Gold price falls over 1% as strong US jobs data lifts US Dollar

- Gold drops to $3,348 after JOLTS report shows tight labor market.

- US job openings jump in April, boosting the US Dollar and weighing on non-yielding Gold.

- Traders await key labor data, including ADP and NFP, to gauge Fed’s policy path.

- Trump’s tariff threats persist, but possible Xi call and Fed’s Bostic favoring patience ease tension.

Gold price trims some of its Monday gains as it edges down over 1% on Tuesday following jobs data from the United States (US), which reveals that the labor market remains tight. At the same time, the overall strength of the Greenback weighed on the non-yielding metal. The XAU/USD trades at $3,348 after hitting a daily high of $3,392.

Investors' mood turned optimistic following the release of the latest US Job Openings & Labor Turnover Survey (JOLTS), which showed that job vacancies rose sharply in April. The data was positive, ahead of a busy week with jobs data releases awaited. On Wednesday, the Automatic Data Processing (ADP) National Employment Change for May is expected to improve, followed by Friday’s Nonfarm Payroll numbers.

Bullion prices retreated on rumors of a possible call between US President Donald Trump and his counterpart, Chinese President Xi Jinping. Last week, Trump announced that China had violated a trade agreement reached in Switzerland. He then doubled down on worldwide steel and aluminum tariffs, which were set to increase from 25% to 50% and take effect on June 4.

The European Commission is pressuring the United States to lower tariffs. Conversely, the Trump administration urged trading partners to submit revised offers by Wednesday to speed up trade talks.

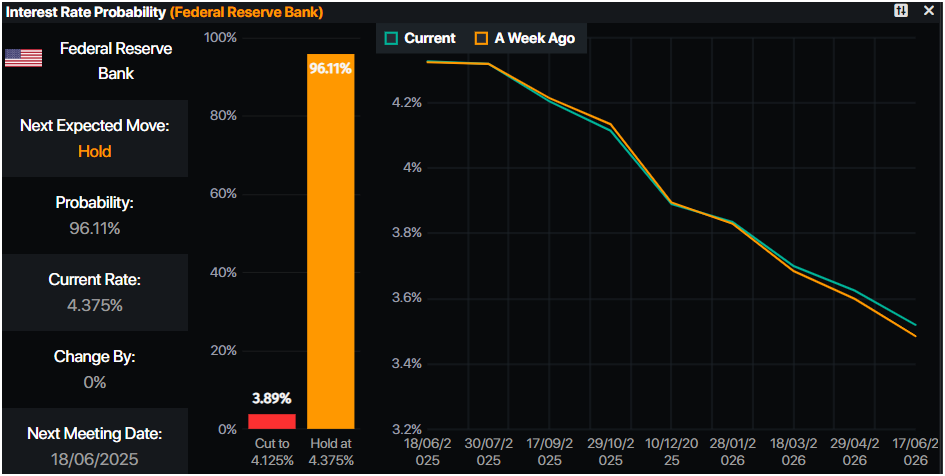

Atlanta Fed President Raphael Bostic said that the best monetary policy approach now entails “patience,” and he still sees just one rate cut this year.

Gold daily market movers: US Dollar stages a comeback, pushes Gold lower

- Gold price disappoints traders as the US Dollar recovers. The US Dollar Index (DXY), which tracks the Greenback’s value against a basket of six currencies, rises 0.52% to 99.22.

- US Treasury bond yields are rising, with the US 10-year Treasury note yielding up two basis points to 4.462%. US real yields have followed suit and are also climbing by two basis points to 2.132%.

- US JOLTS Job Openings in April rose by 7.39 million, from a revised 7.2 million in March. Economists estimated a decrease to 7.10 million vacancies.

- High tensions between the US and China could spur another leg-up in Gold prices. Trump’s decision to raise tariffs on base metals could be inflation prone, increasing precious metals’ appeal. On the other hand, an agreement between Washington and Beijing will likely result in easing tensions and lower Bullion prices.

- Money markets suggest that traders are pricing in 48.5 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold surges past $3,350 with bulls targeting $3,400

Gold price uptrend remains intact despite retreating somewhat from around $3,400. Due to XAU/USD’s overall bias, the ongoing leg down could be an excellent opportunity for buyers, who may target $3,400. Once surpassed, this level clears the path to test key resistance levels.

The first support level to emerge is the May 7 peak at $3,438. A breach of the latter exposes $3,450 as a psychological level, followed by the all-time high (ATH) at $3,500.

Conversely, if Gold falls beneath $3,300, sellers could send XAU/USD on a tailspin toward testing the 50-day Simple Moving Average (SMA) at $3,235, followed by the April 3 high turned support at $3,167.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.