Mexican Peso trades near fresh YTD high against US Dollar

- USD/MXN trades below 19.20 after testing a new YTD low at 19.16.

- US ADP Employment and ISM Services PMI data missed forecasts.

- Mexico responds to increased tariffs on steel and aluminum imports to the US.

The Mexican Peso (MXN) is trading near a fresh year-to-date high against the US Dollar (USD) on Wednesday, which is providing support for the USD/MXN pair above 19.16.

As economic data released from the United States (US) highlighted signs of economic fragility, trade tensions between the US and its global trading partners continue to rise.

With tariffs on aluminium and steel imports to the US rising to 50% on Wednesday, Mexico’s Economy Minister, Marcelo Ebrard, announced that Mexico will be requesting an exemption from the tariffs on Friday.

In a morning conference, Mexican President Claudia Sheinbaum announced that the increase was an “unfair measure”. The President also stated that Mexico will announce countermeasures against the US if no deal is reached by next week.

"It is not a matter of revenge, or retaliation as they call it in English," she said. "It is a matter of protecting our jobs and our businesses," added Sheinbaum.

Meanwhile, other nations, such as Japan and Canada, are expressing similar concerns and frustrations in response to Trump’s tariff policies, which have been driving demand away from the US Dollar and into alternative assets.

On Thursday, Mexico will release Consumer Confidence data for May. With April’s reading of 45.5 serving as the benchmark, any upside or downside surprises could further influence the direction of the Mexican Peso.

For the US, Weekly Jobless claims data will be released at 12:30 GMT, shedding light on the employment situation in the US before Friday’s release of the May Nonfarm Payrolls (NFP) report.

Mexican Peso daily digest: US employment data remains in focus

- On Wednesday, US ADP Employment data indicated that the US private sector added 37,000 jobs in May, missing analyst forecasts of a 115,000 increase.

- The Institute of Supply Management released the latest report for May, which reflected a weakening in business conditions in the US service sector.

- With analysts expecting the ISM Services figures to rise to 52, a reading of 49.9 is reflective of a potential weakening in the perceived business conditions of the service sector, which is the largest contributor of Gross Domestic Product (GDP) in the US.

- On Thursday, Initial Jobless Claims are forecast at 235,000, down from last week’s 240,000 print.

- Focus remains on Friday’s NFP figures, which are expected to show that 130,000 new jobs were added to the US economy in May, down from 177,000 in April.

- Meanwhile, the unemployment rate is expected to remain at 4.2%, reflecting a resilient US labour market.

- According to the CME FedWatch Tool, market participants are currently pricing in a 56% chance of a 25 bps rate cut in September. For June and July meetings, the expectation is that the Fed will maintain its benchmark rate at the current range of 4.25%-4.50%.

- On Thursday, Mexico’s Consumer Confidence data for May will provide insight into how individuals and consumers in Mexico perceive the economy's resilience in the face of current economic risks, as well as their expectations for near-term growth prospects.

Mexican Peso technical analysis: USD/MXN bears regain control

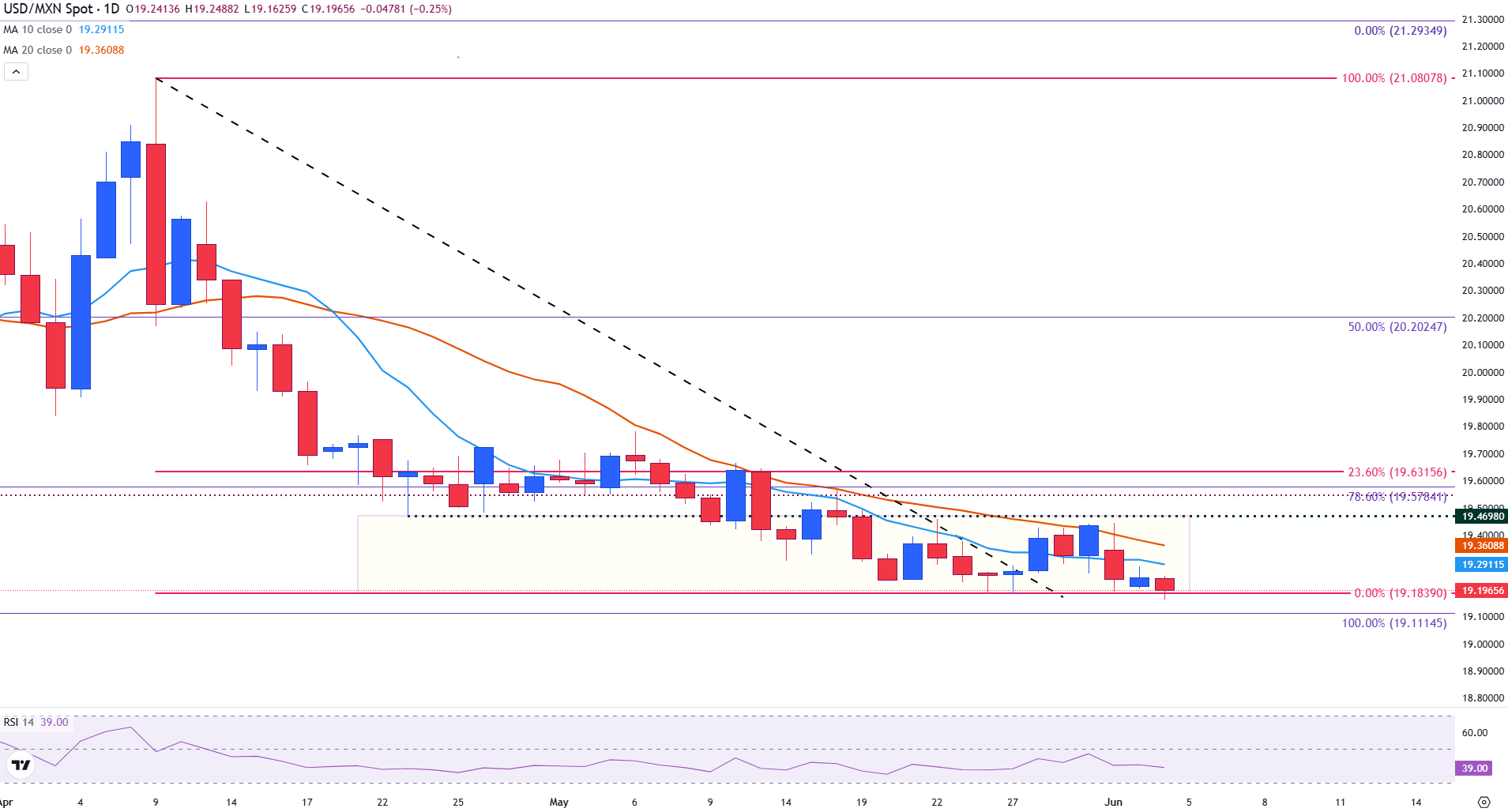

USD/MXN is trading below the 19.20 psychological level, providing near-term resistance for the pair. With the 10-day Simple Moving Average (SMA) firming at 19.29, a move above could see a retest of the 19.30 psychological level.

USD/MXN daily chart

The 20-day SMA stands at 19.36, a break of which may enable bulls to continue driving prices toward the next major level of technical resistance, the April low at 19.47.

On the downside, a break below the May low of 19.18 could reassert bearish momentum, potentially pushing prices down toward Wednesday’s low near 19.16. Below that is the October low of 19.11, providing the potential for the 19.00 psychological level.

Mexican Peso FAQs

The Mexican Peso (MXN) is the most traded currency among its Latin American peers. Its value is broadly determined by the performance of the Mexican economy, the country’s central bank’s policy, the amount of foreign investment in the country and even the levels of remittances sent by Mexicans who live abroad, particularly in the United States. Geopolitical trends can also move MXN: for example, the process of nearshoring – or the decision by some firms to relocate manufacturing capacity and supply chains closer to their home countries – is also seen as a catalyst for the Mexican currency as the country is considered a key manufacturing hub in the American continent. Another catalyst for MXN is Oil prices as Mexico is a key exporter of the commodity.

The main objective of Mexico’s central bank, also known as Banxico, is to maintain inflation at low and stable levels (at or close to its target of 3%, the midpoint in a tolerance band of between 2% and 4%). To this end, the bank sets an appropriate level of interest rates. When inflation is too high, Banxico will attempt to tame it by raising interest rates, making it more expensive for households and businesses to borrow money, thus cooling demand and the overall economy. Higher interest rates are generally positive for the Mexican Peso (MXN) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken MXN.

Macroeconomic data releases are key to assess the state of the economy and can have an impact on the Mexican Peso (MXN) valuation. A strong Mexican economy, based on high economic growth, low unemployment and high confidence is good for MXN. Not only does it attract more foreign investment but it may encourage the Bank of Mexico (Banxico) to increase interest rates, particularly if this strength comes together with elevated inflation. However, if economic data is weak, MXN is likely to depreciate.

As an emerging-market currency, the Mexican Peso (MXN) tends to strive during risk-on periods, or when investors perceive that broader market risks are low and thus are eager to engage with investments that carry a higher risk. Conversely, MXN tends to weaken at times of market turbulence or economic uncertainty as investors tend to sell higher-risk assets and flee to the more-stable safe havens.