The Ultimate Test for the Market: What Nvidia's Earnings Mean for U.S. Stocks

- Gold Price Forecast: XAU/USD recovers above $4,100, hawkish Fed might cap gains

- Bitcoin's 2025 Gains Erased: Who Ended the BTC Bull Market?

- Gold hits three-week top as dovish Fed bets offset US government reopening optimism

- Gold Price Forecast: XAU/USD declines below $4,050 on USD strength and hawkish Fed comments

- U.S. September Nonfarm Payrolls: Two-Scenario Analysis, Will U.S. Stocks Diverge in Short-Term and Medium-to-Long-Term Trends?

- Top 3 Price Prediction: Bitcoin, Ethereum, Ripple – BTC, ETH, and XRP flash deeper downside risks as market selloff intensifies

TradingKey - Nvidia (NVDA), the leader in the AI chip market, is set to release its fiscal year 2026 Q3 earnings report after the close of US markets on Wednesday. As US investors engage in a frantic sell-off driven by interest rate expectations and the AI bubble, the Q3 report from "AI bellwether" Nvidia could definitively settle whether the stock market will continue its correction or stage a rebound.

Analyst Expectations and Supply Chain Breakthroughs

TradingKey previously noted that multiple supply chain indicators pointed to a significant capacity breakthrough for Nvidia's Blackwell chips in Q3, aimed at addressing the persistent supply shortage.

Consequently, both Morgan Stanley and JPMorgan Chase anticipate that Nvidia's quarterly performance will surpass expected growth, building upon the forecast that the company's sales growth would break a six-quarter slowdown and finally bottom out.

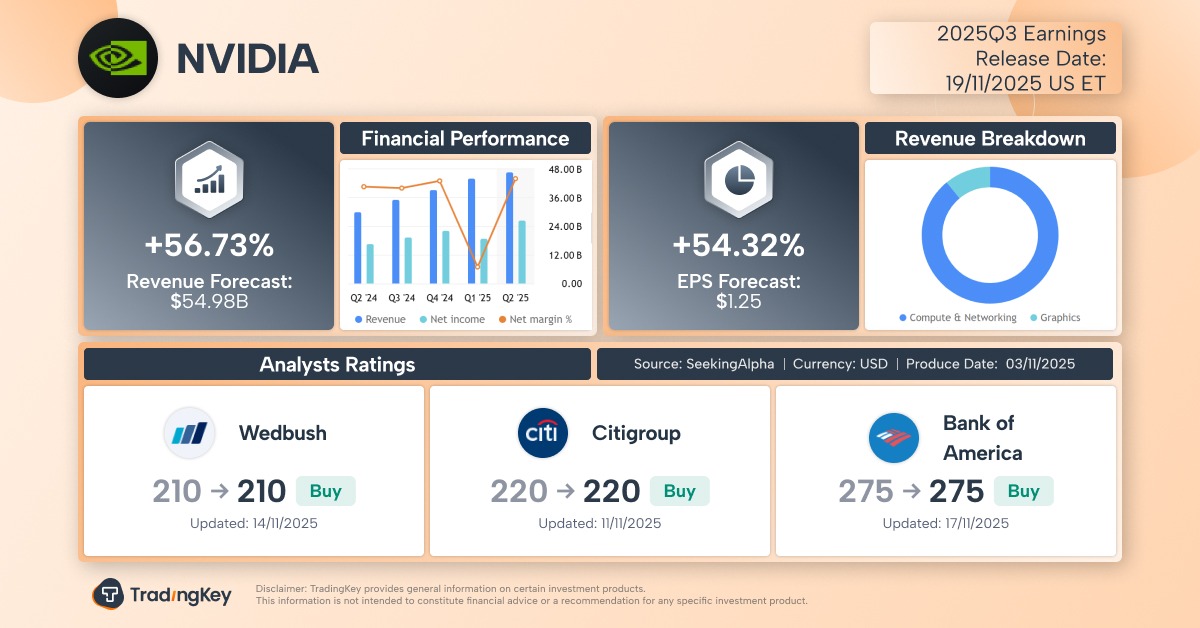

Wall Street analysts had originally projected Nvidia's revenue to grow by 57% year-over-year and earnings per share (EPS) to increase by 54% in the third fiscal quarter (ending October 2025), reaching $55 billion and $1.25, respectively.

The market anticipates a Q3 gross margin of 73.5%, with the expanded Blackwell chip production expected to push the Q4 gross margin up to 75%.

Market Jitters Put Focus on Nvidia's Role as a Macro Indicator

A recent wave of selling in US tech stocks has intensified scrutiny on the AI bellwether's report. Jonas Goltermann, an economist at Capital Economics, stated that the latest tech sell-off makes Nvidia's earnings particularly critical.

Marta Norton, a strategist at Empower, also pointed out that Nvidia's report has now become a macro indicator.

Since the beginning of November, the Nasdaq Composite has fallen more than 5%, and the S&P 500 has dropped more than 3%. Both indices have fallen below the 50-day moving average, a key technical threshold, for the first time since late April.

Concerns over the AI bubble and volatility in the interest rate outlook are subjecting high-flying tech stocks to a rigorous valuation test. A major challenge remains: whether these large tech companies can achieve significant monetization despite their expanded capital expenditure.

Major Institutions Cut Holdings, Increasing Investor Fear

Fear among investors has been exacerbated by major investment institutions reducing their Nvidia positions:

Billionaire Peter Thiel's fund, Thiel Macro LLC, and SoftBank Group have recently disclosed they completely liquidated their Nvidia holdings.

Bridgewater Associates, the world's largest hedge fund, also slashed its Nvidia stake by over 65% in Q3.

Capital markets are now fixed on the critical Nvidia earnings report, hoping for positive signals that support the sustainable growth of AI, including:

The outlook for AI chip demand.

Resolutions for long-term supply capacity issues.

Dynamics concerning the Trump administration's policy on chip exports to China.

Peter Tuz, President of Chase Investment Counsel, commented, "I can't think of a real reason to go in and buy aggressively until that's out of the way."

Valuation and Volatility Warnings

Wong Kok Hoi, CEO of APS Asset Management, cautioned that Nvidia's stock price seems to have priced in perfect expectations, implying that GPU demand must sustain robust growth for many years to justify the current valuation.

Seeking Alpha data shows Nvidia's current P/E ratio is 52.42, more than double the peer average of 22.68. The forward P/E ratio for the next year is 40.96, a premium that has narrowed compared to the peer average of 22.89.

Main Street Research wrote that any poor report or weak outlook could make the stock indices vulnerable. However, Nvidia's 10% pullback over the past month means the expectation bar the stock needs to clear after earnings has been slightly lowered.

Stone Fox Capital noted that while trading behavior might suggest downside risk is materializing, and a $4.6 trillion valuation (currently $4.4 trillion) might sound like an AI bubble, the data itself does not support a bubble conclusion if one considers that Nvidia's valuation remains below its expected growth rate.

ABB CEO Morten Wierod dismissed the idea of a true bubble, stating, "I don't think there is a bubble, but we do see some constraints in terms of construction capacity not keeping up with all the new investments."

"We are talking about trillions in investment. That will take a few years to implement because there is not enough people and resources to build all this."

It is noteworthy that even an earnings beat may not necessarily propel the stock price higher. As seen in previous quarters, the balancing act between the narrative of breaking the growth slowdown trajectory and constantly escalating high expectations continues to challenge Nvidia's share price.

According to Cboe data, traders are preparing for an approximately 8% two-way price swing in the stock between the earnings release and Friday.

Read more

* The content presented above, whether from a third party or not, is considered as general advice only. This article should not be construed as containing investment advice, investment recommendations, an offer of or solicitation for any transactions in financial instruments.