Gold steadies near $3,390 as traders await Fed rate decision, dot plot

- Gold rebounds from $3,370 after Al Jazeera refutes Trump’s claim on Iran talks.

- US jobless claims rise, housing data disappoints, with both supporting safe-haven demand.

- Fed likely to hold rates unchanged; hawkish dot plot could weigh on Gold prices.

Gold price trades flat during the North American session on Wednesday as traders brace for the Federal Reserve’s (Fed) monetary policy decision. Tensions also remain high in the Israel-Iran conflict.

Jobs and housing data released in the United States (US) suggest the economy is continuing to slow down, capping Bullion’s losses. At the time of writing, XAU/USD trades at $3,390, virtually unchanged.

Risk appetite improved slightly on US President Donald Trump’s words that Iran had reached out. Gold tumbled on the remarks, but Al Jazeera citing a Foreign Ministry source revealed that Tehran has not sent a delegation to restart talks. On the headline, XAU/USD jumped from around $3,370 toward its current price.

Besides geopolitics, a raft of US economic data revealed that the labor market has continued to ease as the number of Americans filing for unemployment benefits rose as expected. Housing data disappoints investors, though the primary focus is on the Fed.

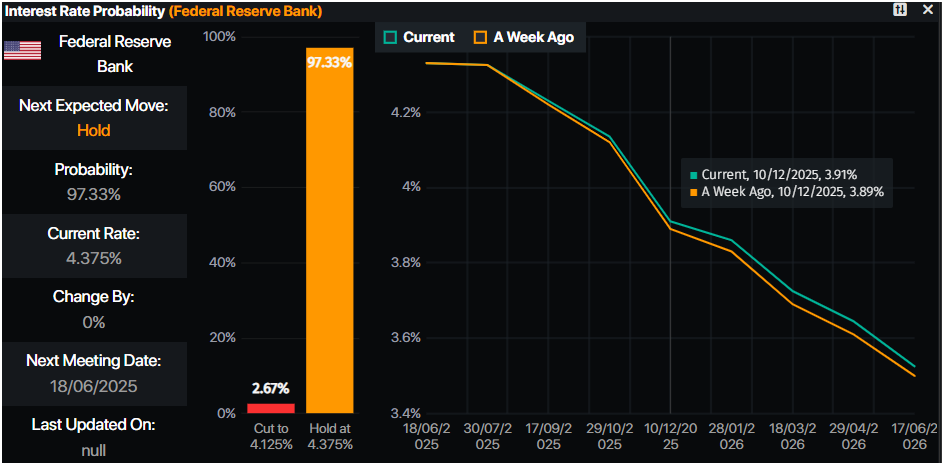

The Fed is expected to keep rates unchanged, though the tone will be of interest. Last week’s inflation figures on the consumer and producer side indicated that the disinflation process continues, but hostilities in the Middle East pushed Oil prices higher. This might prevent the Fed from adjusting to a softer tone, but the main message would be the dot plot in the Summary of Economic Projections (SEP).

If two officials move their dots upwards, this implies that Powell and company are looking for just one rate cut. Hence, a Fed’s hawkish tilt would exert downward pressure on Bullion prices. Otherwise, XAU/USD might climb past $3,400 and above.

Daily digest market movers: Gold price holds firm below $3,400 awaiting the Fed

- The latest US economic data showed Initial Jobless Claims rose by 245,000 for the week ending June 14, matching market expectations. Continuing Claims, used to soften the rate of change in the weekly print, fell 6,000 to a seasonally-adjusted 1.945 million during the week ending June 7.

- Meanwhile, the housing sector showed signs of cooling. May Housing Starts fell to 1.256 million units, marking a 9.8% MoM drop from April’s 1.392 million. Building Permits also edged lower, down 2% MoM to an annual rate of 1.393 million from 1.422 million previously.

- The US Dollar Index (DXY), which tracks the performance of the Dollar against six major currencies, tumbles 0.18% to 98.64.

- US Treasury yields continued to drop as the US 10-year Treasury yield edged down two basis points (bps) to 4.367%. US real yields followed suit, falling almost five bps to 2.057%.

- Money markets suggest that traders are pricing in 46 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price hovers near $3,400, awaiting a fresh catalyst

Gold price remains upwardly biased, but printing back-to-back Dojis indicates traders awaiting the Fed decision. The Relative Strength Index (RSI) is also flat but bullish. Hence, if Powell and other governors turn dovish, expect a rally past $3,400 and beyond.

In that outcome, the next key resistance would be the $3,450 mark and the record high of $3,500 in the near term. Conversely, if XAU/USD tumbles below the day’s low of $3,370, the pullback could extend toward the $3,350 mark and possibly lower. The following key support levels would be the 50-day Simple Moving Average (SMA) at $3,301, followed by the April 3 high-turned-support at $3,167.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.