Why Lucid Stock Spiraled Lower -- Is It a Buy Now?

Key Points

Lucid investors have had reason to cheer thanks to surging deliveries.

Stifel lowered its price target on Lucid to $17 per share.

One key fear for investors is the threat of share dilution over time.

- 10 stocks we like better than Lucid Group ›

Lucid Group (NASDAQ: LCID) investors have had some reason to cheer this year. The young electric vehicle (EV) maker has posted seven consecutive quarters with record deliveries, with the third quarter reaching 4,078 vehicles. The third-quarter delivery record was a 23% gain over the previous quarter and a 46% gain over the prior year. However, despite this momentum from Lucid, the company still has serious drawbacks that investors need to consider, including an analyst downgrade that contributed to the stock's 40% tumble over the past month.

What's going on with Lucid?

Shares of Lucid tumbled on Monday after Stifel lowered its stock price target on the automaker from $21 down to $17, on concerns the company will need to raise more capital in the coming years. In fact, investors have already seen some evidence of this during the third quarter and even more recently.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Management noted that Lucid agreed to increase the delayed draw term loan credit facility, or DDTL, from $750 million to $2 billion. It's essentially just a move that enables Lucid to draw more loan capital for running operations or other aspects of the business. That action was subsequent to the third quarter and essentially takes its total liquidity from $4.2 billion at quarter-end and raises it to roughly $5.5 billion.

Lucid Gravity. Image source: Lucid.

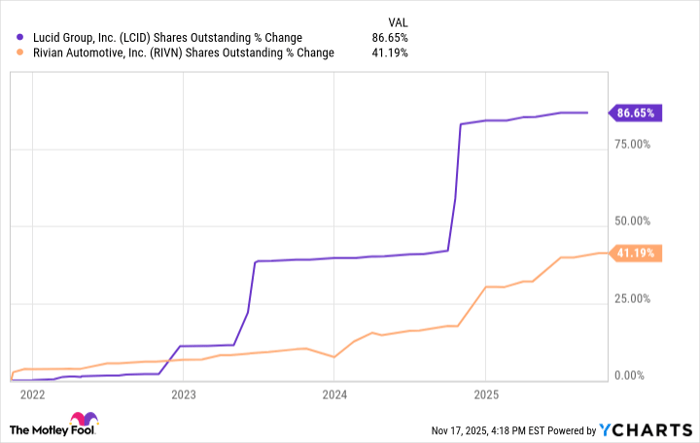

Lucid's next move came in the form of an $875 million private offering of convertible senior notes due in 2031. Now, of that sum, roughly $750 million will be used to repurchase existing convertible senior notes due in 2026, with leftover funds used for general corporate purposes. This move, however, sparked fears that the company could further dilute shareholders. That fear is at least partially justified. As you can see in the chart below, Lucid has increased its shares outstanding, diluting shareholders, at a more rapid rate than a similar competitor, Rivian Automotive (NASDAQ: RIVN).

Data by YCharts.

Elephant in the room

This topic also brings Saudi Arabia's Public Investment Fund (PIF) into the conversation. Saudi Arabia's PIF, in its attempt to diversify and build different parts of its economy, has invested significantly in Lucid and owns a roughly 60% stake in the automaker. This isn't inherently an issue or red flag, but it does raise the level of complexity.

On one hand, Saudi Arabia's PIF is a significant backer with deep pockets that can help keep Lucid financially afloat amid its strong cash burn. It could also open the doors to a Saudi Arabia market for Lucid to sell its vehicles. On the other hand, while this appears to provide a stable long-term partner for Lucid, the truth is Saudi Arabia's PIF could eventually pull the plug on its financial backing and leave Lucid in a world of hurt. The overhang on Lucid's stock as the PIF exited its stake would be devastating alone, but the cost of borrowing capital would likely rise, and its ability to fund operations could come into question if it can't quickly find more funds.

What it all means for Lucid

While Lucid has done well in increasing its production and setting quarter after quarter of record deliveries, the company still has significant losses and is burning cash. It's more than fair that Stifel lowered its price target on concerns of shareholder dilution, and that dilution will likely become a reality down the road. Saudi Arabia's stake in the company also increases uncertainty and complexity, depending on its commitment level, and Lucid will face many headwinds as it still has a long way to go to reach scale and profitability. Lucid is a high-risk stock, and investors should watch this from the sidelines or only open a very small position.

Should you invest $1,000 in Lucid Group right now?

Before you buy stock in Lucid Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Lucid Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $562,536!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,096,510!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 187% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of November 24, 2025

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.