Can Vanguard's International High Dividend Yield ETF Outperform Again in 2026?

Key Points

The leadership trend from U.S. megacap growth stocks looks like it's starting to crack.

Value, dividend, and international stocks have all been stepping up to take the lead.

The Vanguard International High Dividend Yield ETF (VYMI) is invested in the areas that have emerged as outperformers so far in 2026.

- 10 stocks we like better than Vanguard International High Dividend Yield ETF ›

The Vanguard International High Dividend Yield ETF (NASDAQ: VYMI) had an extraordinary year in 2025. The 38% gain was its best calendar-year return since the exchange-traded fund (ETF) launched nearly a decade ago.

International stocks have been largely ignored in an environment dominated by U.S. tech stocks and the S&P 500 (SNPINDEX: ^GSPC). Dividend stocks have generally lagged even further, as investors found little need for defensive income strategies in a high-growth economy.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

But conditions appear to be changing. With global trade relations growing more tense and signs of the economy slowing in many regions, investors are thinking twice about bidding up growth stocks. Non-tech sectors and themes are finally gaining interest again, and international stocks have been near the top of the list.

Below is a look at whether this ETF, which tracks two U.K. indexes exclusive of U.S. stocks, can pull off a repeat in 2026.

Source: Getty Images.

Why the Vanguard International High Dividend Yield ETF performed so well

The simple answer is that the artificial intelligence (AI) stock boom was the rising tide that lifted all boats. Tech and communication stocks were obviously the biggest beneficiaries of this as they were at the forefront of development and implementation.

The huge returns by the megacap growth theme and the "Magnificent 7" stocks were more than enough to lift global investor sentiment. That was the foundation for generating gains, even in unloved areas of the market.

However, this ETF doesn't own a single tech stock in its top 30 holdings, so the tech rally clearly wasn't a driver. The other big catalyst was geopolitical turmoil.

The "Liberation Day" tariffs announced by President Donald Trump turned into a significant, albeit brief, risk-off event. That was enough to trigger a stretch of underperformance for tech stocks that lasted about three months.

The resulting rotation, however, triggered pretty substantial outperformance for international stocks.

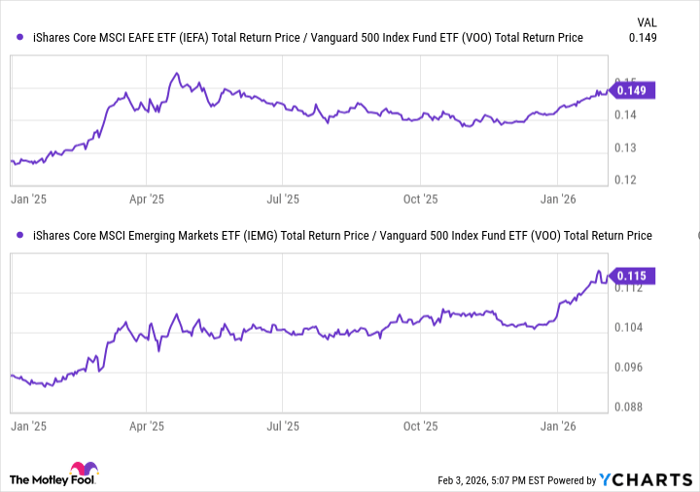

Fundamental Chart data by YCharts.

Investors ultimately saw better relative value from overseas. Plus, the financial fallout from the tariffs was viewed as potentially more damaging to U.S. companies than to their foreign counterparts. Some of that concern has subsided now that the most punitive of threatened tariffs are off the table, but international stocks mostly managed to hang on to that outperformance for the remainder of the year.

The falling dollar, which enhances the returns of non-U.S. assets like those the fund holds, was also a big contributing factor. The dollar index fell from about 109 at the beginning of the year to less than 100 a few months later.

Why it can outperform again in 2026

The market rotation out of U.S. tech shows that investors may have hit their limits with pricey growth stocks. If the economic outlook is changing, that could be a recipe for other areas of the market to lead.

This year, we've seen energy, value, dividend, and international stocks do quite well. This fund trades at just 15 times earnings compared to about 30 for the S&P 500, so there's an unquestionable value tilt.

Tech stocks account for only 3% of the ETF, so it won't take a beating if there's a big retreat in the AI boom. There could be some risk in the fund's 40% allocation to financials, but the 7%-8% allocations to energy, industrials, materials, consumer staples, healthcare, and consumer discretionary stocks provides solid diversification elsewhere.

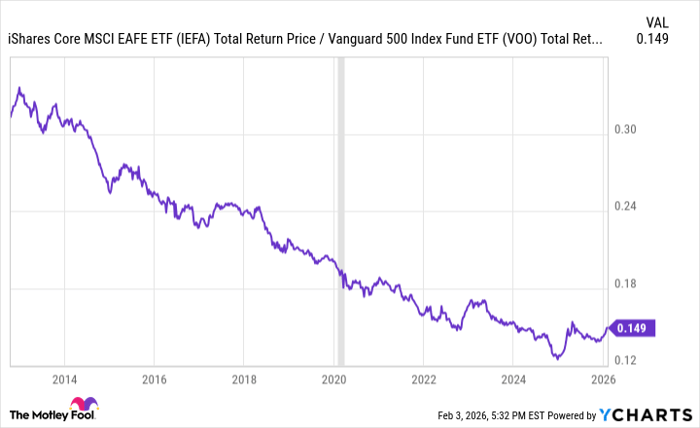

Plus, let's not discount the idea that international stocks have steadily underperformed the S&P 500 for more than a decade.

Fundamental Chart data by YCharts.

Global equity market leadership tends to rotate in multiyear cycles. The time for international stocks to have their moment is certainly long overdue.

The ETF's portfolio doesn't necessarily need an above-average growth environment to outperform again. It just needs the shakeout from U.S. tech stocks to continue. Any bad news, whether it's from corporate earnings, geopolitics, or just a garden-variety slowdown in growth rates could keep undervalued stocks in the lead for an extended stretch.

The Vanguard International High Dividend Yield ETF would be unquestionably well-positioned to take advantage of that trend and continue to outperform.

Should you buy stock in Vanguard International High Dividend Yield ETF right now?

Before you buy stock in Vanguard International High Dividend Yield ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard International High Dividend Yield ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $432,297!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,067,820!*

Now, it’s worth noting Stock Advisor’s total average return is 894% — a market-crushing outperformance compared to 194% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of February 6, 2026.

David Dierking has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.