Could Owning This Energy Stock Today Change Your Financial Trajectory?

Key Points

If you are an income investor, this high-yield stock could provide you with a growing income stream.

If you are a growth investor, reinvesting this stock's massive dividend could produce attractive total returns.

- 10 stocks we like better than Enbridge ›

Canadian midstream energy giant Enbridge (NYSE: ENB) is a dividend stock. That's highlighted by its well above market dividend yield of 5.7%. That said, this high-yield stock could help change your financial trajectory even if you are a growth-oriented investor. Here's why buying this reliable dividend payer could provide you with the financial foundation you've always wanted.

What does Enbridge do?

Enbridge operates in four main lines of business: oil pipelines, natural gas pipelines, regulated natural gas utilities, and renewable power. All produce reliable cash flows, either via long-term contracts or the regulated nature of the businesses. Overall, Enbridge is a very consistent operation.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

The best example of that consistency is the company's 30-year streak of annual dividend increases, in Canadian dollars. Add in the lofty dividend yield, and you can see why dividend investors would find Enbridge attractive. The company's goal is to grow the dividend at a similar rate to its distributable-cash-flow growth, which is expected to rise 3% in 2026 and up to 5% thereafter.

If you add 5% dividend growth to the current 5% or so yield you get roughly 10%, which is the normal total return that investors expect from the S&P 500 index (SNPINDEX: ^GSPC) over time. However, total return is also an important figure to consider if you are a growth investor, because history suggests that Enbridge's dividend can supercharge your returns if you reinvest it.

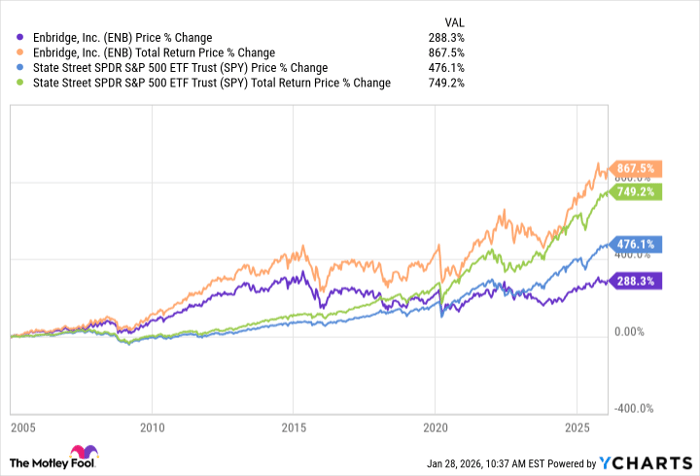

ENB data by YCharts

A hidden growth stock?

The chart above shows that an S&P 500 index ETF has easily beaten Enbridge over the past 20 years or so when you consider only changes in stock price. However, if you reinvest the dividends, which gives you total return, the story is entirely different. Suddenly, Enbridge and its lofty yield looks like the standout.

In other words, Enbridge could help change a growth investor's financial trajectory, too, because its huge dividend will automatically build wealth as the benefit of dividend reinvestment compounds over time. The interesting thing is that dividend reinvestment can be most powerful during periods of weakness, because that is when they buy the most shares.

Bear markets are particularly interesting because they are the periods when investors of all types find themselves paralyzed with fear. For dividend investors Enbridge's reliable dividend is an anchor in a storm. For growth investors, automatically reinvesting dividends lets you lean into the downturn without having to make any decisions while you are in a potentially emotional state. Either way, you improve your financial trajectory with this high-yield stock.

Should you buy stock in Enbridge right now?

Before you buy stock in Enbridge, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $448,476!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,180,126!*

Now, it’s worth noting Stock Advisor’s total average return is 945% — a market-crushing outperformance compared to 197% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of January 31, 2026.

Reuben Gregg Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool has a disclosure policy.