, if XAU/USD drops below $3,300, look for a decline to the June 30 low of $3,246, followed by the 100-day Simple Moving Average (SMA) at $3,209.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.