Gold rallies to $3,400 as Middle East tensions and weak US data spur dovish bets on Fed

- XAU/USD trades at $3,386, extending rally on Fed rate cut speculation.

- US jobless claims top 240K for second week; inflation cools.

- Israel reportedly weighing military strike on Iran adds to geopolitical risk.

Gold price rallies for the second straight day, shy of testing the $3,400 figure following the release of softer inflation and jobs data in the United States (US) as geopolitical tensions grow in the Middle East. The XAU/USD trades at $3,386 at the time of writing.

Market mood remains upbeat, following back-to-back positive inflation reports in the US, which are pressuring the Federal Reserve (Fed) to reduce interest rates as the economy has yet to show the full impact of tariffs on prices. The labor market continues to exhibit some weakness, as the number of Americans filing for unemployment claims surpassed 240,000 for the second consecutive week.

Aside from this, ABC reported that Israel is considering taking military action against Iran in the coming days. In the meantime, US Senior Advisor Steve Witkoff will meet Iranian officials this weekend in Oman.

Regarding trade policy, the US and China agreed to a framework on Wednesday, revealed the US Commerce Secretary Howard Lutnick. The agreement is pending approval from President Donald Trump and Chinese President Xi Jinping.

Ahead of this week, the US economic docket will feature the University of Michigan (UoM) Consumer Sentiment for June. Next week, traders' focus shifts to the Federal Reserve’s (Fed) monetary policy meeting on June 17-18.

Daily digest market movers: Gold price surges as the Greenback and US yields tumble

- The Greenback plunges to three-year lows, according to the US Dollar Index (DXY). The DXY, which tracks the value of the Dollar against a basket of peers, fell 0.60% to 97.99 after hitting a multi-year low of 97.60.

- US Treasury yields are falling as the US 10-year Treasury yield has dropped five basis points (bps) to 4.367%. US real yields followed suit, losing five basis points to 2.097%, boosting Bullion’s advance.

- US Producer Price Index (PPI) in May rose 2.6% YoY, a tenth above April’s reading of 2.5%. Core PPI – which excludes volatile items like food and energy – dipped from 3.1% to 3% YoY.

- Every month, the PPI was mainly muted, rising 0.1% MoM below the 0.2% expected by the consensus. Excluding food and energy, PPI rose 0.1%, down from 0.3%.

- Geopolitical tensions remain high as acknowledged by US President Trump, who said that Israel could strike Iran in the coming days. Sources cited by The Washington Post noted that US intelligence officials are increasingly concerned about Israel striking Iran without Washington's approval.

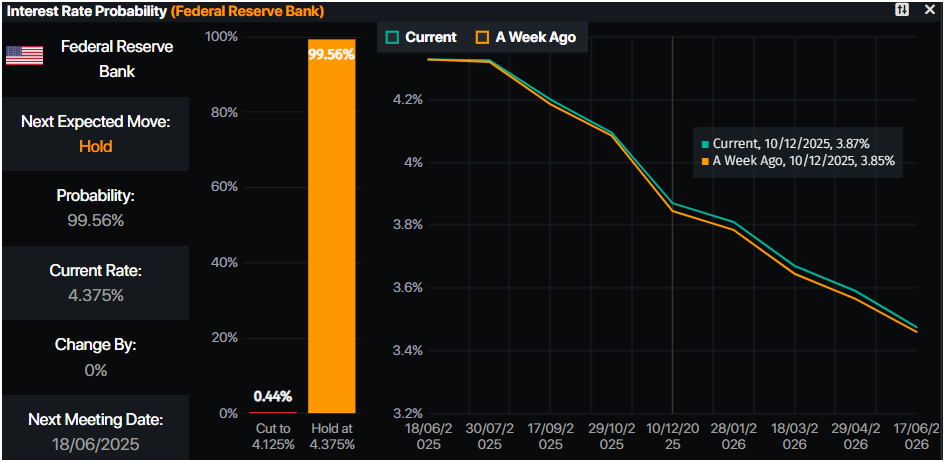

- Money markets suggest that traders are pricing in 51 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold price consolidates near $3,400

Gold price appears poised to test higher levels in the near term as price action remains constructive. The yellow metal has printed a successive series of higher highs and higher lows, trading near the $3,400 figure, which, once cleared, could open the door for further gains.

The Relative Strength Index (RSI) is bullish and has cleared the latest peak, indicating that buyers are gathering momentum. Therefore, if XAU/USD extends its gains past $3,400, it could test key resistance levels. Up next lies the $3,450 mark, followed by the record high of $3,500.

Conversely, if Gold falls below $3,300, look for downward pressure pushing XAU/USD towards the 50-day Simple Moving Average (SMA) at $3,275, ahead of the April 3 high-turned-support at $3,167.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.