Gold slips below $4,600 as US CPI cools, US Dollar caps gains

- Gold dips modestly as stable US CPI reinforces expectations for Fed easing later in 2026.

- A firmer US Dollar and neutral-to-hawkish Fed rhetoric limit upside despite cooling inflation signals.

- Geopolitical tensions and Fed independence concerns remain medium-term tailwinds for Bullion prices.

Gold (XAU/USD) retreats modestly on Tuesday following the release of December’s inflation data in the US, which confirmed that prices remain stable, an indication that further rate cuts by the Federal Reserve may lie ahead. XAU/USD trades at $4,590, down 0.15%, after briefly hitting a record high of $4,634 earlier in the day.

Bullion eases after US inflation confirms cooling trends, while geopolitical risks keep downside contained

The Greenback clings to gain a headwind for Bullion prices, despite the Consumer Price Index (CPI) print for December was mostly aligned with forecasts. Headline and core inflation seem to have stabilized, with both prints remaining steady compared to the previous month, according to the Bureau of Labor Statistics (BLS).

Other data revealed that the labor market is improving, while St. Louis Fed President Alberto Musalem struck a neutral to hawkish tone in his speech earlier.

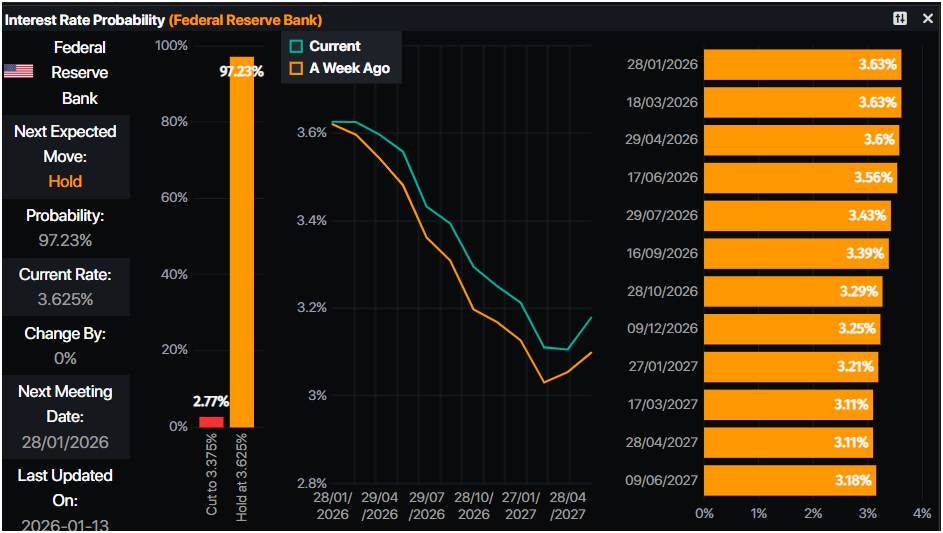

Money markets had priced 50 basis points of easing towards the end of the year, according to Prime Market Terminal. Nevertheless, over the weekend, developments of the Department of Justice indictment of Fed Chair Jerome Powell, a threat to Fed independence, reduced the chances for a rate cut at the January meeting.

Geopolitics and further US data ahead

Threats to Fed independence and tensions arising in the Middle East, adding to ongoing geopolitical risks, are tailwinds for Bullion prices.

US President Donald Trump announced tariffs of 25% on countries that do business with Iran, exerting pressure on China and Russia, two of Iran’s trading partners.

The US economic docket will feature the release of the Producer Price Index (PPI) for October and November, Retail Sales for November and speeches by a flurry of Fed officials.

Daily digest market movers: Gold dips in tandem with US yields

- The strength of the is one of the main reasons behind Gold’s modest dip. The US Dollar Index (DXY), which tracks the buck’s value against a basket of six currencies, is up 0.26% to 99.15. Conversely, US Treasury yields are sliding, led by the 10-year T-note, which is down nearly two basis points at 4.167%.

- The US CPI in December was unchanged from November’s, aligned with estimates at 0.3% MoM. On an annual basis, prices increased by 2.7%, as expected, and unchanged from the previous month.

- Core CPI rose 0.2% MoM, missing forecasts of 0.3% and matching the previous month reading.In the twelve months through December, it remained unchanged from November’s at 2.6%.

- The ADP Employment Change 4-week average improved from 11K to 11.75K.

- New Home Sales in October fell 0.1% MoM from 738K in September to 737K. The Commerce Department revealed that on an annual basis, sales jumped 18.7% YoY for the same period, as mortgage rates and declining prices could support the housing market.

Technical analysis: Gold price struggles at $4,600

Gold’s broader uptrend seems to pause as buyers failed to clear the $4,650 mark, which could’ve put into play the $4,700 mark. Bullish momentum is fading as depicted by the Relative Strength Index (RSI), which turned slightly flat near overbought territory, but failed to record a higher high.

For a bullish continuation, Gold must clear $4,650. Conversely, if XAU drops below $4,550, this could embolden sellers to push prices back toward the $4,500 intraday low, with the $4,400 threshold emerging as the next key downside target.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.